The income statement is among the most important financial statements available to you as a business owner. It provides a snapshot of your current cash flow and offers vital information about your revenue, expenses, profits and losses, letting you keep track of every metric that matters, all in one place.

Creating an Income Statement

Stay informed with Quickbooks income statements

Gain a deeper understanding of your business performance with valuable financial insights.

Always know where you stand with QuickBooks income statements

Keep tabs on your performance

Make big decisions with confidence

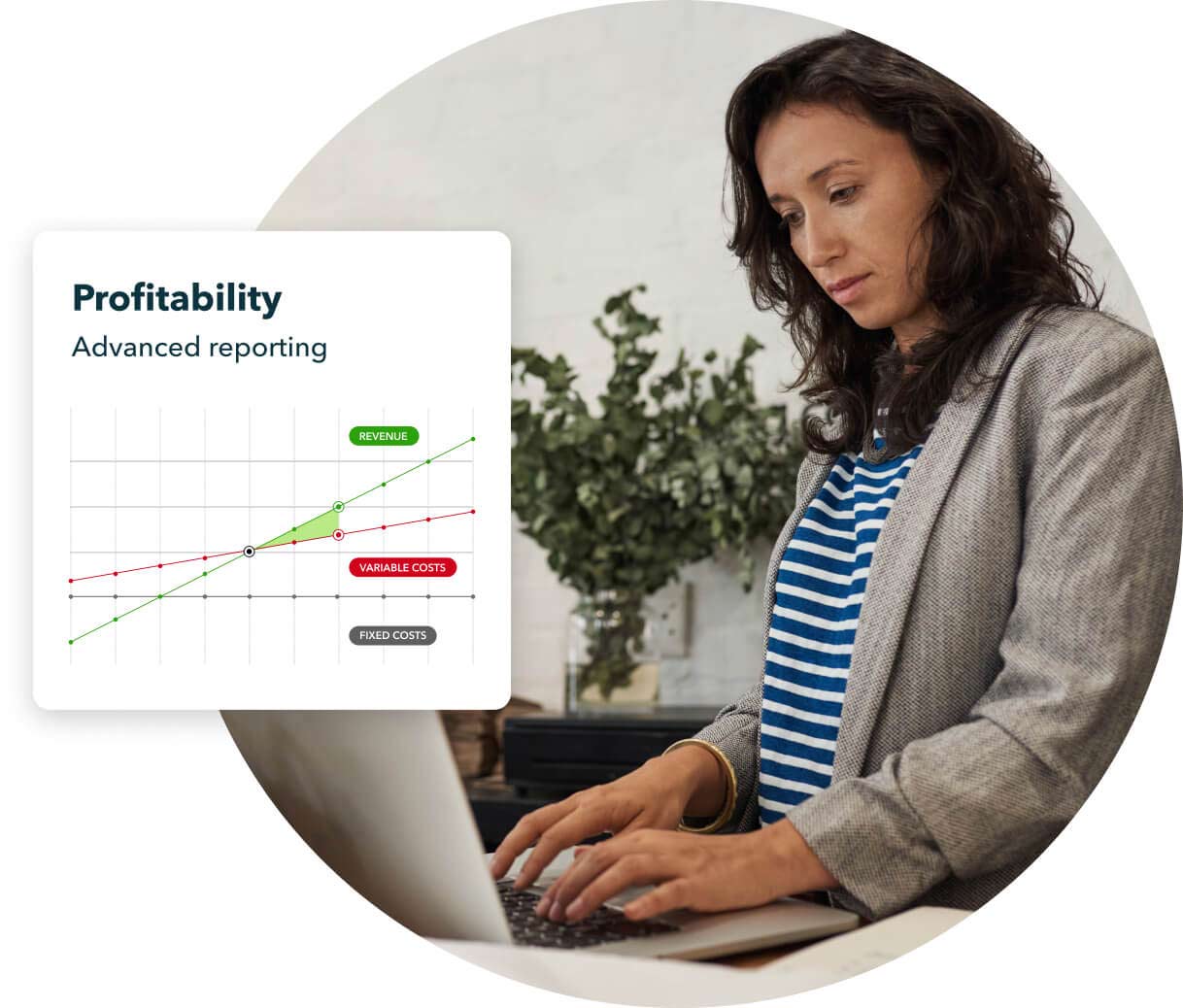

Your income statement offers critical information and valuable insights into your business's profitability and performance, empowering you to make crucial decisions with confidence.

Automate your bookkeeping with QuickBooks

QuickBooks automatically monitors, organises and displays your business's financial data, allowing you to view your income statement at any time. Spend less time inputting data manually and more time building your dream business.

About income statements

What is an income statement?

