Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Explore another connector to reconcile Stripe transactions into QBO.

https://synder.grsm.io/quickbooks

Thank you for your reply.

I do not want to connect an app.

What I wish to achieve is as follows:

I want to add my online payments for a variety of products & services as sales at end of week ( from a report I run )

So to do this I have set up a customer " ONLINE SALES" where I create an invoice dated end of each week and add my detailed product / services sales. They are paid by stripe BUT I manually deposit funds from my Stripe to my Bank Account . I want to continue to do this to save a lot of transactions which have deducted stripe fees causing confusion.

I then drawdown from stripe periodically set amounts ( how do I document this in QB )

Then I enter Stripe Fees as an expense from the tax document stripe issues me with details of fees.

Please instruct me how to set up Stripe this way - so that I can say the payment is received through Stripe and that when I drawdown eg: €100 from my stripe balance to my bank account it is recorded as a transfer and not income. Is this possible. Really finding it difficult to get an answer to this.

Hope I get some help here.

Thanks.

It's good to have you back here in our forum, @MrsK01,

I can share the detailed steps on how to handle your income along with the Stripe fees that comes with it. To manually document the process, use the detailed steps in order.

Step 1: Create the customer invoice with the full sale amount.

Step 2: Receive the payment and deposit it to the Undeposited Funds.

Step 3: Create a bank deposit and add the Stripe fee to get the amount after deductions. (See screenshot)

For your reference, see the following link for the steps: Record and make bank deposits in QuickBooks Online

If you need to do transfers, use the Bank Transfer option in the + New icon.

Let me know if you have further question or concerns about the steps. I'll be right here to guide you if you need additional assistance. Have a good one!

Thank you so much for that information.

It is getting clearer !

However say the invoice amount ( online weekly sales report ) is €500.

That €500 is received to my Stripe account, where I let it sit.

I will not be drawing down / transferring €500. I may at a later date transfer €1000 to my bank as and when I need cashflow.

I think for me it may be easier to treat STRIPE as another bank account, cash and equivalent ?

Can I do this ?

Then just enter the fees as an expense at end of month when the fees tax document is released from stripe.

This allows me to then account for balance transfer from my STRIPE account o my bank as a transfer.

Or do you have a better suggestion on how I can do this with teh set up I currently have - letting funds sit in Stripe balance and drawing down / transferring funds as and when I need cash flow to my bank account.

Thanks again.

That would be a great idea, @MrsK01.

You can create a bank clearing account called “Stripe”. Doing this allows you to let your funds sit in Stripe until you're ready to move it into your real bank account.

Here's how:

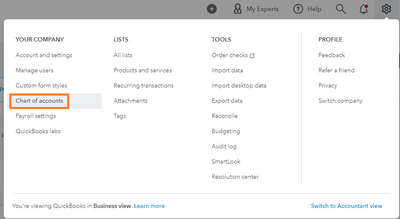

For your reference, check out our guide on adding an account to your Chart of Accounts.

Once set up, you can record customer payments and deposit to your Stripe account. When you're ready to move your money to your bank account, you can use the Transfer option to do so.

Keep in touch should you need further assistance with this. I'm here to make sure we get everything straightened out. Have a good one.

I have the same question. I finally linked my bank account to QBO and today there was a "Stripe transfer" to my bank account and I'm not sure what to do with it. I already have those sales for this deposit posted to my account as income, so I don't want to duplicate them. I'm not sure what to enter as the payee, or what category to choose.

Glad to know you're able to connect your bank account, valerie47.

I'm here to help you handle this transaction in QuickBooks Online.

Since the transaction is already posted in the account, let's match the downloaded transaction with it. This links them together to avoid duplicates. Here's how:

For more details, please see this article: Categorise and Match online Bank Transactions in QuickBooks Online.

If you're unable to match the transaction, I'd recommend excluding it. This prevents you from having duplicate entries. I'll show you how:

Additionally, I've added an article that'll help you review your accounts in QuickBooks to make sure they match your bank and credit card statements: Reconcile Workflow.

I'd appreciate it if you'll let us know if you have additional questions about managing your transactions in QuickBooks. We're always here to help you out.

Thank you for the response but I'm not understanding. You said if there's no match (and there's nothing that says match for my Stripe transfer) - why would I exclude it? I have to show that deposit somewhere or it will mess up my bank account when I reconcile. Do I record it as a transfer or do I categorize it?

Hello there, @valerie47. Thanks for getting back and providing a screenshot.

I want to ensure you'll able to manage your transactions properly.

