A business runs on transactions, which can be traced through receipts or the creation of accounting forms known as source documents, such as sales slips and bills. Once a business transaction takes place, it triggers the accounting recording process.

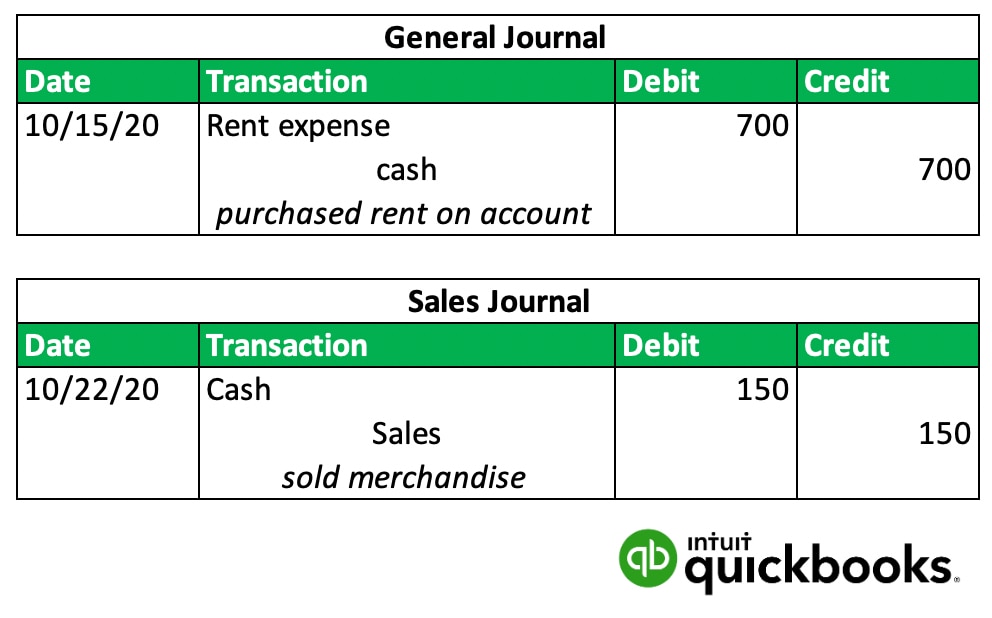

This process turns transaction source documents into debits and credits in an accounting journal, thus making a journal entry. Journal entries are then used to create a company’s financial statements at the end of every accounting period.