Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

We get deposits from our payment processor which sometimes includes refunds and so is less than the full payment amount.

ie. there was a payment of R200 but also a refund of R50 on the same day. We then only get a deposit of R150.

The R200 is created as a payment and linked to an invoice. The R50 refund is created as an expense (because there is no invoice or goods attached, and so can't be a refund receipt).

The problem: how do I link the bank statement line of R150 with the payment (R200) and expense (-R50)? Note: it's important that the expense can be created outside of the bank recon as a separate action (since it will be automated via the API), and so we don't want to use the "Resolve" option on the bank recon to create the expense there - we need a way of linking already created documents.

I appreciate any help. Thanks.

Thanks for being detailed about your concern, @Steven_ZA. I'm here to help you link the bank statement to the payment and expense.

In QuickBooks Online (QBO), the option to match both expense and deposit to a single transaction from Online Banking is unavailable. To help you fix this, you'll have to create a clearing account. This is used to move funds from one account to another. This is similar to a holding account where your funds are kept until you're ready to transfer them. Let me guide you how:

To get more information about this, you can open this article: Set up a clearing account. This is a QuickBooks Desktop article and also applies to QBO when using a clearing account.

Once done, you'll have to put the payment and the deposit in the clearing account so the balance of the account can be zeroed by your bank. Then, match that to online banking.

When everything is fine, you can now reconcile your bank account.

You can also generate a handy copy of your reconciliations to have a reference guide in the future. To have one, check out this article for the detailed steps: How do I view, print, or export a reconciliation report?. You can either print or export it and save it on your desktop folder.

You can count on me if you ever need additional help with reconciling your bank in QBO. I got your back. Keep safe always.

Thanks. I guess this is the only way. However, please explain this part in detail:

"Once done, you'll have to put the payment and the deposit in the clearing account so the balance of the account can be zeroed by your bank. Then, match that to online banking."

Edit: Potentially something like this?

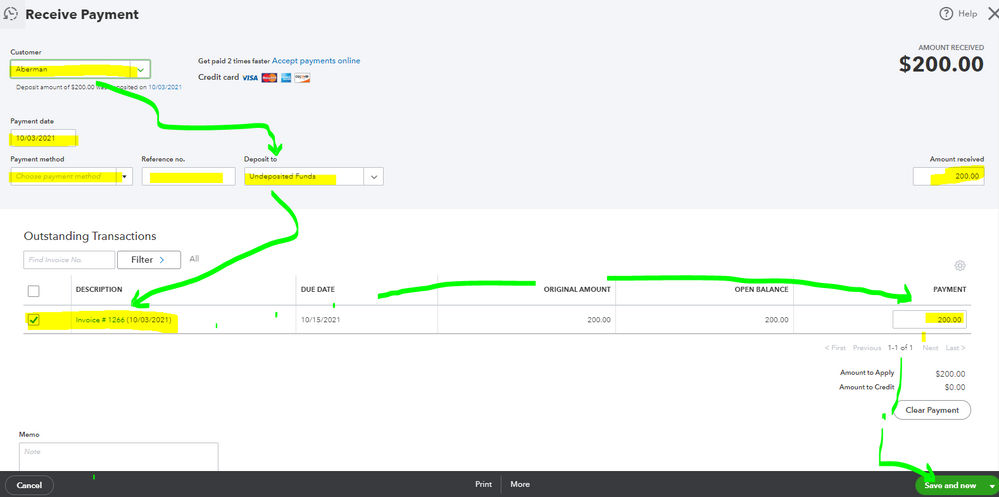

1. Payment "Deposit To" set as the Clearing Account

2. Expense "Payment Account" set as the Clearing Account

3. Journal Entry to move the balance to the "Undeposited Funds"

4. Match the Journal Entry to the Online Banking deposit

Hello there, Steven_ZA.

In QuickBooks, a clearing account is used to move money from one account to another without moving it directly. This is like a holding account that holds your fund until you’re ready to move it. This account is also called a Barter or Wash Account that has a balance of $0.00 because we always take out the amount we put in. Also, you won’t have to reconcile this account as this doesn’t hold any funds.

Also, if you need some references in the future, you can always access our site: Help articles for QuickBooks Online.

If you have other questions in mind, please place them here. Anytime I can help. Have a safe day ahead!

I understand what a clearing account is. My question was referring to how record the transactions mentioned by @DivinaMercy_N

Thanks for adding a few details to make sure we can match the transactions from your bank, @Steven_ZA.

To match them, you can record the payment received (R200) and put it in the Undeposited Funds account (this will place the money on a clearing account until you deposit the funds to your bank). Then for the expense/refund (R50), you can create a bank deposit and add it as a new category/account in the Add funds to this deposit section to track the expense. Also, ensure to enter a negative amount to minus it with the invoice payment.

