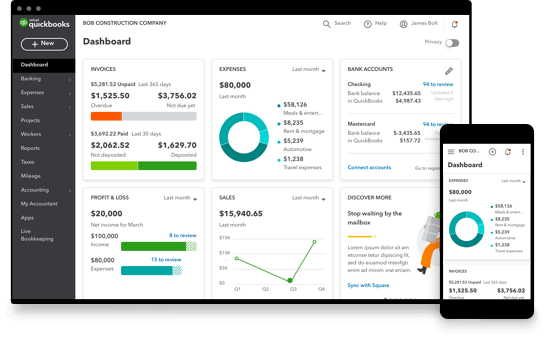

As a business owner, you need accounting software that helps you save time, increase productivity and is cost-effective. Small businesses should switch to cloud accounting software because it provides better access, efficiency, accuracy, scalability, and security compared to traditional accounting software.

Small businesses simply cannot rely on traditional accounting software as there are chances of committing data entry errors, subjecting financial information to data loss and viruses as a result of storing it in hard drives and USB devices, and shelling out huge amounts of money on data backup devices and software updates.

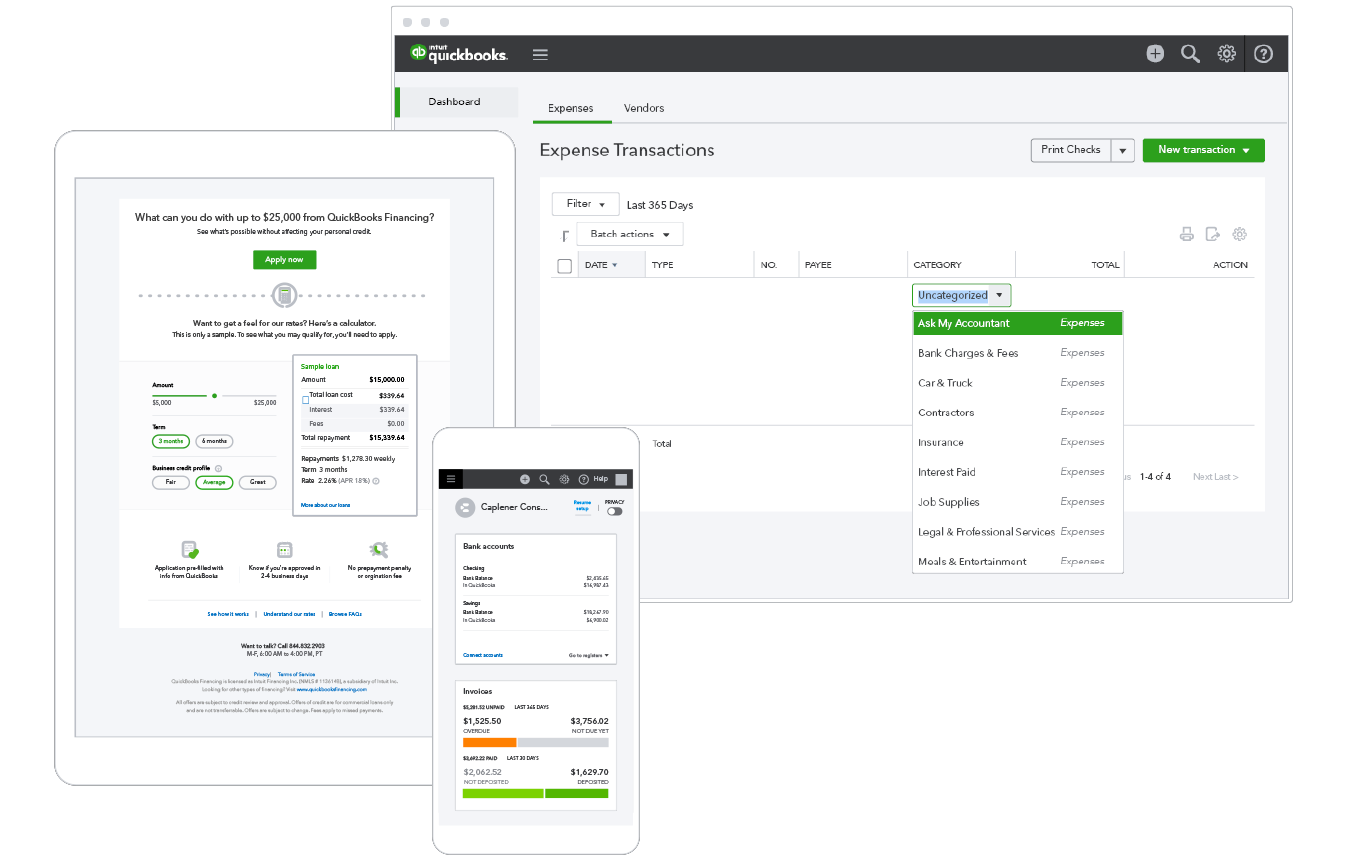

Thus, if you are still dependent on traditional accounting software, it’s time to switch to cloud based accounting platforms. Sign up for a QuickBooks free 30-day trial to try out the platform for your small business before you commit.