What is Payroll?

Payroll Definition

Payroll refers to the process of calculating and distributing wages, salaries, and bonuses to employees of a company. It is a critical function of any business as it ensures that employees are paid accurately, on time, and in compliance with local, state, and federal laws and regulations.

The payroll process begins with the calculation of gross pay, which is the total amount earned by the employee in a specific pay period. Gross pay includes regular wages or salaries, as well as any overtime pay, bonuses, commission, and other compensation.

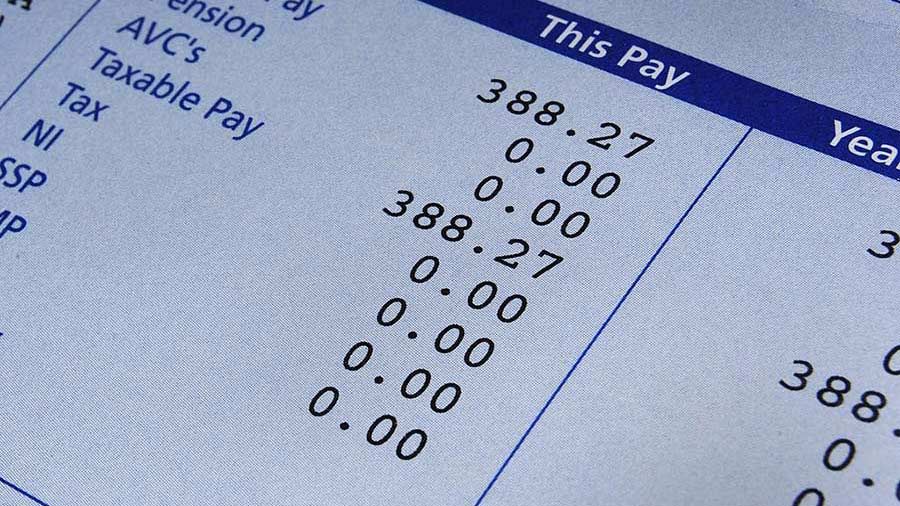

After calculating gross pay, various deductions are made from the employee's paycheck, including taxes, Social Security, Medicare, retirement contributions, and any other pre-tax or post-tax deductions agreed upon with the employee. The remaining amount is referred to as net pay, which is the actual amount the employee will receive in their paycheck.

Payroll processing can be a complicated and time-consuming task, particularly for large businesses with multiple employees. Some businesses choose to outsource their payroll operations to third-party providers who specialize in payroll processing and can handle the complex calculations and regulatory compliance involved.

Ensuring accurate and on-time payments to employees is essential for maintaining positive employee relations and compliance with legal requirements in terms of labor and employment regulations.

Payroll is an essential function of any business, and it must be managed carefully and accurately to ensure employee satisfaction, compliance, and overall business success.

Payroll processing involves several steps, including:

- Collecting and Verifying Employee Information: The payroll processing process typically begins with collecting and verifying employee information, including their hours worked, time off requests, tax information, and any deductions or contributions.

- Calculating Gross Wages: The gross pay owed to each employee is calculated based on the hours worked and compensation rates, including bonuses or other types of payments.

- Deductions and Taxes: After calculating the gross pay, various deductions are made for taxes and other contributions like social security, Medicare, and state or local taxes.

- Net Pay: The remaining amount after accounting for taxes and deductions is referred to as net pay, which is the amount to be paid to the employee in their paycheck.

- Issuing Paychecks: Once net pay has been calculated, employers can issue paychecks or make direct deposits into employee accounts.

- Record-Keeping: Employers must maintain accurate and detailed payroll records for each employee, including hours worked, payments made, and deductions taken from their pay.

Payroll processing can be complex, especially for large organizations with numerous employees and varying pay structures. To ensure accuracy and compliance, many businesses use specialized payroll software that automates the entire process, minimising errors and ensuring timely payments.

A failure to keep accurate payroll records, or errors in payroll processing, can lead to potential legal issues and damaged employee relations. As such, managing payroll effectively is an essential aspect of any successful business, helping to attract and retain quality employees, avoid legal issues, and ensure overall financial stability.