Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello there, @nithipong-subane.

I'm here to share insights about the update of your transaction from OCBC to QuickBooks Online.

Manual updates in QuickBooks Online(QBO) will download any new transaction listed within the previous 90 days and the most current information when you connect to your account.

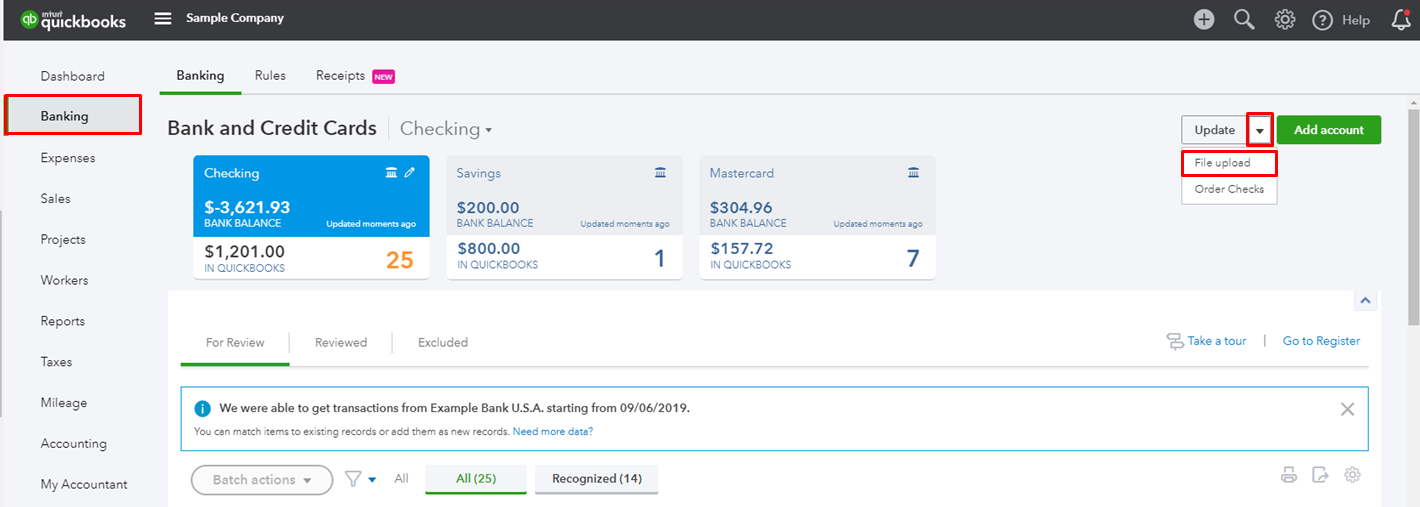

Let me guide you on how to manually update your account:

You'll be notified when the update is complete. If it's successful, the date and the total number of transactions will be shown on the account card change.

For more information, you can check this article: How to manually update an account to fix banking errors.

I've also provided these articles for future reference:

You can tag my name if you have further questions. I'll be happy to help. Have a good one.

Yes, I am also facing the same issue. Somehow the OCBC app's notification does not appear at the right time to prompt us for verification.

I will attempt to press 'Done' then 'Connect' on QBO (without any notification from app). THEN the notification appears on app, but pressing it will say the notification has expired.

We're receiving reports that other users are getting this error as well, asontgw

Our records show that we have an open investigation about the notification code that has expired. Our Engineering Team is still working with OCBC Bank to get a permanent fix for this unusual behavior.

While they are at it, let's perform the following workaround.

First, let's log in and access your account in a new incognito or private browser because it won't save cookies that will help load faster and seeing the latest info.

Here are the shortcut keys:

Google Chrome: press CTRL + Shift + N

Mozilla Firefox: press CTRL + Shift + P

Internet Explorer: press CTRL + Shift + P

Safari: press Command + Shift + N

Second, if you can successfully connect your bank, go back to your regular browser and clear the cache. Deleting your cache and history may clear up some room on your computer or mobile device. Switch to a different browser like Firefox, Internet Explorer, Google Chrome, or Safari is good alternative too.

However, if the issue persists, you can manually update your bank. You can follow the steps provided by my colleague @JoesemM above.

For additional insight in updating bank, you can check this article: How to manually update bank accounts.

And also, I would advise you to reach out to our QuickBooks Online Support.

This way our engineers can add your account information to the list of affected users and attach your case to the INV-36471. Any progress will be communicated via email.

To reach us, here's how:

You can also go to this article: http://status.quickbooks.intuit.com/. You can sign up with that website so that you'll be up to date if there are ongoing issues and the statuses of any investigation. Simply click the Intuit Developer Group then click the Subscribes to Update button.

Let me know if you have additional concerns. I'm glad to help. Have a great day ahead.

Sadly, none of the proposed solutions seem to work: private browser session, clear cache, edit bank login details to reset. It seems that when OCBC implemented their new mobile "One Token" tool, obviating the need for the password generation fob, it broke the connection with QBO. Right now the only option is to download transactions from OCBC and upload them to QBO - a clunky and annoying step.

