Shopify and QuickBooks Online integration guide

by Intuit•11• Updated 3 days ago

Set up your integration between Shopify and QuickBooks Online within minutes using our simple setup process. Below is a step-by-step walkthrough, highlighting some useful key points throughout the process.

Step 1: Connect

Begin by connecting your apps to QuickBooks Connector. If you haven't already connected your apps, you can follow our guides to connect Shopify and QuickBooks Online.

Sales taxes and the QuickBooks Online Connector

The QuickBooks Online Connector automatically tracks and records taxes collected by Shopify on your behalf. This makes sure your payout deposits match your bank records and your tax liability remains accurate.

Step 2: Configure

The configuration process below will present you with various options detailing exactly how you want your Shopify and QuickBooks Online integration to work. You'll need to have some basic accounting knowledge to make sure that the integration settings are tailored to your business and accounting practices.

- You'll be required to set up your Synchronisation Options before you can start configuring your workflows. You need to set up the following:

- Account timezone

- Integrations starting date

- Email sync report options

- You'll be presented with workflows that are all optional. In this walkthrough, these workflows will be selected to demonstrate the full capabilities of the setup process.

- Sales from Shopify will be sent to QuickBooks Online as an invoice.

- Payouts from Shopify will be sent as deposits.

- Products from Shopify will be created in QuickBooks Online.

- Inventory level updates from QuickBooks Online will be sent to Shopify.

Invoice creation workflow

When you select the "When an Order is created in Shopify, create a Sale in QuickBooks Online" workflow, you'll be asked to:

- Set up the filters to determine which orders will be retrieved from Shopify. You'll have to set up filters based on the order status.

- You also have the option to select whether you want the sale to be created as a sales invoice or sales receipt to QuickBooks Online.

- Select the Default Products and Advanced Options.

- On the tax configuration page, for each tax created in Shopify, select its corresponding tax code in QuickBooks Online.

Note: Read more about the tax configuration here. - Select how you want to match your Shopify products with your QuickBooks Online products.

Notes: To make sure sales is properly integrated with your accounting system, check if you have all of your Shopify items set up with unique SKUs. With QuickBooks Online integrations, we have two product matching options:- Name: We match the product's SKU field from Shopify to the product's Name field in QuickBooks Online.

- SKU: We match the product's SKU field from Shopify to the product's SKU field in QuickBooks Online.

- Additionally, if you want the new items within your invoices from Shopify to be created in QuickBooks Online:

- Select the checkbox before the Create New Items in QuickBooks Online setting.

- In this section, select the income and expense accounts to be used for your inventoried and non-inventoried items.

Notes:- Read more about the integration of items here.

- QuickBooks Connector can only assign the COS account for the products upon creation, but won't sync the COS price of products.

- From the Send Payments from Shopify to QuickBooks Online setting, you can select whether you want payment data from Shopify to be linked to your sales in QuickBooks Online.

- To map different payment methods to different clearing accounts, select the Advanced Options link.

- You also have an option to Create Credit Notes in QuickBooks Online. In this workflow:

- You'll be asked to map a fallback account from which the payment money is refunded.

- You'll also be asked to input your preferred Refund Number Prefix, which will be appended before the refund receipt number.

Note: Select the Refunded and Partially Refunded status on the order filter if you wish to sync credit notes to your accounting app.

- Within the integration, you can opt to sync Shopify fees, which will appear as Expenses under Bills in QuickBooks Online.

Note: To sync fees in QuickBooks Online, the payments section and the payment method accounts should be configured as proper accounts.

- Select Save.

