3 years of compounding interest

Here’s a simple example to understand the math behind compounding interest. Assume that you invest R1,000 at a 5% interest rate in year one, which generates annual interest of R50.

In year two, you keep the original R1,000 invested, plus the year one earnings of R50. The total amount invested in year two is R1,050—which, invested at 5%, produces R52.50 in interest. By investing year one earnings of R50, you earn R52.50 in year two.

As the number of periods increases, the additional amount of money you earn from compounding also increases. You earn an extra R2.50 in year two, and the year three earnings are R5.13 greater than year one.

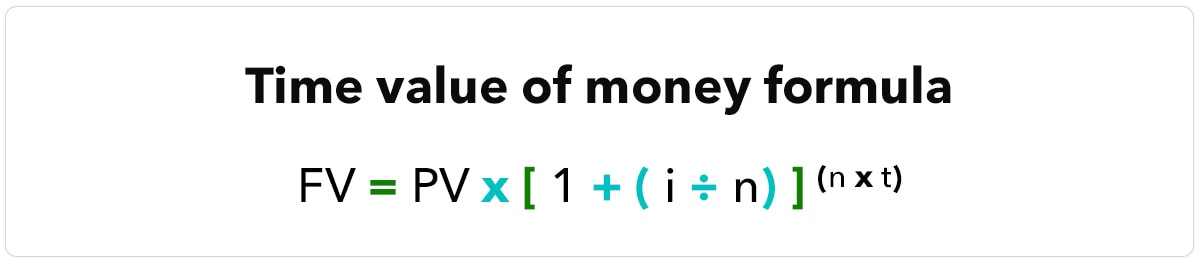

The manual calculation gives you the same result (with rounding) as the future value tables:

- The earnings over three years total R63, and the future value table factor (using the link above) for 3 years at 5% is 1.1576.

- The “1” in the factor is the original R1,000, and the 0.1576 is the total earnings over three years.

- R1,000 times1576 is R157.60.

The calculations discussed so far assume a single amount. Annuities, on the other hand, use a series of payments.