Marginal cost formula and examples

To calculate your business’s marginal cost, first determine your fixed and variable costs. Fixed costs are expenses you can predict over a certain period of time. Fixed costs remain the same regardless of how many units you produce, and they include leases, fixed-rate mortgages, annual insurance costs, and annual property taxes.

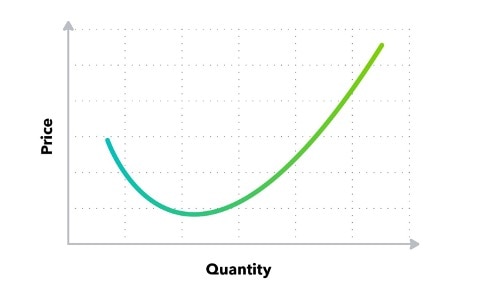

Variable costs change when your production level increases and when you need to expand your capacity and make adjustments. These variable costs can go up or down: for example, larger manufacturers may decrease their overall unit costs by negotiating lower prices on bulk purchases, which are cost advantages known as economies of scale. Other variable costs, though, such as labour, may increase as production increases. Variable costs include labour, raw materials, equipment repairs, and commissions, all of which you must consider if you want to know how to write your final business plan.