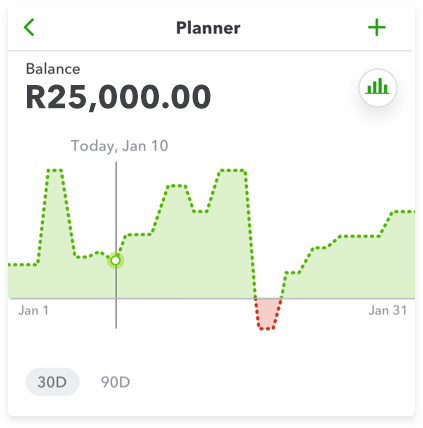

In this uncertain time for businesses, the new cash flow planner can give you insight into your cash flow for the next 90 days. By playing with future expense and income scenarios offering realistic cash flow projections, you can make informed decisions without messing up your actual books.

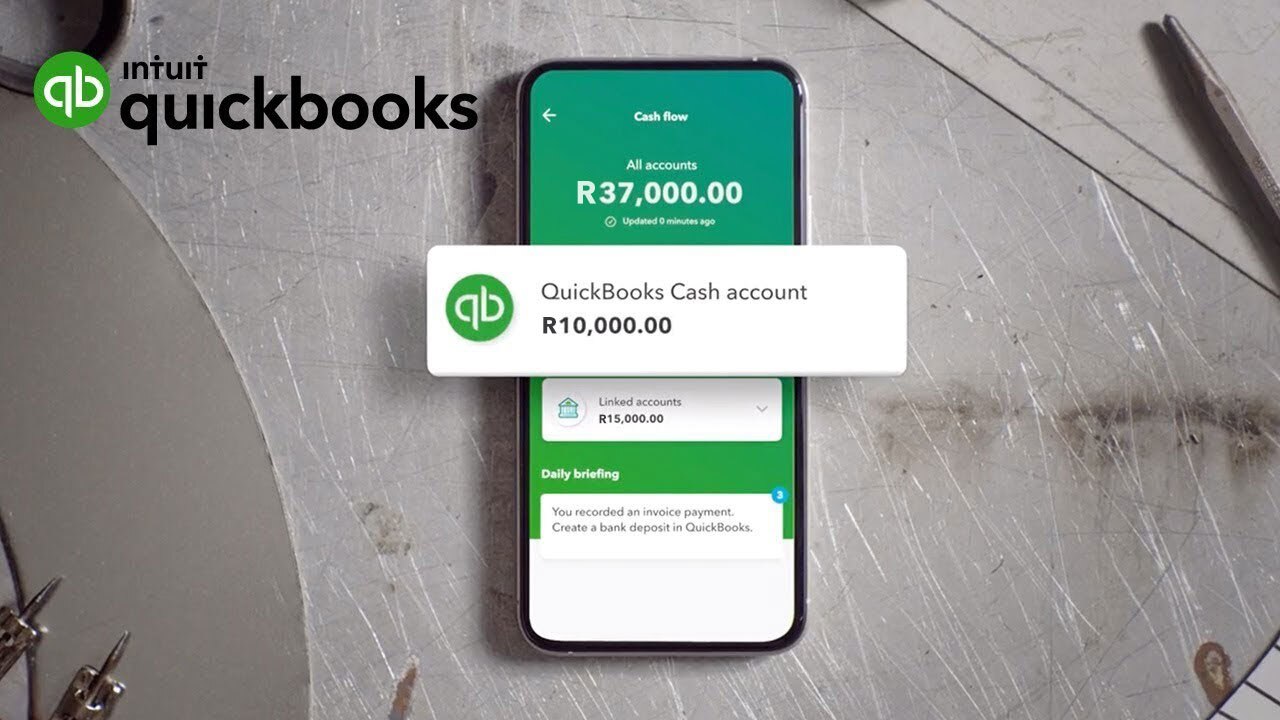

Effortlessly manage your business cash flow using QuickBooks

Take control of your cash flow

Sync with your bank to have the pulse of your cash flow at your fingertips. Discover ways to improve cash flow; chase overdue invoices, and review the necessity of some recurring expenses.

Take an advanced look at your cash flow

What will your cash flow look like in the next 90 days? View this by playing with potential purchases, investments and income scenarios — without messing up your actual books.

See your cash flow projection

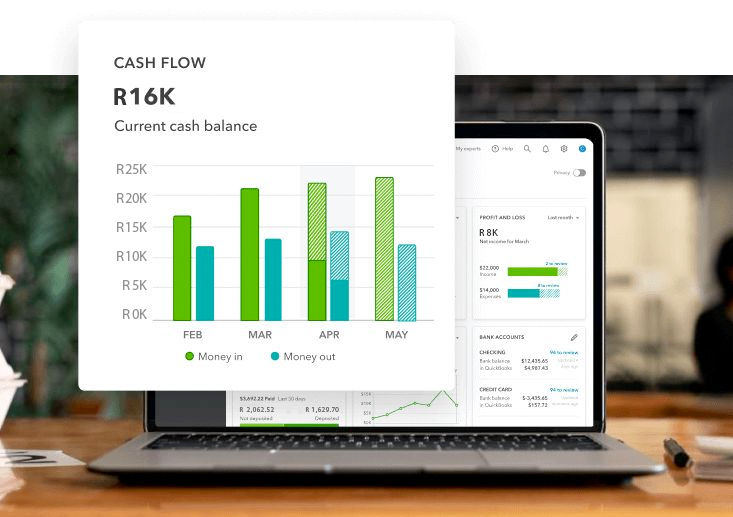

Stay prepared by forecasting money-in and money-out transactions over 30 and 90 days. Your data imports sync automatically for up-to-the-minute cash flow analysis without preparing and checking multiple spreadsheets.

