Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Consultancy Company where they track all income and expenditure per client and consultant. A profit and loss is produced through the project and at the conclusion. Purpose of the P&L is to determine profitability, which consultant manged the project and a history of all jobs for this client.

Would it be better in the above scenario to use Projects or assign all income and expenses to a class and thereafter extract reports.

Is there a fundamental difference between Project and classes>

Hi Deano2

Classes and Projects are definitely similar in Quickbooks, however, the intent of them is slightly different.

Classes are generally for categorizing business departments or different services your business may provide.

Projects are for tracking and analyzing the profitability of a job. If you have a project-based business such as contracting, interior design or consulting this means projects can vary widely in scope and complexity.

The Projects feature lets you organize all the components of one job - like sales, expenses, and timesheets - in one place, making it easier to track individual projects or jobs.

For your above scenario then Projects would work perfectly:)

Cheers

Thank you for the speedy response. This board is excelent.

In thus instance one client may have numerous jobs at various times.

1) Can we produce a profit and loss on individual jobs and then all jobs.

2) Can we reflect a custom fields to track who worked on the project

3) If we receive one bill from a supplier ..can we enter this bill and allicate to different projects. (in the same way as well can do when assigning classes)

Tia

I have some steps that might help you with your concerns, Deano2.

We can run an individual profitability report for each project by following these steps:

You can also customise the report to include other projects or run a separate report called Profit and Loss by Customers. This report allows you to view income, expenses, and net income (profit or loss) to all customers or projects.

With regard to the custom fields, you can add the option by following these steps:

The option will appear in customer transactions like invoice or sales receipt. You can also run a Transaction List by Customer report and customise it to add the custom field as a column.

For the bill, you can make it billable to a project. Just make sure to enable the billable feature in the settings.

Here are the steps:

When you create a bill, put a check mark on the Billable box and select the project from the Customer/Project column.

Here's a screenshot of what it looks like:

If you need anything else, I'm here to help you some more. Thanks.

Thank you for help.

Is there any way we can add a cistom field <<custom 1>> to the project profitability responts. We hoping to track which salesman was managing the project and thereafter pay a commission

thank you

Hi there, @Deano2.

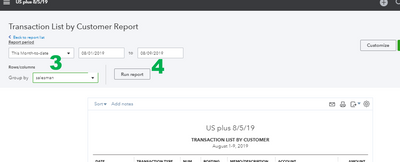

There isn't an option to add a custom field in the Project Profitability Report. However, you can consider pulling up the Transaction List by Customer Report and add a custom field from there. I'll be glad to guide you on how to achieve this.

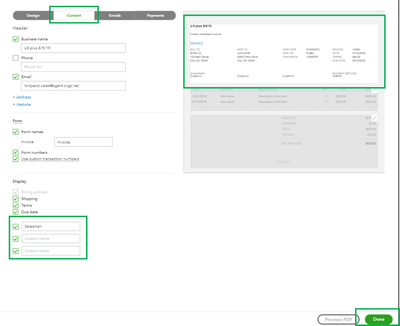

First, let's edit your current template or create a new style. Here's how:

To learn more information on customizing sales forms, please refer to this article: Add, Customize, or Remove Logos on Sales Forms.

You also have the option to Import Custom Form Styles for Invoices or Estimates.

After going through the steps above:

You can always visit our Reports and accounting page to learn more on managing your reports for QuickBooks Online (QBO).

Also, visit our Help articles page in case you want to learn some "How do I" steps in QBO.

If you have any other concerns @Deano2, feel free to leave a comment below. I'm always here to help. Have a good day and more success in your business!

A similar question on if to use Projects vs. Classes:

We have one legal entity set up in QBO. We are building two buildings in this QBO file, a hotel and office building. We'd like to separate these two projects out. I'd like to use Projects over Classes. However, I read that you can't run the balance sheet and P&L by Project. Is that true? I do need full reporting by Project. Classes allow you mostly to do this. But unsure if Projects does. Is this true? Is there another recommendation on how to set up QBO to report two projects within the legal entity?

Hi Knievel124,

Thank you for reaching out on this.

You can actually track the profit for both of your projects. We have put together a 3 mins QuickUpdate video on the feature. Please take a look:

QuickUpdate: Project Profitability

Thank you.

Thanks. It didn't quite answer my question. It sounds like I need to create unique customers that match each Project (i.e. Project A belongs to Customer A and Project B belongs to Customer B). That way I code every transaction, JE, and expense to Project A/Customer A or Project B/Customer B only. When I pull a balance sheet, P&L, CF statement, etc I can see the breakout by Project A/Customer A and Project B/Customer B. The same will go for PO's. I'd need to split a PO into each Project/Customer and apply invoices the same way. Otherwise, if Project A & B both belong to Customer A (the legal entity) then the above reporting won't work since QB only has one profitability report for Projects, not the full B/S, P&L, CF Statement reporting that Classes or Customer do.

Hi knievel124,

When creating a new project, it is correct that it is tied to one customer (Customer A = Project A). However you can create a different project tied to the same customer (so you have Project A & B tied to Customer A). Our report customisation options allow you to filter by Customer and then narrow down to the specific projects they are tied to, which allows you to filter other reports like the Balance Sheet, P&L and Cash Flow.

You can test this out by running one of the above reports, then selecting Customise on the top-right, the Filter drop-down and then selecting the relevant Customer/Project combination from the Customer drop-down.

Let us know if this is what you're looking for.

Bonny

If you select the "Billable" box when entering a Bill, does that just "bill" it to the project, or does it actually add that invoice as a charge to the customer.

I'd like to add it to the Job (Job costing), but not charge the customer.

Thanks,

Brandi

Welcome to the Community, @bebasin.

I am here to give information about your inquiry regarding the billable expense being charged to your customer in your QuickBooks Online (QBO) account.

In creating a bill in QBO, it does not automatically assign to a project or charge your customer when you mark check the billable box.

If you want to assign to the project but not charge the customer, you can select the Customer/Project but don’t tick the Billable box.

You can read more about creating a billable expense by checking this article out: Enter billable expenses.

Let me know if you have further concerns about creating a bill in your QBO account. I’ll be here to assist you at any time. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here