What is a Payslip ?

Payslip (Definition)

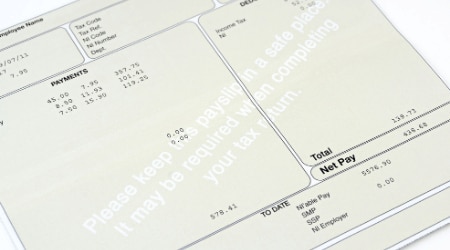

A payslip is a record of a person's wages that is created in either paper or electronic form. It provides information on an employee's earnings, including any taxes withheld from the employee's gross pay. In most countries, a payslip must be provided to employees by law. In many cases it must legally be provided on the same day payment is made, or within 7 days of payment being made.

A payslip should include the following:

- Date of payment

- Pay period (weekly, fortnightly, monthly)

- Rate of pay (e.g., hourly)

- Number of hours worked if paid hourly

- Employer’s name and ABN

- Employee’s name

- Payment amount (Gross and net)

- Tax withheld

- Incentive-based payments

- Bonuses and allowances

- Penalty rates, if applicable

- Superannuation, including account details and amount contributed