- AU QuickBooks Community

- :

- QuickBooks Q & A

- :

- Payroll and STP

- :

- Re: Can I reinstate a terminated employee

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

5 Comments 5

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can I reinstate a terminated employee

Yes, you can reinstate a terminated employee, @ANGELA25. I'm here to walk you through the steps.

- Go to Employees from the left menu.

- Set the employee view to All Employees.

- Select the terminated employee from the list.

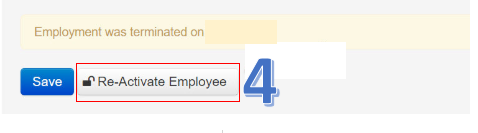

- In the Employee Details page, scroll down to the bottom and choose Re-Activate Employee.

- Click Activate to confirm.

The screenshot below shows you the fourth step. For detailed instructions, check out this article: Re-activating An Employee.

After that, you can create a pay run to the reactivated employee. Then, click Finalise Pay Run. You can also select Actions to add adjustments to your employee’s earnings.

If the employee is subject to withholding, you can lodge a pay event with the ATO after you finalised the pay run. To learn more about this process, visit this article: Create and Lodge A Pay Event.

I'm just a comment away if you need anything else. Have a great rest of your day, @ANGELA25.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can I reinstate a terminated employee

Thank you. Due to Covid19, employees were made inactive. Now that we have received our PPP funds, we would like to re-activate employees and also give them their back pay during this timeframe.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can I reinstate a terminated employee

Hi Pat2304,

Following the steps above should assist you in re-activating those employees. If you will be paying JobKeeper to these employees, you can refer to this article for setting up the payments, and this article for specifics on back-paying JobKeeper.

-Kass

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Can I reinstate a terminated employee

Hi Sandy H,

It's up to you if you want to change the start date of the employee or not, however if this change happens in the middle of a pay period, there is the change that automatic pro-rata changes will be applied based on the change in hours - this article goes into some more detail about the impact that this can have.

-Lucas