The income statement gives you a snapshot view of your business’s financial performance and profitability so you can make better financial decisions. It’s one of the main financial statements that businesses use to understand cash flow and profitability.

Keep tabs on your business’ financial performance

Know where you’re at

Make better business decisions

The income statement details revenue, expenses, and profits (or losses) over a specific time period. Insights from the income statement can help you evaluate where you can reduce expenses, grow revenue, and increase profit.

We’ll handle the numbers

Spend less time manually entering data. QuickBooks tracks and organizes all of your business’s accounting data, making it easy to access and review your income statement.

Everything you need to know about income statements

By Kathryn Pomroy

What is an income statement?

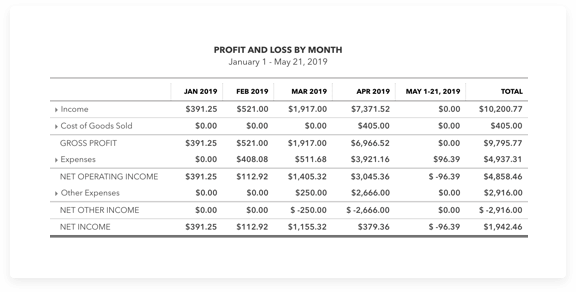

An income statement, also known as a profit and loss statement (P&L), is one of several key financial statements that small business owners, accountants, and the self-employed use to assess their company’s financial performance.

The income statement — along with the balance sheet and the cash flow statement — summarizes a company’s profitability for the year. It shows income through a particular period of time, which may read something like, “for the fiscal year or quarter ending [date].”

The time period is determined by the company and will vary. For example, it could be:

- For the three months ending December 31, 2019 (October 1-December 31, 2019)

- For the four weeks ending December 27, 2019 (November 29-December 27, 2019)

- For the fiscal year ending June 30, 2020 (July 1, 2019-June 30, 2020)

What does an income statement show?

Your company’s income statement shows operating expenses, revenues, gains, and losses, but does not show line items such as cash receipts or cash disbursements. If your company’s revenue minus its total expenses and losses is positive, then your income statement will show a net profit for the reporting period. However, if the bottom line is negative, your company will show a net loss

To make sure your company’s performance remains in tip-top shape, we’ve provided a few tips you can use to understand your income statement. After which, you can download our free single-step income statement template on the other tab of this page.

The income statement formula

The income statement is:

Net Income = ( Revenue + Gains ) — ( Expenses + Losses )

The formula applies to one of the three core financial statements, the income statement (the balance sheet and the cash flow statement are the other two). It shows your company’s profit and loss over a specific period of time and is used to summarize the financial performance of your company. It’s also called the statement of earnings or profit and loss statement.

The matching principle and accrual accounting

The matching principle is a combination of the revenue recognition principle and accrual accounting. Both methods specify the accounting period when both revenues and expenses are realized. The matching principle and accrual accounting create consistency in income statements, cash flow statements, and balance sheets.

Generally Accepted Accounting Principles (GAAP) require a business to use the accrual method of accounting so that revenue is matched with expenses in the proper month or year. In other words, you record income whenever you complete a service or when goods are shipped and delivered.

The single-step or matching income statement formula is:

Net Income = Revenues – Expenses

For example, let’s assume that Sterling Sporting Goods spends $30,000 to purchase 300 baseball bats as inventory in February. The cost of the baseball bats ($100 per bat) is posted to inventory, an asset account.

If 50 of the bats are sold in March for $120 each, the cost of the 50 bats ($5,000) is reclassified as cost of goods sold, an expense account. As a result, the $6,000 revenue from March bat sales ($120 x 50 bats) is matched with the $5,000 March expense of purchasing the inventory.

Sterling shows a $1,000 sales revenue, and the profit is posted to net income on the company’s income statement.

Keep in mind that although Sterling Sporting Goods shows a $1,000 gross profit, there are other expenses that affect the bottom line such as advertising expenses, interest expenses, administrative expenses, income tax collected, etc. After considering each of these expenses, the company’s income statement will show a net profit (or loss).

