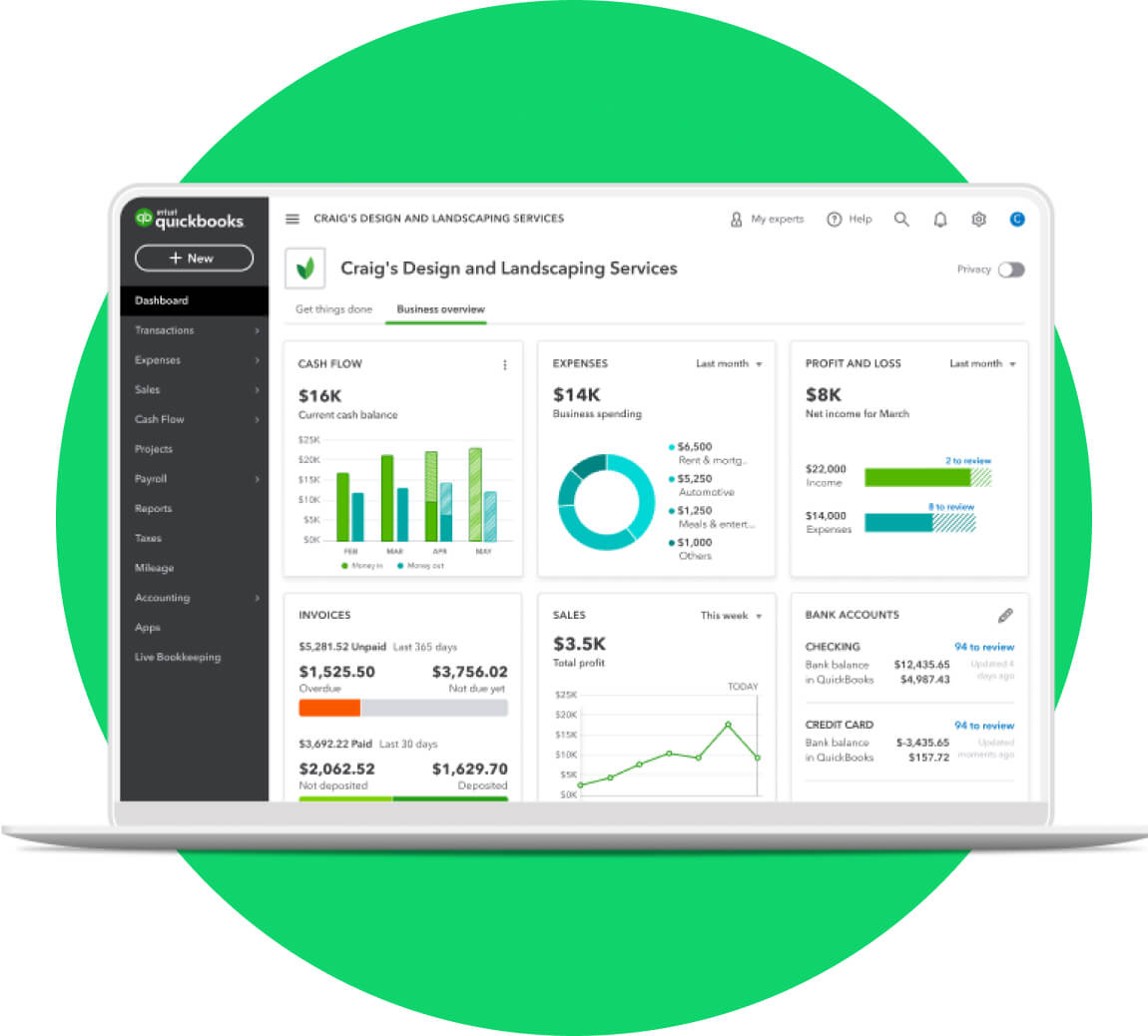

QuickBooks tracks and organises all of your business’s accounting data for you, making it easy to view your balance sheet whenever you like. Spend less time manually inputting data and more time working on your business.