This way, you can link the expense/refund with the invoice payment and able to get the R150 total and match it with the bank statement line of R150 in a single deposit. Furthermore, this won't make use of the Resolve option when matching the records in QuickBooks with the bank statement.

Here are the steps to follow:

Once done, you can create a bank deposit to choose the invoice payment and add the expense/refund manually as a new category to link the two transactions.

When you match transactions in the For review tab of the Banking page, QuickBooks will automatically detect the bank deposit recorded when you click the R150 worth entry in the bank statement. You can easily match or confirm it thoroughly.

If you matched the transactions recently with the incorrect transaction, you can go to the Categorised tab and click the Undo button to return the entries in the For review tab.

I've added some references to get more details about matching and categorising transactions from your bank and reconciling bank accounts in QuickBooks Online:

Categorise and match online banking transactions in QuickBooks Online.

Reconcile and account in QuickBooks Online.

It's good to know your interest to learn more. If you have additional questions about recording transactions and matching them with your bank statement/online banking, feel free to tag me (@Jovychris_A) and my other peers in your comment. We'll make sure to help you. Have a nice and prosperous day ahead!

Thanks for the detailed reply. This does seem to be a better way than using a journal entry. My last question though is regarding the recording of the expense details as a negative on the bank deposit.

In terms of the "Received From" and "Category/Account", do I match what the expense has since the expense has already been created? So if the expense has the Payee "Test Customer" and the Category "Bank Account", will the bank deposit line for it be the same? That won't cause duplicate transactions?

Hello there, @Steven_ZA.

Let me add some information about recording a payment with the refund.

I understand you created an expense for the refund amount as advised by one of m colleagues above. However, an expense transaction will show in your Profit & Loss report in a positive amount.

I suggest you follow the recommended steps from Jovychris_A. You can delete the expense transaction and record the refund in a negative amount when adding a Deposit.

I'm also adding this article as your reference in reconciling an account: Reconcile and account in QuickBooks Online.

If you have any questions about recording the refund amount of the payment received, let me know in the comment section. I'll be glad to share and provide further assistance.

It says over here you should create an expense to refund a customer where no goods/items were purchased (basically an over payment)? - https://quickbooks.intuit.com/learn-support/en-za/help-article/customer-refunds-credits/record-custo...

We need to be able to create the refund separately to the amount being processed on the bank account since it can happen on different days. So the above solution doesn't work.

Hi, Steven_ZA.

I appreciate you trying out the steps above. Allow me to share insight into how to create refunds separately.

In QuickBooks Online, you can use expense if it's an overpayment. But in your case, there is an invoice of 200. Either you can follow the steps provided by my colleague Jovychris_A or use a refund receipt and select the product used in the invoice.

For additional resources, let me share some links that will guide you on how to manage a customer credit or overpayment. From there, you’ll learn how to track excess payments, void or refund a transaction.

For other concerns about customer payments or refunds, post them again here. I'll be right here to help you. Have a wonderful day!

My original request may not have been clear, so apologies for that, but the payment that the refund is for is not linked to an invoice - it's an overpayment.

So, Day 1:

100 in payments from payment gateway but there's only a 50 invoice. Customer has overpaid by 50.

Day 2:

Customer wants refund of 50. Create expense for 50

Day 3:

150 in payments is received from payment gateway, but this is because it contains 200 debit and 50 credit for the refund. 200 still needs to be linked to a new invoice (different customer). The -50 needs to be applied to the refund expense. So the bank recon is only 150. A new invoice is 200. And the refund (expense) is -50.

Hope that explains it a bit better.

Thanks for the clarification, Steven.

I want to help you with these transactions. But it would be best to contact your accountant for the most appropriate way to handle payment refunds. They can guide you thoroughly to ensure everything matches your bank statement.

You can also visit our ProAdvisor website to find an accountant near you. Just simply enter your city, state, or ZIP code.

Once settled, you can use this information to reconcile your account in QuickBooks Online. It has complete instructions to ensure books are always accurate.

Visit us anytime if you have any other questions or concerns with managing your transactions. The Community team is right here to help. Take care!

This isn't an accounting problem though - it's a Quickbooks problem. In accounting I'd simply create a debtors payment and a debtors refund payment, and link those to the bank account. But Quickbooks seemingly has no way of linking a single bank amount to different payment types.

It isn't the kind of impression I'd like you to have, @Steven_ZA.

QuickBooks Online has limited features. But, we have a Development team working to improve our service to give you a better experience.

You can send feedback to our product developers to request the addition of this feature to QBO. Here's how:

Then, you can check our feedback page to check the requests made, and you can cast your vote for the same topic. It can help you with your future concerns about QBO.

Feel welcome to leave a comment if you have additional questions about the pop-ups in QBO. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here