Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

In 2019, my client invoiced their client in QBO, recording revenue to their Services account. When the invoice was paid, rather than receiving payment, they recorded revenue to another income account. Now, income is overstated for 2019 and there's an open invoice more than a year past due. I don't want to change anything in 2019 for tax purposes (it's a negligible amount), but I need to clear out this invoice. If I 1) change the bank deposit to book to Accounts Receivable instead of the other income account and receive payment, applying the deposit to the invoice, or 2) delete the invoice, that will impact 2019 numbers. What would be the best way to clear the invoice out and not impact 2019? Thanks in advance for your help!

Hi there, chasingmoore!

The better way is option 1. Categorize the bank deposit as Accounts Receivable and don't forget to tag the customer's name in the NAME field, so this becomes credits to their profile. Then, yes, you can use it to pay the invoice via Receive Payment.

If you have other questions, you can always go back to this thread. Have a good one!

Thanks for your response! I tried this, and while it works to close out the invoice, it ends up impacting 2019 since the invoice was created and payment was made in 2019. I don't want to change 2019 for tax purposes. Is there a way to close it out in 2020?

Welcome back, chasingmoore.

You can create a Journal Entry to close out your invoices from last year. Doing this prevents changes in your 2019 books.

To get the best option on what kind of entry you need to make, I recommend consulting with an accountant to be sure. They'd be able to give you the best accounting advice for your unique business.

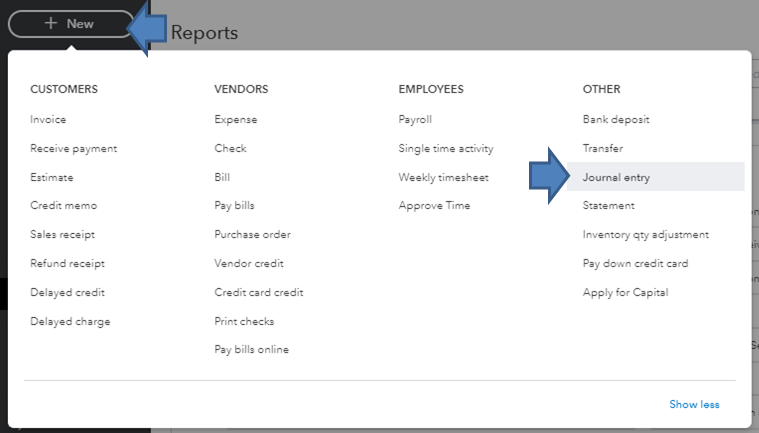

Here's how to create a Journal Entry:

Here's an article that can provide more information about Journal Entries in QBO.

In case you want to review the entries made, you can pull up or print a report for Journal Entries.

To do that:

If you have additional questions, please don't hesitate to ask. I value the success of your business. Have a good one.

Thanks for your help! Would I book the entry as a credit to A/R, debit to the revenue account that was overstated in 2019, and then follow the steps in this article to apply the journal entry to the invoice?

Hi there, @chasingmoore.

You're right in applying a journal entry to an invoice, @chasingmoore.

Once you've entered a journal entry crediting to the Accounts Receivable account, this automatically applies to the open invoice when recording a payment. For now, let's review why you're getting this error message. Make sure that the transactions have the amount for both the invoice and the journal entry.

This article also details the steps about applying a journal entry credit to an invoice in QuickBooks Online.

I'm sure you'll now be able to record the transactions accordingly. If you have any other questions, mention me in the comment section below. I'll get back to you as quickly as possible!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here