Creating a balance sheet

The QuickBooks balance sheet feature makes your life just that little bit easier

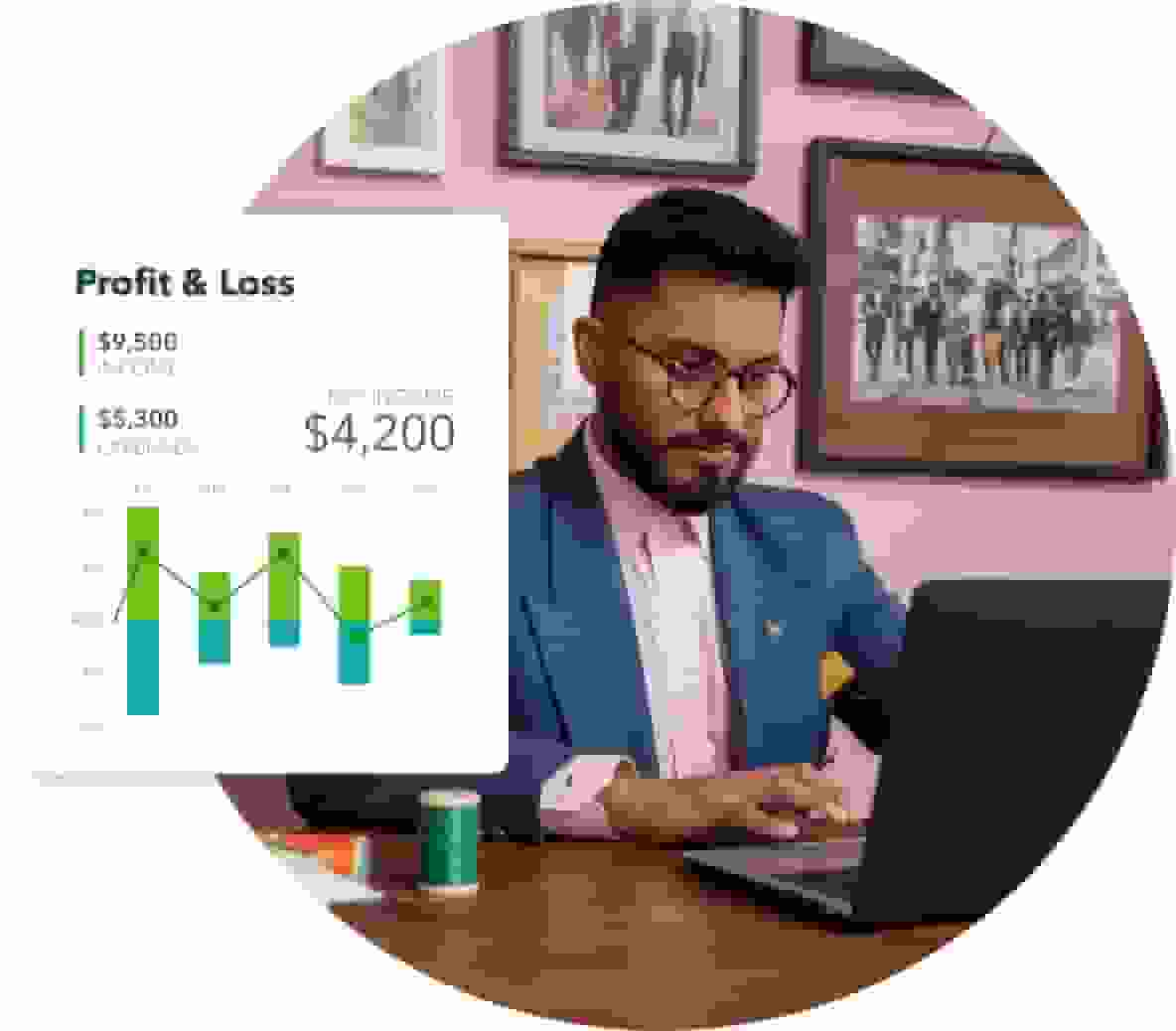

Know your business like the back of your hand

Say goodbye to manual data entry

Customise and adapt your financial statements

Generate and customise up to 65 accounting reports in QuickBooks. Easily share your reports with investors, colleagues or business partners. QuickBooks Online even lets you schedule your financial statements to be generated daily, weekly, or monthly, so you’re always across how your business is performing.