Relationship to cash flow

If you’re using the accrual method, your statement of cash flows will not directly connect to activity in your company’s income statement. The accrual method of accounting posts revenue and expenses, regardless of when cash moves in or out of the business.

Using the baseball bat example above, Sterling Sporting Goods posts $6,000 in revenue in March, even if none of the $6,000 is received in cash. The $6,000 is posted in accounts receivable, which is the money due to a company for goods or services delivered but not yet paid for by the customer.

In March, the revenue from the sale of baseball bats is matched with the expense of purchasing inventory, and a $1,000 profit is recorded. When cash is received, Sterling reduces the accounts receivable account and increases cash or total revenue from the sale.

Connection to the balance sheet

A company’s balance sheet is a snapshot of a company’s net worth at any given time. A company’s net income on the income statement will also be posted to the equity section of the balance sheet. The balance sheet formula is:

Assets = Liabilities + Equity

The connection between Sterling Sporting Goods’ balance sheet and its income statement looks like this:

At the end of each accounting period (month and year), Sterling closes the books by adjusting all revenue and expense accounts to zero. The company’s total revenue minus expenses is posted to net income, and net income increases the equity balance on the balance sheet.

The $1,000 profit (net income) from March bat sales increases Sterling’s equity. Bear in mind that income statement accounts begin each new period with a zero balance, while the balance sheet amounts are carried forward from one year to the next.

Operating vs. non-operating income

The income statement formula is used to produce a single-step income statement, which is perfectly acceptable for many companies. However, many tax accountants and some banks analyze business results using a multiple-step income statement since it provides more detail.

A multiple-step income statement separates operating income and expenses from non-operating activity. Operating income and expenses are transactions related to the day-to-day operations of the business. Non-operating activity includes things like gains or losses from investments, sales of property or assets, etc.

How to calculate both operating and non-operating income

Sterling Sporting Goods, for example, is in the business of selling sporting goods equipment through its retail locations. If, on the other hand, the company sells a building, resulting in a capital gain, the gain is considered non-operating income.

To put it another way, Sterling Sporting Goods wants to take out a business loan and must show the company’s operating income to its creditors.

The company pulls up its accounting software and learns that the company’s revenue was $250,000 last year.

The company reported the following expenses:

- Cost of goods sold (COGS): $15,000.

- Improvements to property: $5,000.

- Utilities: $4,000

- Wages: $65,000

- Office supplies: $3,500

- Insurance: $7,500

Before Sterling calculates its operating income, their gross income must be calculated.

Revenue – COGS = Gross Income

$250,000 – $15,000 = $235,000

Sterling then tallies it’s operating expenses, which equal $85,000.

To calculate Sterling’s operating income, they subtract their operating expenses from their gross income.

Gross Income – Operating Expenses = Operating Income

$235,000 – $85,000 = $150,000

Therefore, Sterling Sporting Goods operating income for the year was $150,000.

Operating income equals long-term success

Analyzing both operating income, also called operating margin (income generated from a company’s primary business operations) and non-operating income (that portion of a company’s income that is derived from any activity not directly related to a company’s primary business) is important.

Successful companies must be able to consistently generate operating income to thrive over the long-term. Reporting non-operating income is unusual, and a business cannot rely on non-operating income each year to reflect a company’s performance.

A company’s income statement shows revenue, costs, sales, expenses, gross profit, income, taxes paid, and net profit in an orderly manner. You can download our single-step income statement template on the next tab, which you can easily modify to include all of the relevant revenues and expenses that apply to your company.

Over 98% of customers recommend QuickBooks†

Free income statement template

Understand the performance of your business with the income statement. The income statement, also known as the profit and loss statement, summarizes your business’s income, revenue, and expenses. We’ve created a free income statement template that you can download and start using today.

If you’re a new small business owner, Excel templates can be a useful solution. The more your business grows, the harder it gets to manage everything in Excel. If you want to save time and spare the headaches, accounting software like QuickBooks can do the hard work for you.