This has been going on for weeks now. Please can you (Intuit) prioritize a fix or offer a refund for our service for the month of January. Thanks.

I appreciate you sharing the steps you've taken to resolve this issue, @mark1231.

It'll absolutely help other users who might encounter the same error. Please know that you'll receive all available updates about this on-going investigation once you'been added to the list of affected users.

If you haven't yet, here's how you can contact our dedicated support:

In case you need some related information, I've included this helpful article that'll guide you in categorising your transactions after uploading them: Download, match, and categorise your bank transactions in QuickBooks Online.

We thank you for your patience as we're working on this, please let me know in the comment section down below if you have any other concerns.

I've been having problems since December 2019 as well.

Nothing works at all. I tried using the app to manually generate a code and was able to enter it into the QBO prompt, but after proceeding I received an error message.

It's been many many weeks and the problem still exists.

I think the only way would be to contact OCBC to revert back from OneToken to physical token device (which is rather inconvenient to carry around) , or move over to another service like Xefo.

Hi,

Is there any update to this issue? We are basically facing months of backlog of transaction to reconcile. Please give us an update please.

Thanks for requesting an update about this banking issue, @ksim1,

Our Financial Data Team is still working to identify what's causing the issue with OCBC Bank account.

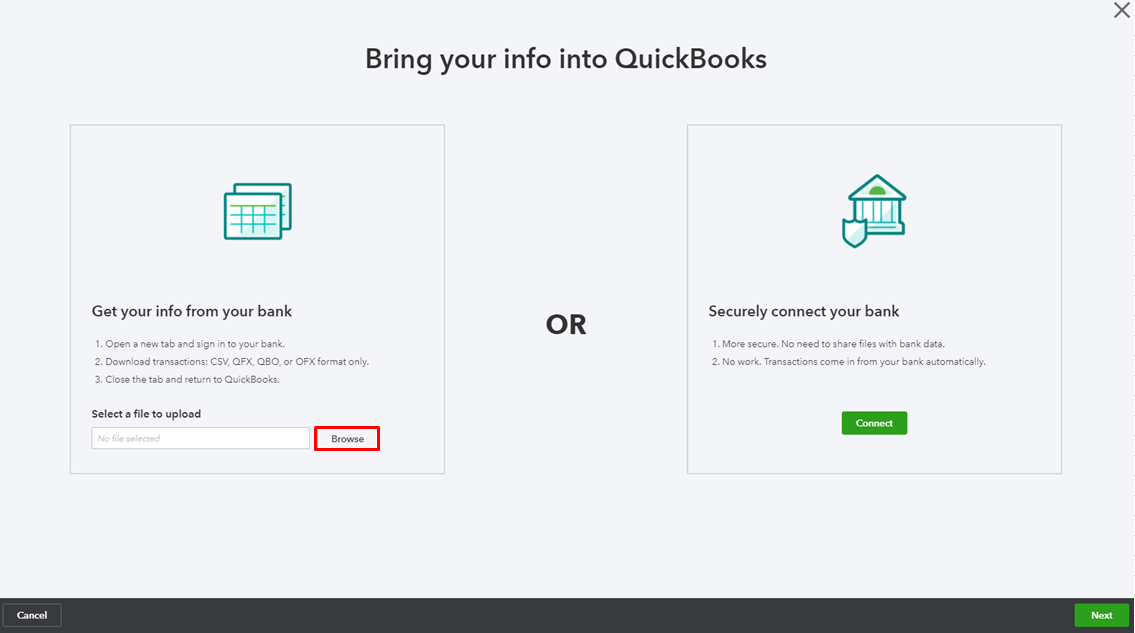

In the meantime, you can upload the transactions manually to ensure the account is up-to-date. Download the data from your bank then map the transactions in the following supported formats or file types:

Once the bank file is ready, start importing the file to your QuickBooks Online company. Follow these steps:

For the information and steps on importing these files, see this article: Manually upload transactions into QuickBooks Online.

Please note that the Bank Feed will download these transactions once the connection resumes to its normal order. To avoid duplicates, exclude them to keep your accounts accurate.

Here's how:

Excluded transactions are moved to the Excluded tab, and won’t be added to QuickBooks or downloaded again.

If you haven't contacted us to receive live updates about this issue, I recommend getting in touch with our Support Team. They can add your account and email to the notification list of affected users. Provide the investigation number INV-36471.

Here's how to contact Support:

I'll be waiting for an update from you about this topic or if you have other questions about QuickBooks Banking. Click the Reply button below to notify me. I'll be more than happy to share additional insights and help at any time. Have a wonderful day!

I contacted OCBC customer service (it took them 3 business days to respond to the emailed enquiry) and they provided me with the following not helpful guidance:

"We wish to inform you that currently, you are unable to link the Quickbooks accounting software bank feeds to Velocity@ocbc. The development of automatic bank feeds will require some enhancements and security considerations. We are unable to commit to a time estimate as we are still working out the details."

I guess the answer is that we should not hold our breath on a fix coming from either side any time soon and just get used to the old way of uploading a CSV file of transactions. By the way, I made the mistake of uploading the same transactions twice and it just duplicates the transactions in QBO. Make sure you only upload new transactions subsequent to the last ones uploaded.