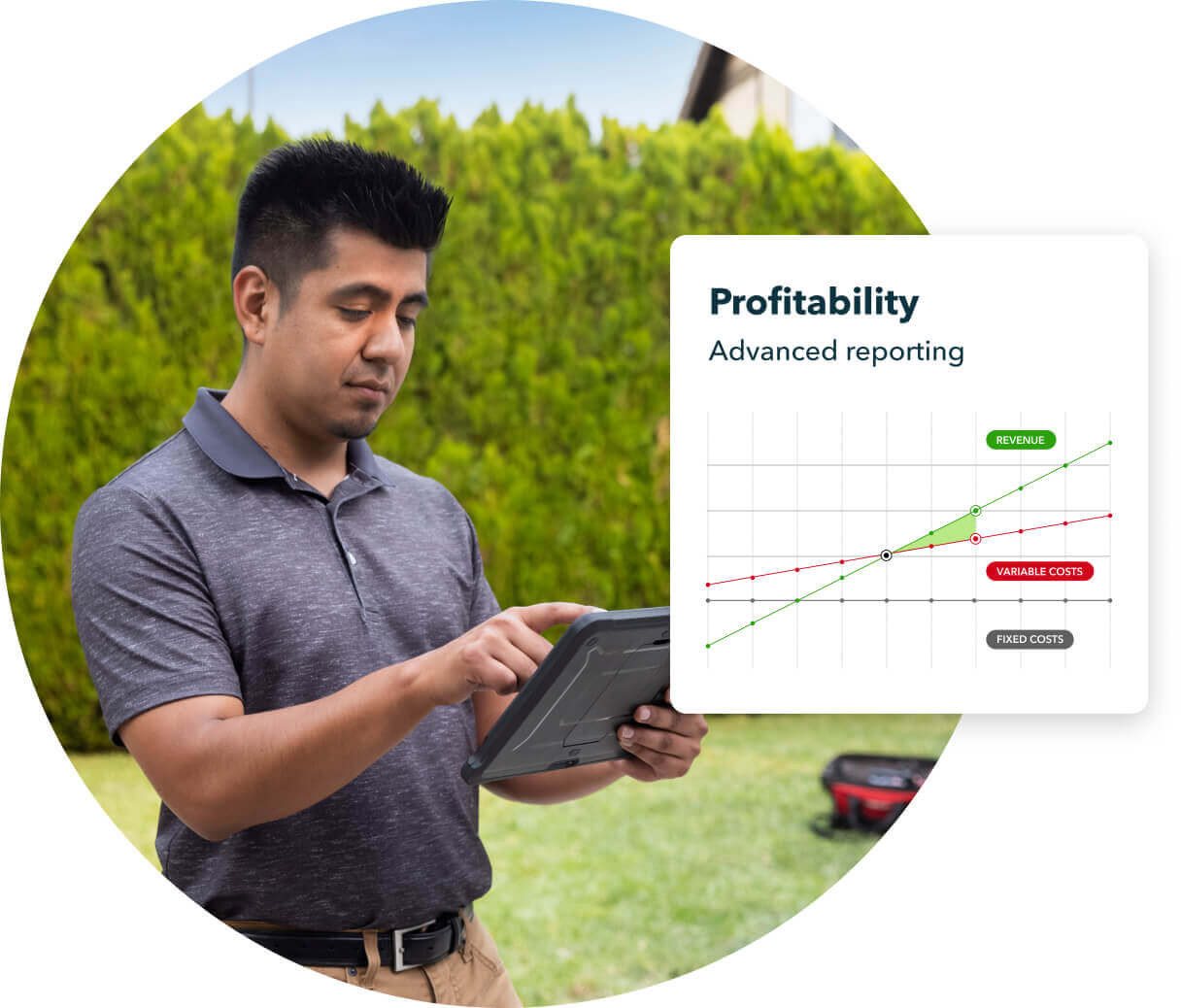

Make crucial decisions confidently

Your balance sheet offers insights into what you own (assets) and what you owe (liabilities). This tells you your business’s worth and helps you to identify the health of your business, empowering you to make confident decisions about your future growth plan.