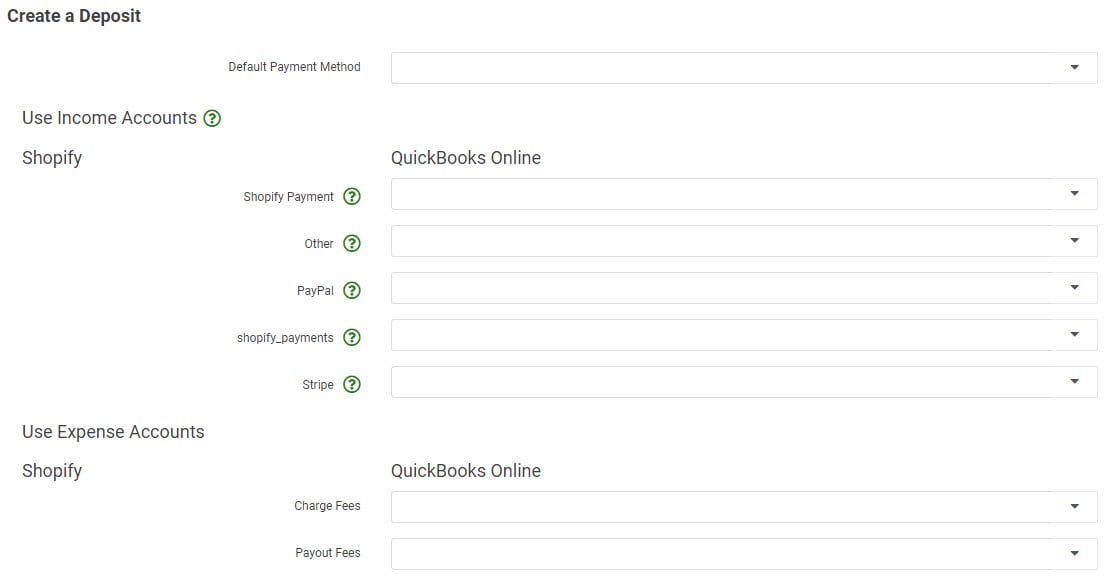

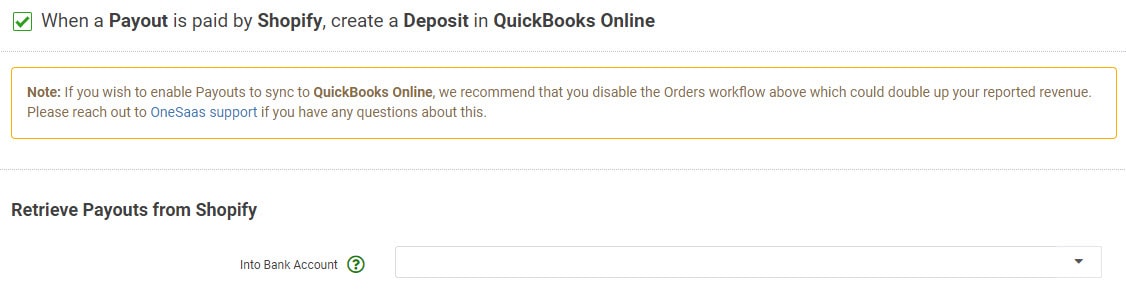

Payouts sync workflow

By turning on the payouts workflow, you allow QuickBooks Connector to automatically create deposits within QuickBooks Online for the payouts sent to your account by Shopify.

If you are not sure as to what exactly Shopify payouts are, please refer to this Shopify support guide.

Note: If you wish to turn on payouts to sync to QuickBooks Online, we recommend that you turn off the orders workflow above, which could double up your reported revenue if not set up correctly.

- Map the Into Bank Account field with an appropriate account.

Notes:- This is where we record your Shopify Payouts as a bank transaction.

- The account should be of type Current assets or Cash and cash equivalents.

- The selected account will be the one that you select when viewing your deposits in your QuickBooks Online account.

- To view the deposits created in QuickBooks Online:

- Follow this link to complete the steps in product

- Select the account assigned to the Into Bank Account.

- Follow this link to complete the steps in product

- In the Create a Deposit section, map the default payment method.

Note: Assign an account here if you want QuickBooks Connector to use a single clearing account for the deposits from all the payment methods.

- Select Save.

