Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi!

I'm actually new to this software and would like some clarifications.

1. If im adding a bill with items in it and selecting customer/project field, will the items automatically get deducted from the inventory without me invoicing the item from the stock.

2. Ive made a PO, a bill and a payment which is on cash basis from a supplier and other suppliers in the same manner, how will I properly file the documents as qb does not generate a transaction number.

Solved! Go to Solution.

I appreciate you getting back to us, @Hijasmuhammed.

At this time, adding another field to enter the supplier invoice number in Purchase Order isn't available. QuickBooks Online (QBO) only allows you to customise sales forms, like invoices, sales receipts, and estimates template.

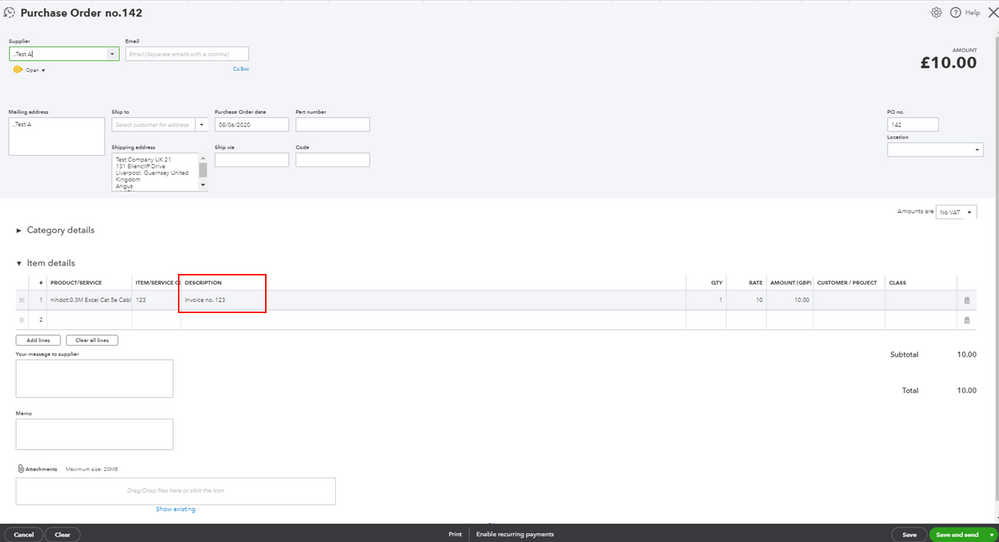

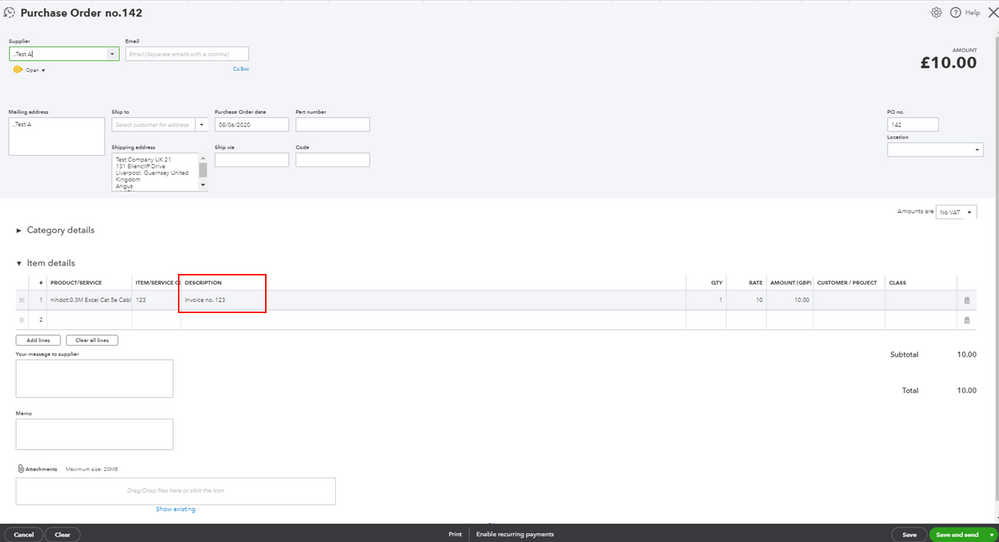

As a workaround, you can consider entering the supplier invoice number in the Description field to track it. Here's how:

I'm adding this article for more details: Create purchase orders in QuickBooks Online.