Get the full picture of your finances with an easy-to-read balance sheet

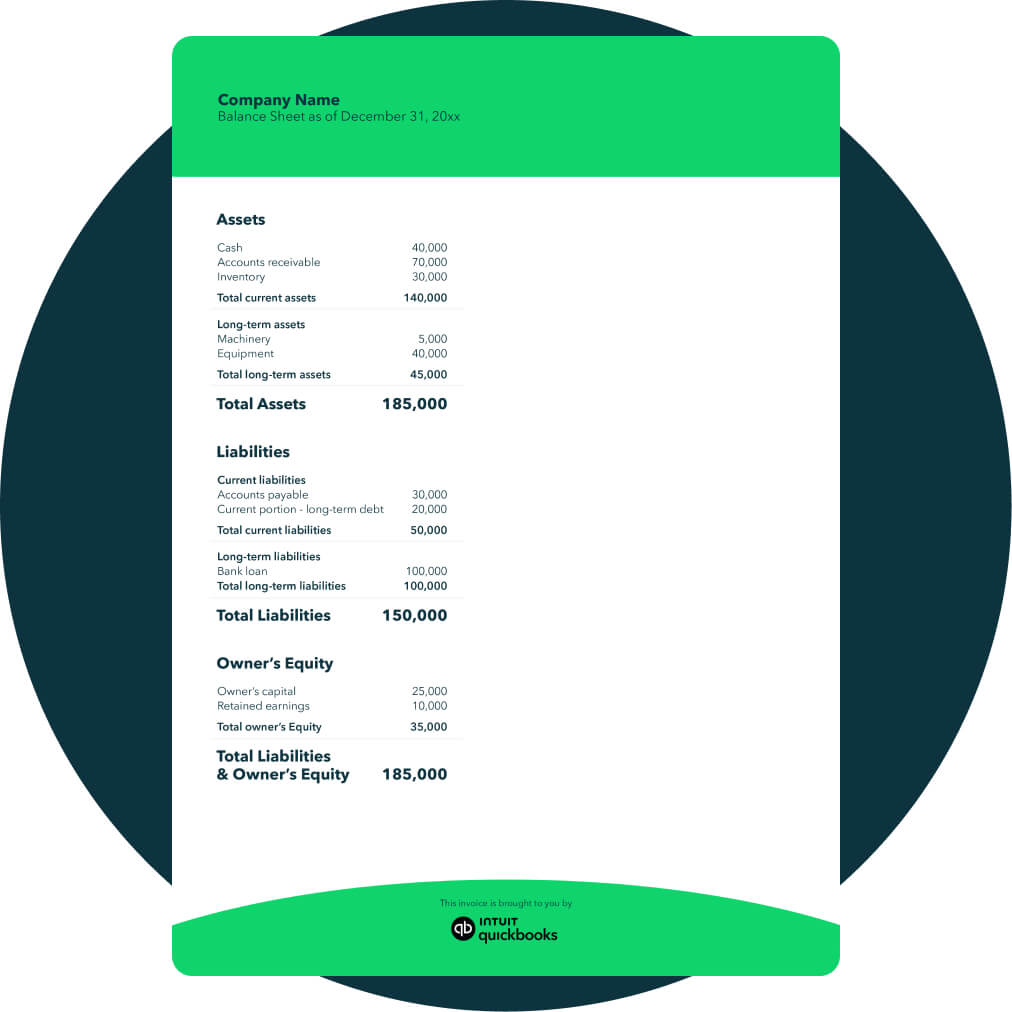

The three core elements of the balance sheet are assets, liabilities and equity. The financial statement has two sections that need to be balanced, hence the name ‘balance sheet’. Your balance sheet is one of three critical statements that indicate your business’s financial performance, the other two being the cash flow and income statements.

Your QuickBooks Online balance sheet makes it easy to track your finances

About balance sheets

What is a balance sheet?

A balance sheet is a financial statement that shows a company’s assets, liabilities and equity at a given time. It is one of the three core statements that indicate a business’s financial health, the other two being the income statement (profit and loss statement) and the cash flow statement.

The balance sheet shows what a business owns and what it owes. It also indicates the amount of money shareholders have invested in a company. When combined with other key financial statements, the balance sheet can be used to calculate crucial metrics, such as rates of return and other essential financial ratios.

What does the balance sheet indicate?

The balance sheet is organised into two sections: The assets section and the liabilities and equity section.

The assets section includes everything the business owns, such as cash, accounts receivable, property and equipment. The liabilities section includes everything the company owes, such as accounts payable, accrued expenses and loans.

Once a company’s liabilities are subtracted from its assets (money owed - money owed), the leftover amount is known as ‘shareholder equity’. This is the amount of money that belongs to the business owners. Altogether, the balance sheet provides a snapshot of a company’s finances at a single point in time.

The balance sheet must always ‘balance out’. This is because the amount of finance left over after a business’s liabilities have been subtracted from its assets always belongs to the business owners (equity).

Understanding the balance sheet

The balance sheet is split into two sections: Assets make up one side of the sheet and liabilities and equity make up the other. This section will explore each component of the balance sheet in more detail.

Assets