To ensure we're on the same page, I'd like to verify if you mean on posted to your account, is it recorded on your QuickBooks Online (QBO) account or your bank account? If reported in QBO, you'll have to manually match the recorded transaction to the downloaded one to avoid duplicates.

Here's how:

On the other hand, if that transaction is posted to your bank account and not in QBO, you have to add it and categorize it as income.

For more details on handling your bank transactions, see this article: Categorize and match online bank transactions in QuickBooks Online.

For your future tasks, read this great resource about the best practices when reconciling: Learn the reconcile workflow in QuickBooks.

Get back to us if you have questions when working with your QBO account. We're here to help you in any way. Have a good day!

As shown in my screen shot above, there isn't anything that says "match".

I sell on multiple platforms - Amazon, Etsy, Ebay, and my own website, which I use Stripe for my credit card processing. I use apps to record all of these transactions individually to my QBO. But the payments are batched and transferred to my bank account separately. I'm asking how to record or categorize those batched payments (Stripe/Amazon/Etsy ACH transfers to my bank account). The individual sales are already in my QBO but now my bank feed shows these ACH payment transfers and I don't know what to do with them.

Thank you for keeping an eye on this thread, valerie47. I'm jumping in to share how to match ACH payments with the sales that are already in QuickBooks.

I can see the Find match option next to Categorize on your screenshot. You can click it and QuickBooks will provide the list of records you've already entered.

If there are no matches, here are the possible reasons why.

You'll want to review and make sure all details matches with what's in the Banking page. That way, you'll be able to successfully find a match.

About categorizing bank transactions, I recommend consulting an accountant. If you don't have one, this link will help you find a certified QuickBooks ProAdvisor near your place: https://quickbooks.intuit.com/find-an-accountant/.

In case you would like to reconcile your account, this article provides instructions and detailed steps: Learn the reconcile workflow in QuickBooks

Keep me posted if you have follow-up question about recording payments from Stripe/Amazon/Etsy ACH transfers to your bank account. Send me a reply in the comment section below.

Nothing is going to match, because I could get 100 sales in a day, all which are individually posted to my QBO, and Stripe will transfer the funds to me in batches and maybe only send over 25 payments for those orders in one batch, maybe 20 in another transfer and maybe 55 in another for all of those 100 transactions that are already posted as sales in my QBO.

Hi there, @valerie47.

Allow me to help you achieve your goal today.

I suggest excluding your Stripe transactions to avoid duplicates.

Here's how to exclude:

If you accidentally exclude a transaction, just select the Excluded tab, then tap the checkbox, and select Undo.

You can read this article if you want to learn how to reconcile your account.

Know that you're posting on the international site of QB Community. If you require additional assistance on excluding your transactions, you can go through this link: QuickBooks Q & A.

Have a great day!

I sell on multiple platforms - Amazon, Etsy, Ebay, and my own website, which I use Stripe for my credit card processing

Time to explore a connector app to reconcile your transactions into QBO as I mentioned earlier.

https://partnerstack.synder.com/quickbooks

As an additional option, consider having a backup restore app before connecting the apps.

https://partnerwithus.rewind.com/quickbooks

I'm not interested in an app. I simply want to know what category to put these bank transfers in!!

And, I already use apps to download all of my transactions from these platforms. I just want to know what category to use for these batched deposits! I don't know why this is so difficult to answer.

Hey there, I hope you already solved this issue,

I don't know if we're on the same page but I had a similar problem with stripe and batched payments before,

What I did was simply categorize these deposits as transfers from the stripe bank account (in the chart of accounts) used when recognizing the sale, or from "undeposited funds" when I didn't have stripe as a bank account,

I see you have the record as transfer option next to find match, where you would only have to select your stripe bank account as the source of that deposit, or from "undeposited funds" if you recognized those sales there instead of a stripe bank account when received

No need to categorize these deposits as anything else than a transfer

Hi I have another question about Stripe. I have my Stripe account set up to only transfer funds to my bank account once a month. But in April I had refunded a customer right after the monthly transfer went through so the next day or so Stripe charged that refund and pulled the amount I refunded my customer out of my bank account. Now I'm not sure how to record that in my banking feed.

Hello there, @valerie47. I'm here to help you sort things out.

To record the refund charge from Stripe in your banking feed in QuickBooks, you can follow these steps:

By following these steps, you can accurately record the refund charge from Stripe in your banking feed in QuickBooks.

Therefore, I recommend contacting your accountant for guidance in choosing the needed account category. If you haven't yet, you can use this link to find someone near you and whom you can work with: QuickBooks Certified ProAdvisor.

I'll be adding these articles for future reference:

If you need more help matching your bank transactions in QuickBooks Online. I'll be around. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here