We're here for you.

Set up your clients on QuickBooks Online

Step-by-step guide

Step 1: Migrate your client files

If you need to switch your existing clients across to QuickBooks Online, our migration partners can help you safely and securely transfer your client’s data.

Check out our comprehensive guide on switching.

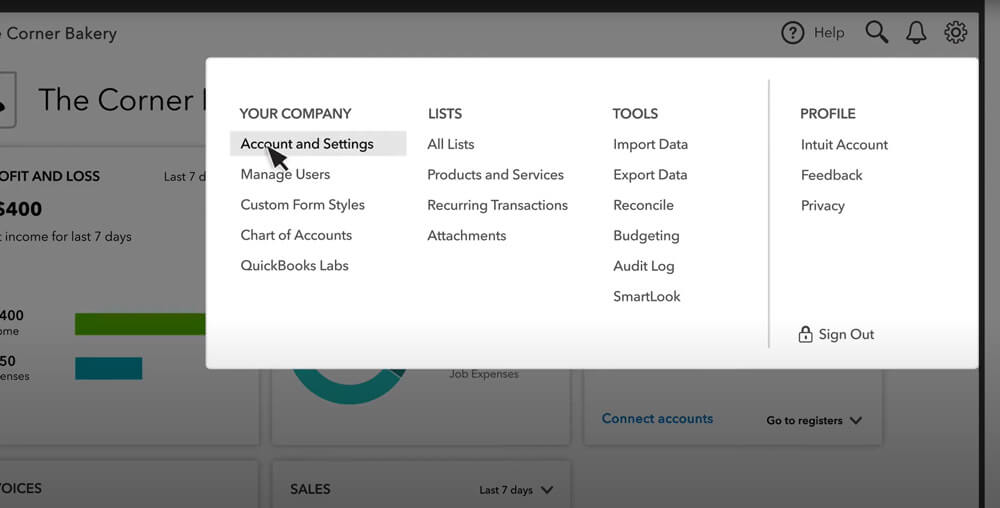

Step 2: Company Settings

Learn how to change your client’s company settings and turn on features.

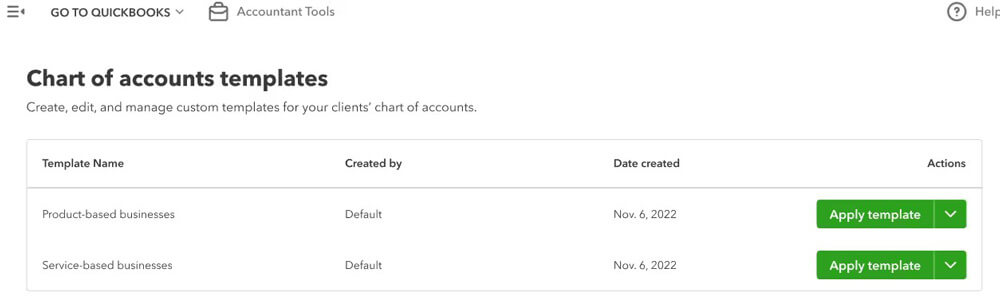

Step 3: Chart of Account Templates

If you’re setting up a new client onto QuickBooks, you can quickly create a chart of accounts using our handy templates. This organized list allows for prompt focus on gaining useful insights and precise reports.