Hi all,

I have managed to pull the bank statement feeds into my QBO. What needs to happen is the following:

a) Press 'Update' like you normally would;

b) Click into 'Complete secure connection' in your QBO;

c) When prompted by your OCBC Business mobile app, press in to validate via your OneToken;

d) Click on 'Done' and click on 'Connect' in your QBO;

You would expect things to work from here, but I have come to realise your QBO will prompt you to enter a 6-digit One Time Password to fix the connection.

e) Return to your OCBC Business mobile app, do not login;

f) Go to top right arrow on screen;

g) Click on OneToken;

h) Generate OTP for account login;

i) Use the 6-digit generated OTP in QBO.

At least for me (at time of writing), QBO will show me a successful connection after doing the above steps. For most of you, you would not be able to pull the bank statement feeds from Dec 2019 as there is a limit to how far back you can pull. I had to manual upload the transactions for those which did not get sync-ed into my QBO.

Hope this has been helpful.

You are a worker of miracles! Thank you so much for figuring this out. It does indeed work.

It is clunky, but works as promised.

Thanks again.

Please can you assign a dedicated tech team to resolve this problem and report back here ASAP. Honestly, I am beyond shocked that you can not resolve this issue in over 6 months. You are a $75b company! WT*! It is not feasible for anyone to keep uploaded transactions manually and this should not be seen as an appropriate resolution to this issue. If I can figure out a way to transfer my QuickBooks data to another accounting tool I will leave QB unless the problem is fixed.

I'm also waiting for a resolution to this problem. Manually uploading is just not an option in the long run. Please let us know how this is progressing. We would prefer not to switch software for this.

Hello everyone,

Let me share some information about your banking concern in QuickBooks Online.

I've checked here, and the investigation mentioned above about the OCBC bank is now closed. To successfully connect your account in QuickBooks, you'll need to enter the OTP provided by your financial institution via mobile banking.

Here's how:

If you're still unable to make it work, I suggest providing more details about the result. Any further information will help ensure we provide the necessary action about the problem.

In case you need to contact QuickBooks Customer Care, here are the steps:

Additionally, here are some helpful references that you can check out about bank errors, as well as how to resolve an issue related to bank added security:

Drop me a comment below if you have any other questions. I'll be more than happy to help. Wishing you a good one.

Ok, strangely it didn't work the first time. I tried it again and now it pulled in the data! My screen within Quickbooks was frozen though. It seems to work, but its still a bit buggy.

I've been having this problem as well. When trying to connect to OCBC Business Velocity, it always asks for OTP after I've authorise the Onetoken through the notification.

I've found a solution tho!

At the top right corner of the OCBC Business Velocity App, there is an arrow.

In there, there is a option named "OneToken". Click that and a "Generate OTP" page will appear.

Click the "For Account Login" and a 6 digit OTP will appear. Input that 6 digit when QBO prompts you to input your 6 digit OTP.

All done! Hope it works for yall :)

Hi Paradrop :) !! Does it pull out bank transactions with only one time authentication or it still require multiple times reauthentication with OCBC mobile app?

How do you manually update the bank statement in CSV file? Do you have to change some of the header inside the file or just do a direct download from bank and proceed to direct upload to QBO?

Thanks for joining this thread, SGRuth.

Let me help ensure you can manually upload transactions in QuickBooks Online (QBO).

In order to import data successfully with a .CSV file, there is a format you need to follow. You may use either the 3-column or 4-column. If an incorrectly formatted file is uploaded, the option will gray out or you will receive an error.

I have some tips for you to help prepare your .CSV file before importing it to the system. These are the following:

For guidelines of the format you need to use, here's a great resource you can check: Import bank transactions using Excel CSV files. When the file is ready, you can now import bank transactions.

However, if you've encountered an error message during the process, I have some articles for troubleshooting steps to fix the problem:

Once imported, you can now go to the For Review tab to categorise, add, and match your transactions.

If you need anything else, let me know by commenting below. I'm always here to help. Take care always.

Same here..I'm getting really frustrated. After using my fingerprint recognition, they keep prompting again to key in the OTP which I did not get any.

Thank you!! You are a life saver!!

Hi i can connect my OCBC account but it only downloads 90 days of transactions.

do you know if the bank allows download for say 12 months of past transactions?

Hello, ConorIB.

Thanks for dropping by in Community. In QuickBooks, the system only downloads up to the last 90 days of transactions, you can manually import data beyond the time limit. Download the bank statement from your bank using the following supported formats or file types:

Once the bank file is ready, start importing the file to your QuickBooks Online company. You can refer to this article for more detailed steps and the process: Manually upload transactions into QuickBooks Online. Then, you can categorise and match the transactions.

Feel free to shoot comments below if you have any other concerns or questions about bank transaction. I'm always glad to help in any way I can. Take care!

Really appreciate this forum.

OCBC bank no longer has an API connection with Quickbooks.

Downloading transactions is possible BUT the date formats used by OCBC and QB are incompatible. Unfortunately OCBC uses YYYYMMDD.

It would be great if someone at OCBC can look into this.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here