You might also want to check out this article to learn how to run purchase order reports: How to run purchase order reports.

Keep in touch if you need any more assistance with this, or there's something else I can do for you. I've got your back. Have a good day and keep safe.

How are you, Hijasmuhammed?

I'm glad that you're now using QuickBooks to help you manage your business. It's my pleasure to help and share with you some information about the software.

Creating a bill and making it billable with a customer/project has nothing to do in subtracting our inventory. The number that we have entered from the bill will be added to our inventory once it's saved. With that, it'll only change the quantity of the item, but it will not automatically deduct the inventory.

For your second question, I see that you're using the same process for multiple suppliers. What you have figured out is right that QuickBooks will generate a transaction number every time we create a transaction like purchase order (PO) and bill payment. This how QuickBooks works.

If you don't want to have a transaction number, we can manually remove it by following these steps. I see that this is not a simple method since it requires more effort on our part to make these things done. But, it's a way to help us remove the transaction number in QuickBooks. Here's how:

Let me know if you have other questions about QuickBooks Online. I'm always around to assist and provide you further information as you need. I hope you're okay. Keep safe!

Hi Sarah!

Thank you for the reply. My initial query is solved. but the second question, to be more precise is that quickbooks only has one field for entering the reference number (where I will enter the supplier invoice number) and does not generate a transaction number which I can use to file the documents of all the suppliers in one file based on the transaction number.

Please let me know if the question is not clear.

Thanks again!

I appreciate you getting back to us, @Hijasmuhammed.

At this time, adding another field to enter the supplier invoice number in Purchase Order isn't available. QuickBooks Online (QBO) only allows you to customise sales forms, like invoices, sales receipts, and estimates template.

As a workaround, you can consider entering the supplier invoice number in the Description field to track it. Here's how:

I'm adding this article for more details: Create purchase orders in QuickBooks Online.

You might also want to check out this article to learn how to run purchase order reports: How to run purchase order reports.

Keep in touch if you need any more assistance with this, or there's something else I can do for you. I've got your back. Have a good day and keep safe.

Hi Mark!

Thanks for the confirmation. I will have to file according to the date or like you said, I will have to enter the supplier invoice number in the description and mention the reference number in the field.

Thank you

Hi @Mark_R !

Hi @SarahannC

There is one more thing I need help with.

I have added a bill with a value of say 320.25 and when Im paying the supplier at a later date ive paid him only 320, but qb does not have an option to round off or discount the .25. The amount shows in the payables and does not look clean. Is there a simple work around for this as I have some bill which are in decimals and we usually pay by rounding it up or down to the nearest value.

Good observation, Hijasmuhammed. QuickBooks Online is unable to round off the amount.

You can create a journal entry to zero out the payable account. Here's how:

Before creating any entries, I'd suggest conferring with your accountant on the best way to categorize the items.

Moving forward, you'll want to add a discount item to a bill before paying it. I'll guide you with the steps.

First, create an account for the discount item. Here's how:

Next, create a discount item. Here's how:

Lastly, once you pay the bill, open the transaction, add the item, and then pay it.

If you have more questions, please feel free to click the Reply button below.

Hi,

In project - what cant i see the costing of material? i have key in the material use.

From inventory i can see where the material been use, but on project - i cant see the cost of material involve. it just have time and other expenses - but not the material

Hello, @mohdrais. Let me share some insights about tracking costs on projects.

Do you track the cost of materials as billable expenses so your customers can reimburse them? The cost of materials will only show on projects if you bill them to the customer/project. Make sure to add the billable expenses to invoices. This way, they'll show on the reports.

Here's how:

For more info, refer to this article: Invoice customers for project expenses.