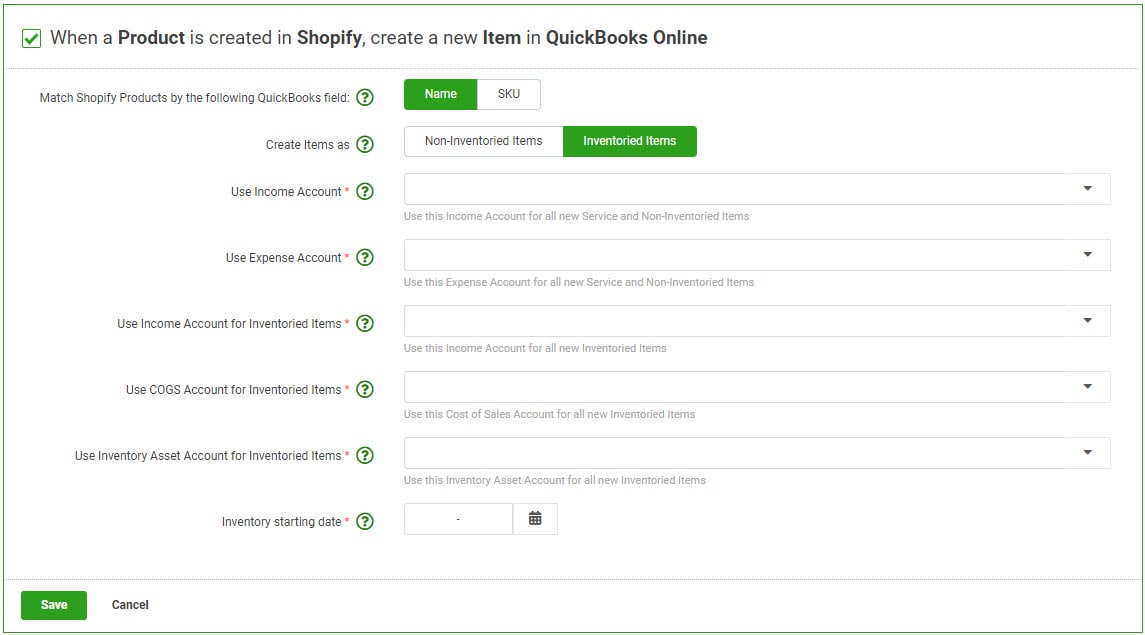

Product creation workflow

If you want all your new products from Shopify to be created in QuickBooks Online:

- Select the "When a Product is created in Shopify, create a new Item in QuickBooks Online" workflow.

- Select the income and expense accounts to be used for your inventoried and non-inventoried items.

- Select Save.

Notes:

- Read more about the integration of items here.

- QuickBooks Connector can only assign the COS account for the products upon creation, but we won’t sync the COS price of products.

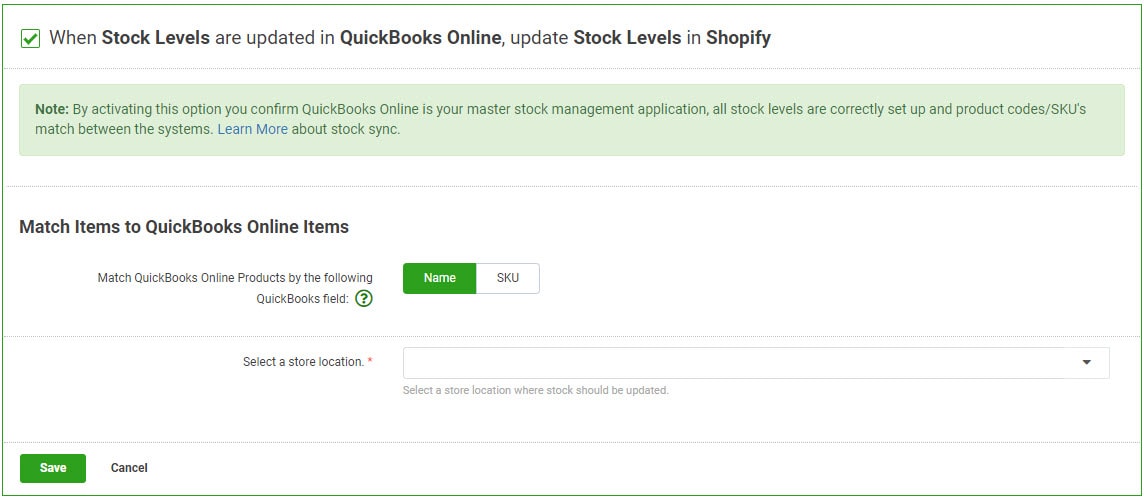

Stock update workflow

When you select the "When Stock Levels are updated in QuickBooks Online, update Stock Levels in Shopify" workflow, you’ll be asked to select how you want to match the items to QuickBooks Online items either by Name or SKU and the store location where the inventory should be updated. Once you're done, select Save.

Note: This option should be turned on only if you have inventory levels set up in QuickBooks Online prior to the integration. Otherwise, you’ll risk wiping out your Shopify stock levels. Learn more about our Inventory control process.

Step 3: Sync

Your account is now ready to sync your data across your apps. When auto-sync is on, your account should sync every hour, but you can trigger a manual sync at any time. Select the Sync Now ![]() icon above Synchronisation Options on the Manage tab.

icon above Synchronisation Options on the Manage tab.

If you have any questions, reach out to our Support team for help at any time.