Invoices Requirements in South Africa

The South African government has strict criteria for invoicing clients. If your annual turnover exceeds or is likely to exceed R1 million, you must register for VAT and collect it on your invoices.

If your turnover in the past 12-month period has exceeded R50,000, you can choose to register for VAT voluntarily. However, if your business is registered for the turnover tax you don’t need to charge VAT on your invoices.

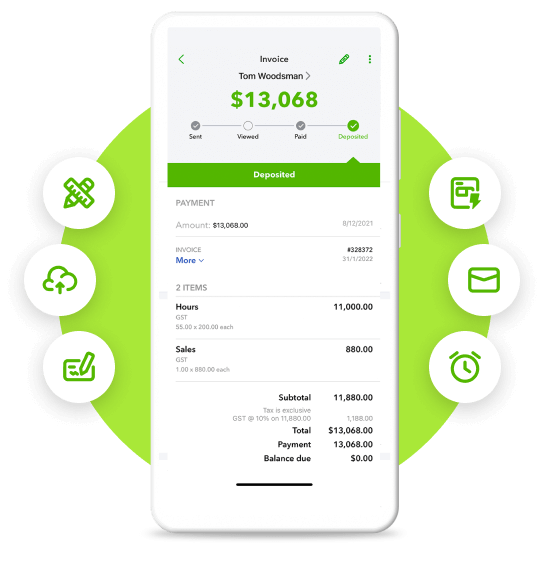

For local currency invoices, include:

- The exact date the invoice was issued

- The word “Tax Invoice”, “Invoice”, or “VAT Invoice”

- The invoice number

- The VAT number of your business

- The contents or services supplied

- Address of the company or individual you are billing (for example, Sandtion, South Africa)

- The net amount

- Value of the supply, the amount of tax charged and the consideration of the supply (value and the tax)

You can read more about tax invoice requirements in South Africa on the South African Revenue Service (SARS) website.