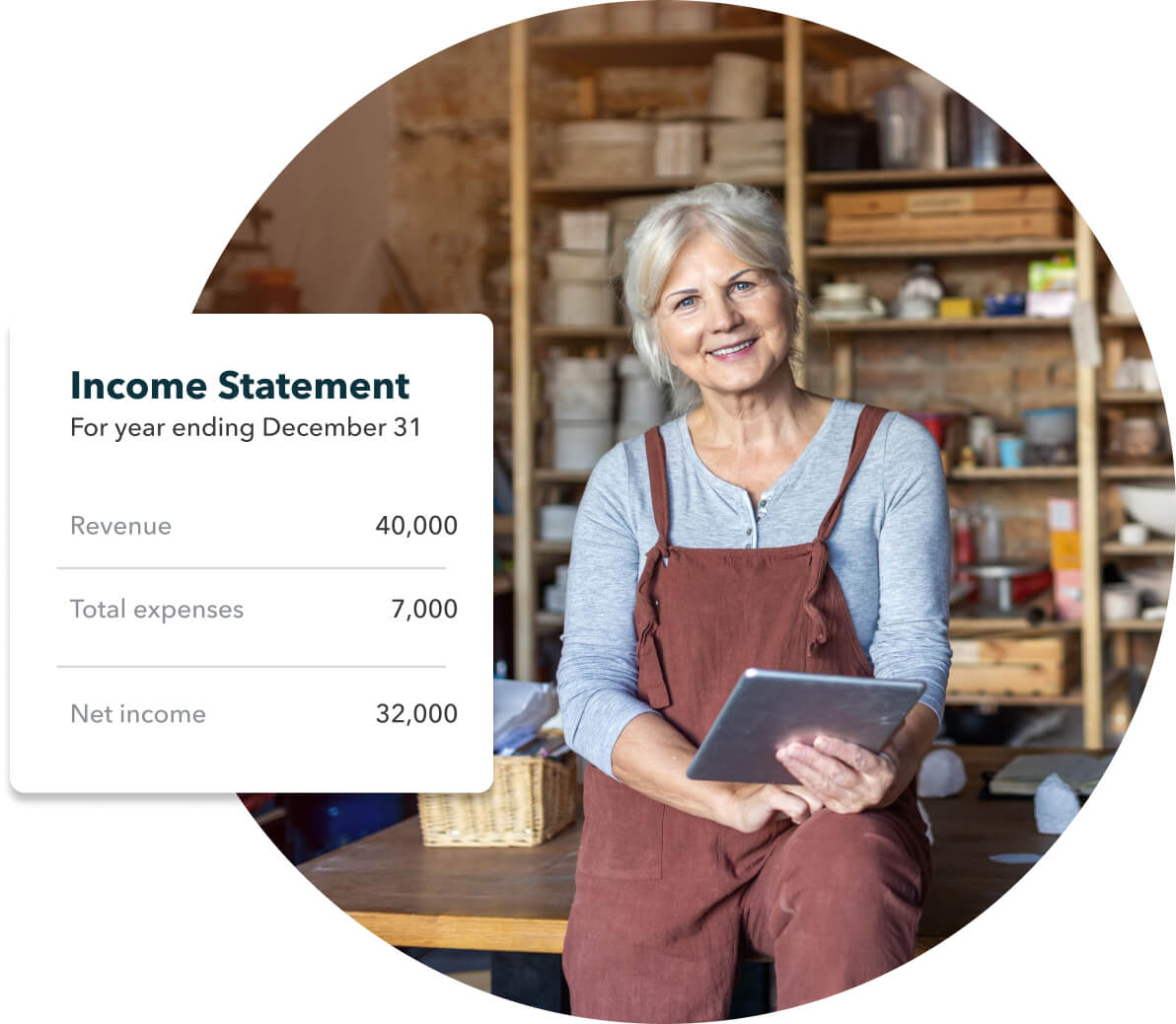

An income statement, also referred to as a profit and loss statement, is a crucial way for small business owners, self-employed individuals, and accountants to monitor, assess and review their business’s financial performance.