The assets section of a balance sheet indicates everything a business owns or can convert into cash. The assets in a balance sheet are usually listed top to bottom based on their liquidity (how quickly they can be converted into funds).

Assets are typically broken down into current assets and non-current assets.

Current assets

A current asset is an asset that can be converted into cash within a year. Current assets usually consist of cash and cash equivalents, such as accounts receivable (money owed to the company), prepaid expenses and stock.

Non-current assets

A non-current asset is an asset that cannot easily be converted to cash within a year, such as property, long-term investments, equipment and intangible assets, such as patents and trademarks.

Liabilities

The liabilities section of the balance sheet indicates financial obligations the business owes to other parties, such as employees, lenders or suppliers. They are usually listed in order of how soon they are expected to be paid. Like assets, liabilities are often broken down into current and non-current sections.

Current liabilities

Current liabilities are a company's liabilities that will be paid within one year. These include accounts payable (money owed to suppliers or other businesses), income taxes payable, accrued expenses and short-term loans.

Non-current liabilities

Non-current liabilities are liabilities that don’t need to be paid back within one year. These include long-term loans, deferred tax liabilities, long-term debts and pension liabilities.

Equity

Equity refers to the residual interest owned by the business once all liabilities have been paid. In short, it is the amount of the company that belongs to the owners. Equity has two main components: capital contributions and retained earnings.

Capital contributions

Capital contributions, also known as common stock or paid-in capital, refer to the amount of money invested by business shareholders.

Retained earnings

This is the portion of the company’s profits that have been retained and reinvested into the business rather than being paid out to shareholders as dividends.

Build the right plan for your business

Customer success stories

Customer success stories

“QuickBooks helps a lot. It doesn’t matter where I am, I can keep an eye on what’s going on. We’ve integrated it with the ATO, which makes my life so much easier. It gives me so much confidence that now when I am overseas I can actually take time to rest”