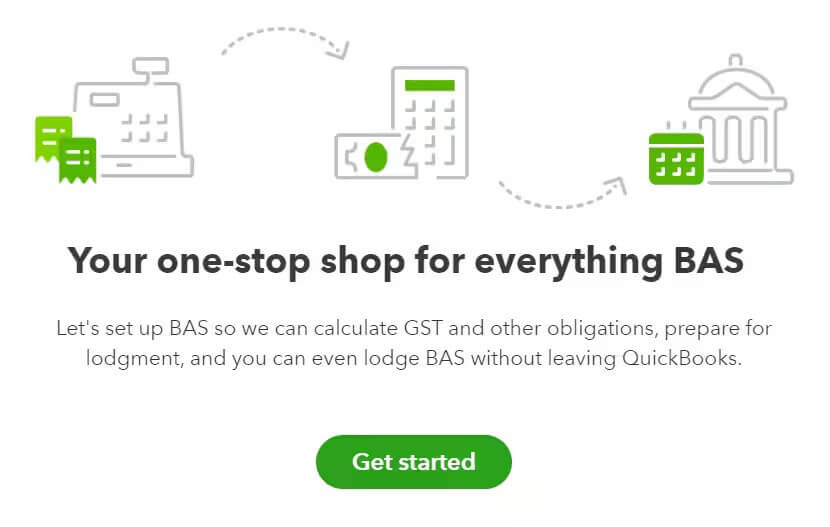

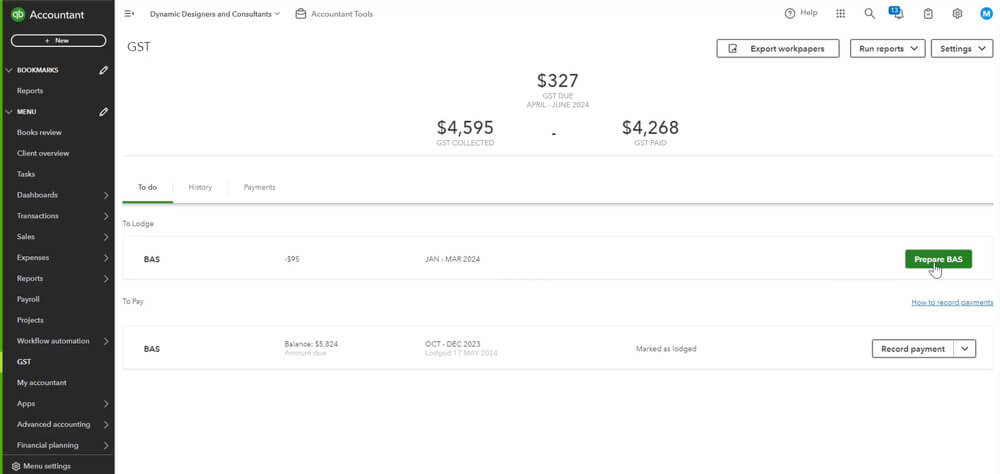

Step 4: Turn on GST

- To enable GST in QuickBooks Online, go to GST and select Get started.

- Follow the prompts to set up the accounting method and BAS lodgement frequency (monthly, quarterly, annually)

- If needed, set up Pay-as-you-go Withholding, PAYG Instalments and/or other taxes.

- Select Save and finish.

GST is now enabled, once GST has been turned on within QuickBooks it can’t be disabled. You can edit GST settings here.