- View and play with your business’ future using the 90-day cash flow planner.

- Run and export reports, including profit and loss, and balance sheet.

- Share a summary of your books with your accountant.

What is the cash flow planner?

The Cash Flow Planner is an interactive tool that forecasts cash flow, which is the in-and-out of your money over the next 90 days. It looks at your financial history to forecast future money in and money out events. You can also add and adjust future events to see how certain changes affect your cash flow without impacting your actual books.

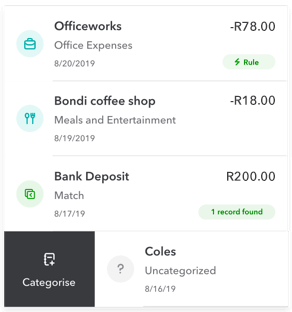

You also have a Cash Flow Overview to get a picture of your cash flow position and take actions to improve it including:

- Money in – Overdue invoices, open invoices, quotes

- Money out – Overdue bills, open bills and other recurring expenses.

To view the Cash Flow Planner and Cash Flow Overview, go to the Cash Flow left menu item on your dashboard:

How does the forecast work? What data is included?

The Cash Flow Planner chart uses historical data from your bank accounts connected to QuickBooks Online to forecast future recurring income and expenses. This includes categorised and uncategorised transactions. You can also manually include data to forecast cash flow by adding events that may occur in the future.

The Cash Flow Planner chart does not include:

- Credit card transactions

- Transactions you’ve entered manually into QuickBooks

- Multi-currency enabled files

How do I add events for possible money in or money out?

You can manually add events for potential income and expenses. For example, if you have a big sale coming up, add it as an event so it will be a part of the forecast.

Important: Events aren’t actual transactions and won’t affect your finances in QuickBooks.

- Select the Add Event button.

- Select Money in if the event is income, or Money out if it’s an expense.

- Name the event and enter an amount, then select Continue.

- Select the date when the event will occur.

- When you’re done, select Save.

To edit or delete an event:

- Select and open an event.

- Select the Date, Name, or Amount field, or change whether it’s Money in or Money out.

- When you’re done, select Save.

Frequently asked questions

The cash flow represents the amount of money coming in and going out of a business at any time. Cash flow is an umbrella term because it covers many different areas of your business. Ultimately though, it’s about balancing income with expenditure.

What is considered a good cash flow? What are the characteristics of a strong cash flow statement? Many South African small business owners ask these questions when they first start tracking cash flow and preparing cash flow statements.

What does a good cash flow statement look like?

The amount of cash on hand can vary significantly depending on your type of business and your operations.

With this in mind, no perfect or standard cash flow statement applies to every business – however, there are three general indicators that your cash flow is in a healthy position:

- You record positive cash flow from operating activities: The foremost requirement of a healthy business is its ability to generate more cash than it spends. As such, your business’s core operations should consistently grow your net cash flow over time.

- Your customer payments are up-to-date: Late payments frequently contribute to an unhealthy cash flow. This forces business owners to shoulder unnecessary expenses such as overdraft fees as a direct consequence. To minimise delayed payments, you should calculate your debtor days (the average time it takes for your customers to pay you) and work out an acceptable number of debtor days. Generally, the acceptable number of debtor days will depend on your credit terms and business model, but the lower the number, the better.

- Fund your investments with cash, not financing: Although from time to time, having positive net cash flow from financing activities is necessary when expanding your business, ideally, it should be the exception rather than the rule. This suggests the company is using its cash flow from operating activities to pay off external financing and issue dividends instead of taking out new loans. Simply put, it reassures investors that the business fundamentals are strong enough and can pay for its growth instead of relying on one-time gains such as selling its assets or raising funds.

Tips for managing cash flow effectively

Whether you’re running a start-up or an established business, effectively managing cash flow is critical for long-term success.

To ensure success, there are quick ways to optimise your business cash flow and avoid problems like:

- Streamline your invoicing process: However you track payments, it’s crucial to be able to see what you’re owed and know how to collect on unpaid invoices. QuickBooks makes it easy to manage invoices from end to end. You can create, send, track and send reminders to customers, all in one place.

- Reduce outgoings: Look for areas where you can reduce recurring monthly, quarterly and annual expenses. Can you reduce the cost of utilities, rent, payroll, subscriptions or any other unnecessary expenses?

- Increase income: Consider how you can increase revenue by exploring new sales channels, expanding your offering or selling off assets you no longer need for a quick cash injection.

- Expand your payment options: There are plenty of reasons why invoices go unpaid—and a lack of payment options is one of them. It’s a good idea to be flexible about your payment methods. The EFT option is a given, as is accepting credit and debit cards, and PayPal is an option to consider.[tc1] Including your payment details along with your invoices gives your customers all the options they need.

- Consider your borrowing options: Injecting money into your business by borrowing is another way to boost your cash flow. Ask your current financial service provider what they can offer to help you bridge the gap in the case of cash shortfalls.

- Negotiate accounts payable: Negotiating payment terms with suppliers or other payees can help you spread your cash flow more evenly. With more working capital available, you can prioritise your most important expenses and prevent minor cash flow problems from becoming major issues.

- Customise and automate your financial reports: Business owners should be familiar with a handful of accounting reports. Profit and loss statements and a balance sheet are two examples of reports that need to be checked frequently to understand your cash position.

Perhaps the most significant advantage of online accounting software over Excel spreadsheets is the ability to customise and automate these reports, giving you a constant and clear picture of your financials, including cash flow.