What is a Profit and loss statement?

Profit and loss statement (Definition)

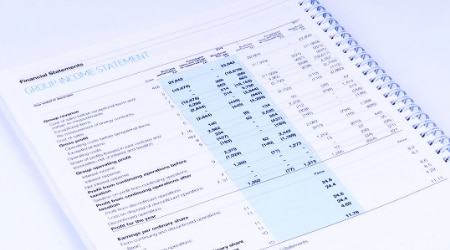

A profit and loss statement summarises a company's sales, expenses, and profit (or loss). Both business owners and accountants use it to determine the success of a company and it determines whether the company recorded a profit or a loss for the accounting period (monthly, quarterly, annually). A profit and loss statement also allows you to analyse revenue and spending patterns, cash flow and net income so you can better manage resources and budgets. Included in a profit and loss statement are:

- Revenue: the total amount of sales received during the accounting period, from primary business activity and non-operating activities.

- Cost of Goods Sold (COGS): The price of products and services.

- Gross profit: Net revenue, excluding the cost of sales.

- Operating expenses: the cost of day-to-day operations, such as wages, rent, utilities and marketing expenses.

- Operating income: earnings before taxes, depreciation, interest, and other expenses.

- Other income and expenses, such as long-term asset sales, interest, and dividend income from investments

- Net profit (or loss): the entire amount earned after all expenses have been deducted.