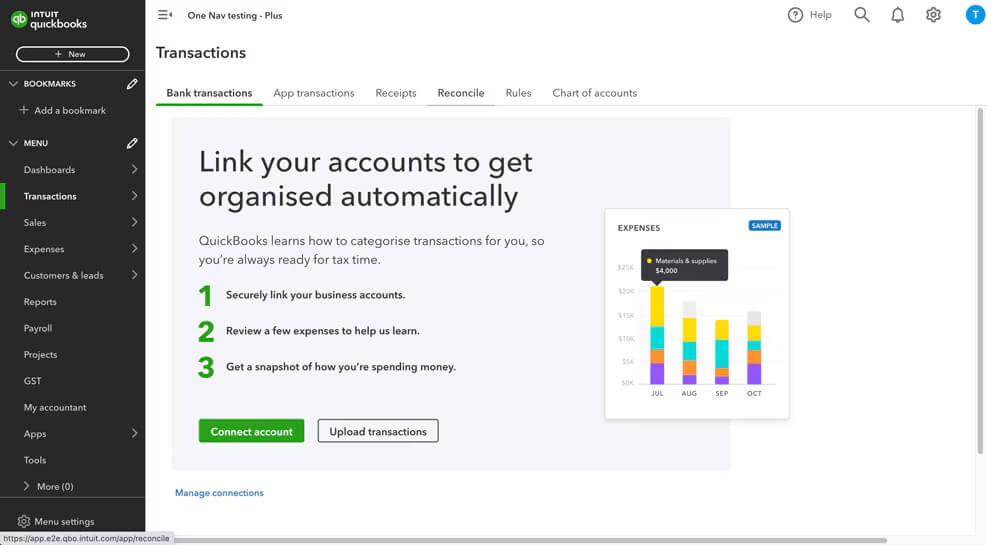

Step 5: Connect Bank Feeds

- Follow our guide to connect a bank feed

- Invite your client to provide access to connecting a bank feed

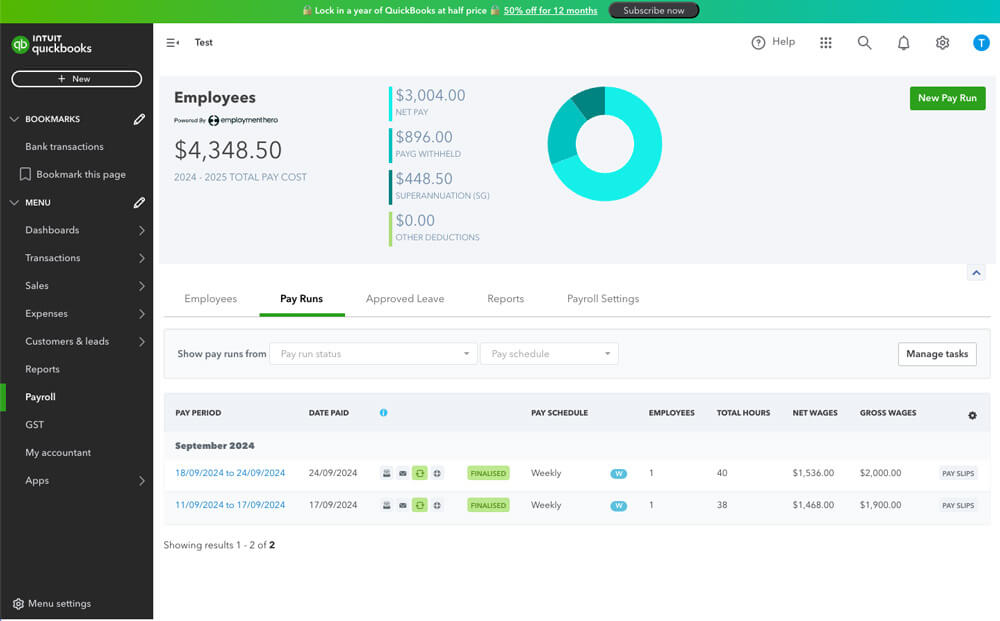

Step 6: Set up QuickBooks Payroll powered by Employment Hero

Connect your client to QuickBooks Payroll.

Follow our payroll set up guide to get your client set up and ready for their first pay run.

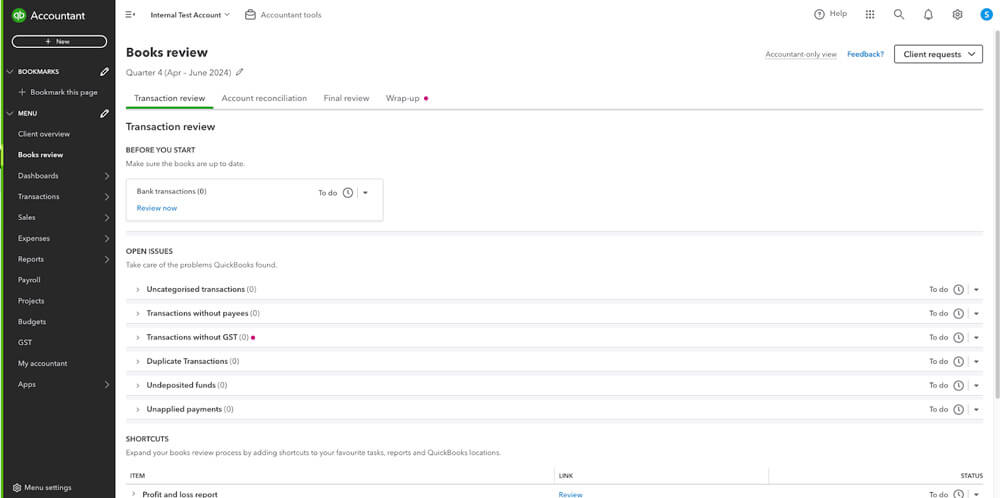

Step 7: Complete Books Review

Start reconciling your accounts with Books Review. The Book Review tool addresses common bookkeeping problems and allows for easy task prioritization, collaboration, and customization in Quickbooks.

You can also reconcile your accounts directly in the Reconcile tab.

