How to set up GST

An easy guide to setting up Goods and Services Tax (GST) so you can track transactions, manage cash flow and lodge your business activity statement (BAS).

Do I need to register for GST and how to register for GST

Before you start:

You need to be registered for GST and need your ABN.

Why tracking GST is important

By forecasting your GST tax

liabilities, preparing and paying your BAS will be a breeze

Get reminders when GST is due

and never miss another payment

Ditch the stress around your BAS

by auto tracking and calculating your obligations

Step-by-step guide

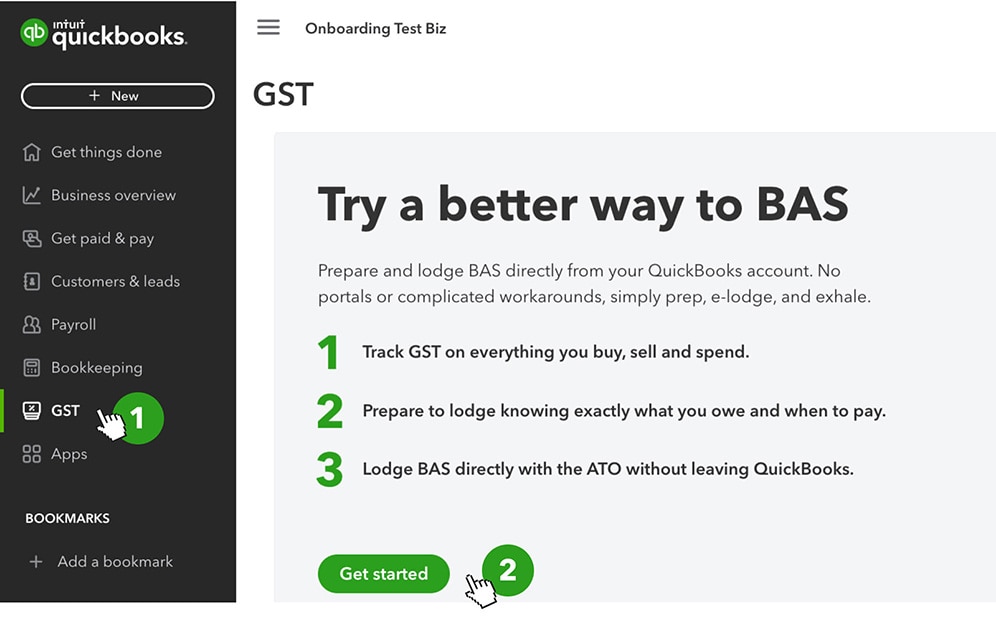

Step 1

- Select GST from the left menu and select Get started.