To track how much you're making or losing on the project, you can run the Project Profitability report.

Here's how:

Feel free to swing by should you need additional assistance with running project reports. I'm always here to help.

Hi,

What I mean was :

1. In invoice, I have select the material used (this to deduct inventory item - which is working - material in inventory do go down)

2. But in my project costing - it didn't show the cost or track material used or invoice as cost (which it have deduct from the inventory - and it also link to the specific customer and project)

If I choose billable.

1. I need to choose the supplier - which I already have purchase the stock in bulk, but I want it to track as cost for each or every project separately

Lastly, why when I create invoice and link it to specific project - the invoice didn't link when I click the project? if I click create invoice it will require me to issue another invoice.

Example, the invoice 005025 is created and link to the project. But on project page, it didn't show the invoice and didn't track the quantity material used (cost too)

thanks

rais

I’ve got the information you need on how to track cost from every project, @mohdrais.

In QuickBooks Online, you can only add an invoice to a project when it wasn't created from an estimate and doesn't have any attached time or billable expenses. You’ll want to replace the customer's name in the invoice with the project name to add the invoice to a project.

This information contains complete instructions on how to track project costs and profits in QuickBooks: Track income, costs, and profitability by project.

I’m also adding this reference to learn more about projects: Projects FAQ.

Please let me know if you have any other questions or concerns with tracking costs on your projects. I'll be around to help. Always take care!

HI,

Im confuse a little bit. This what I do.

1. Create Project

2. Create estimate (some I didn't create estimate straight to invoice)

3. create invoice (track material usage and it deducted from my inventory)

4. add time

my question,

- the invoice didn't appear.

- the material deducted from inventory dan link to project (from inventory report)

- but no cost of material shown in project (all material I purchase in bulk. so I don't create billable expenses)

Thanks for getting back to us, @mohdrais. I appreciate your continued patience and all the details that you've provided. Allow me to share some details about concern.

To successfully track your inventory, make sure to set up the Cost of Goods Sold (COGS) for the item used in the invoice. Then, toggle the affected invoice items and save the changes.

You can also check this link for more details about inventory assets and cost of goods sold tracking.

If you have any trouble with any transactions in QuickBooks Online, please let me know and I’ll do everything I can to help here in the Community

Hi,

Yes - the inventory, I do choose "Cost of Sales"

1. if I go by material report - I can see the cost and where the material used

2. if I go by "Profit & Loss By Customer" - I just can see the overall cost instead of breakdown by each customer"

and yes, I did choose - cost of sales for the material.

But, when I click into project link - It didn't list off the detail accept the time cost.. invoice, material - didn't show

Hello again, mohdrais.

Let me get the help you need in running the report you need.

To have the cost of the material shown on the report, ensure that the cost amount is entered in the item settings.

Here's how:

To learn more about how the Project feature works, check these articles:

I'm only a couple of clicks away if you need further assistance in managing your account. It's always a pleasure to help. Have a great day!

Hi,

I do as per step by step from FAQ - some how - it just don't record it..

example - invoice it didn't show at project.. just the cost for time..

invoice, material didn't appear at project

time and other expenses i.e petrol do appear but things like material or invoice didn't link or shown

can someone help me?

thanks

Hello, mohdrais.

I'll make sure that you'll be able to record the invoice and show it as part of a project.

There are times when a browser's cache becomes full or damaged. When this happens, issues like this can occur. To better isolate, let's try logging in to your QBO account using an incognito or private browser. Since this doesn't store data in the cache, it is the best place to isolate browser issues.

Kindly use either of the following shortcut keys:

If it works, you may want to clear the browsing history of your regular web browser. This will remove previously-stored browsing data that might have caused the issue. Otherwise, you can try using other supported browsers to be thorough.

Additionally, I'd be happy to share the following guides to become more familiar with managing projects in QuickBooks Online (QBO):

You might also want to visit our QuickBooks Online learning guides for tutorials and webinars about the product.

In case you'll need assistance about projects and inventory, don't hesitate to get back on this thread. We're always here to help you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here