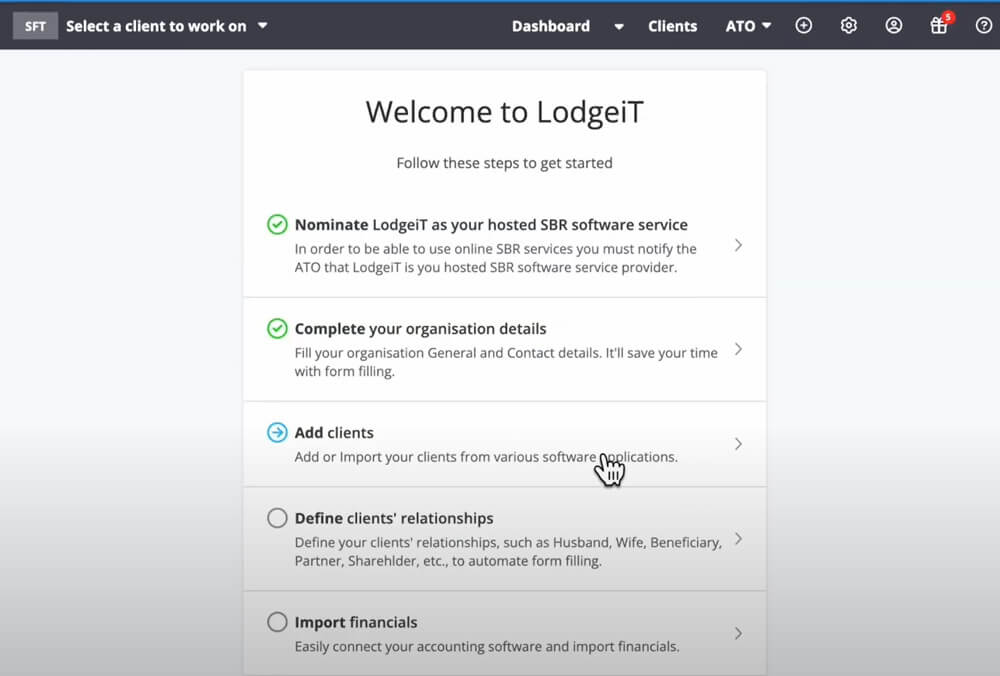

Step 8: Set up QuickBooks Tax powered by LodgeiT

Start using QuickBooks Tax powered by LodgeiT. Set up QuickBooks Tax and add your client manually, or import their details from QuickBooks Online Accountant (QBOA).

Step 9: Prepare and lodge your first BAS

Now that the accounts are reconciled, you’re ready to finalise BAS.

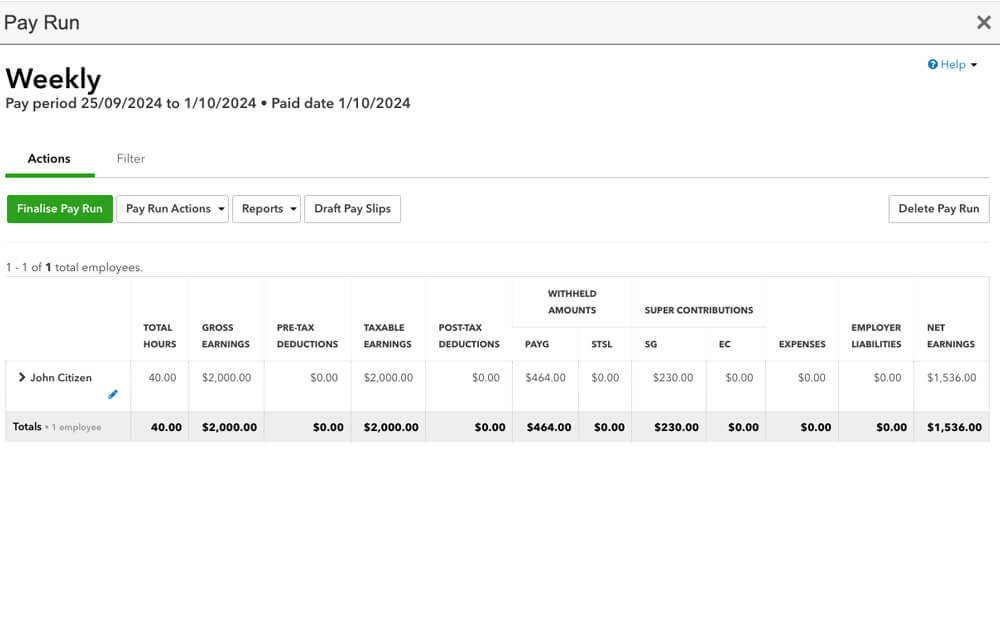

Step 10: First pay run

Get your client’s staff paid by finalising their first pay run.