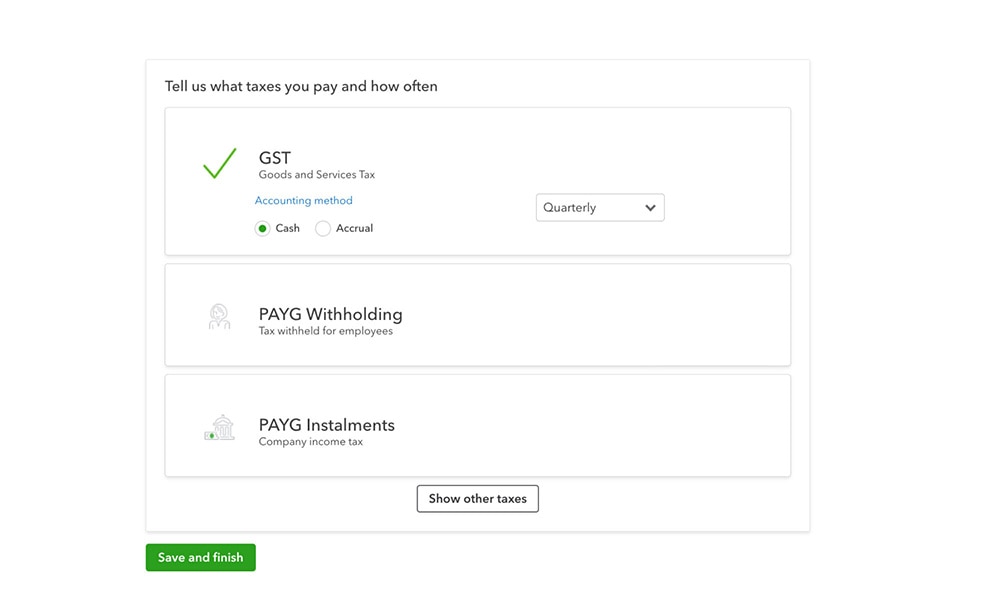

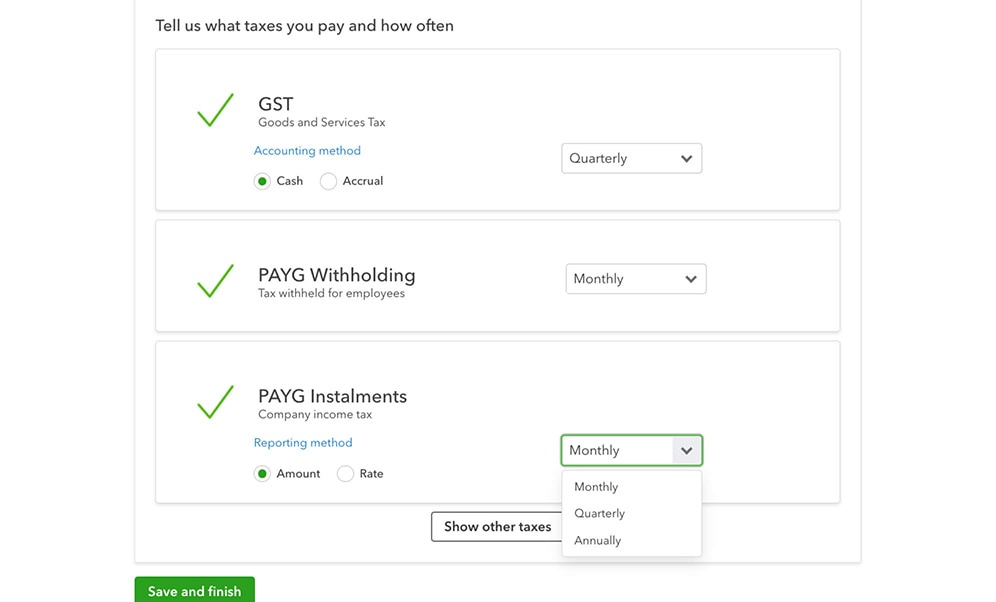

Step 2

- Select your accounting method, either cash or accrual.

- Choose your BAS lodgement frequency from monthly, quarterly, or annually.

Step 3

- If you have employees and are obligated to report on PAYG withholding, tick the box and select your reporting frequency. If you report PAYG in instalments, tick this box.

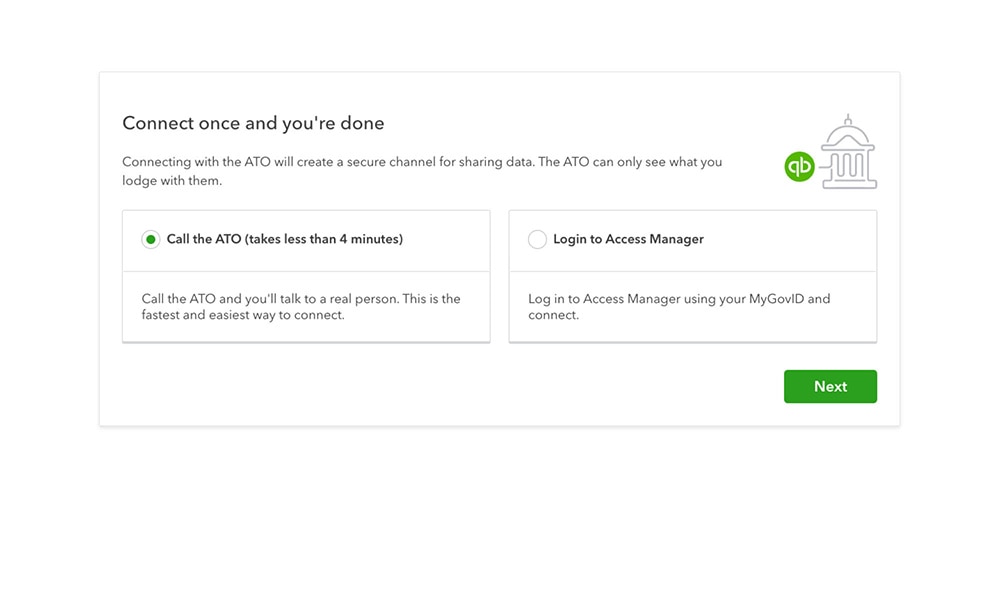

Step 4

- Connect to the ATO to lodge your BAS statements (optional).

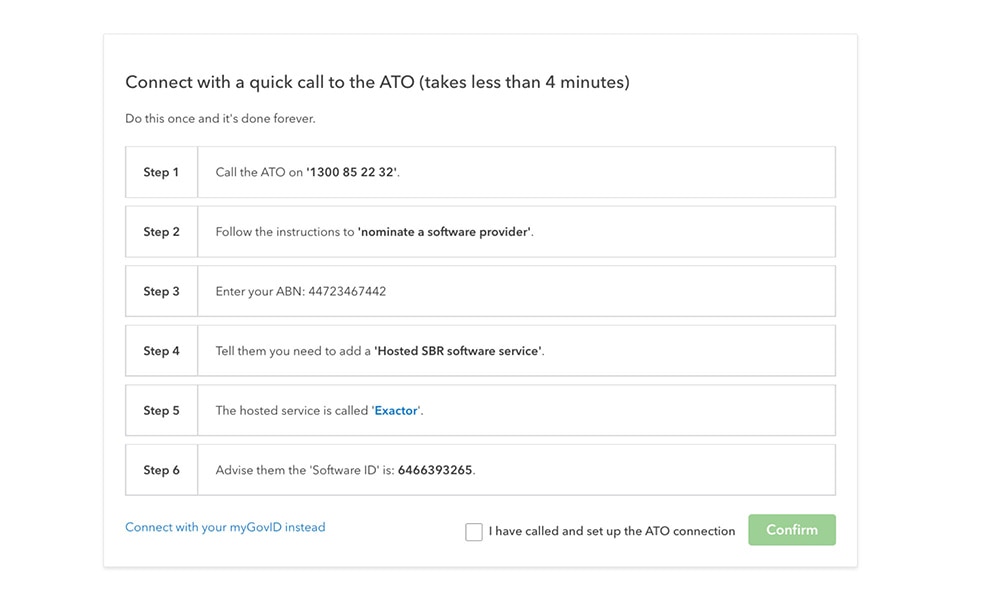

- Call the ATO (takes 4 minutes). You'll need your ABN and company phone number.

Step 5

- Follow the on screen instructions. Once you have confirmation from the ATO, click on confirm. You have now set up GST on your account!