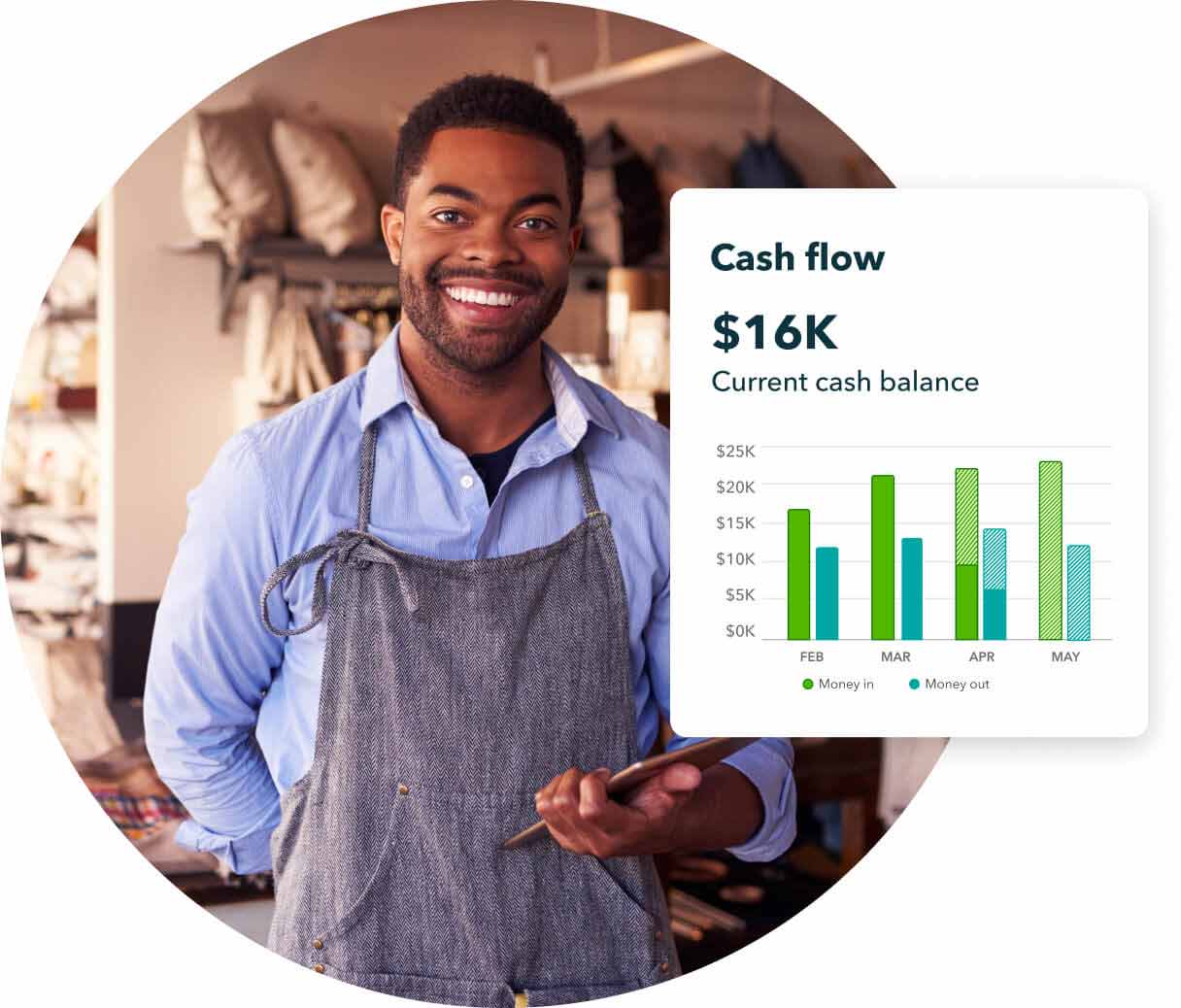

Along with other essential metrics, such as cash flow statements and balance sheets, the income statement provides an overview of a business's performance and profitability. It shows how much money a company has made or lost over a set period of time.

For example, an income statement might tell a company how much money they have made in a fiscal year, a specific month of the year, or a fiscal quarter (three months).

Understanding your income statement

Your income statement can be broken down into four core sections that help you calculate your net income. These are revenue, gains, expenses and losses. Let's look at each element in more detail to understand what they mean.

Revenue

In general, revenue refers to the amount of money realised through business activities. In some cases, an income statement may break revenue down further into 'operating revenue' and non-operating revenue'.

Operating revenue

Revenue gained through a business's primary activities is referred to as operating revenue.

For example, if a company offers a product or service, operating revenue refers to the money earned by the business through the sales of that product or service.

Non-operating revenue

Revenue gained through a business’s secondary activities is referred to as non-operating revenue.

This revenue is attained by means outside of the sales of goods or services. For example, investment income or rental income from an unused property are both classified as non-operating revenue.

Note that non-operating revenue is still 'recurring revenue', meaning that this revenue is realised on a regular basis. One-time nonbusiness income, such as a company selling old or unused machinery, falls into the 'gains' category.

Gains

Money earned from other one-time business activities is referred to as gains. For example, the sale of old machinery, unused land, or money earned from lawsuits falls under gains.

Expenses

An expense is a cost incurred by a business as part of its daily operations to generate revenue.

For example, the cost of goods sold (COGS), employee wages, utility bills and research and development (R&D) costs are all classified as expenses because they are required to keep the business functioning and generating a profit on a day-to-day basis.

Losses

A loss is a one-time, unexpected event resulting in a financial loss. For example, lawsuits, theft and damage to property are all unplanned costs, meaning they are classified as losses.

Customer success stories

Customer success stories

“QuickBooks helps a lot. It doesn’t matter where I am, I can keep an eye on what’s going on. We’ve integrated it with the ATO, which makes my life so much easier. It gives me so much confidence that now when I am overseas I can actually take time to rest”

Find a plan that’s right for you

Free unlimited support

No contract, cancel anytime