is the fastest way to accurately record your company's financial transactions

Benefits include

Connecting a bank account

It's easy to capture one-time

expenses that are not captured in your bank feed.

Getting real-time insights

with cash flow

Step-by-step guide

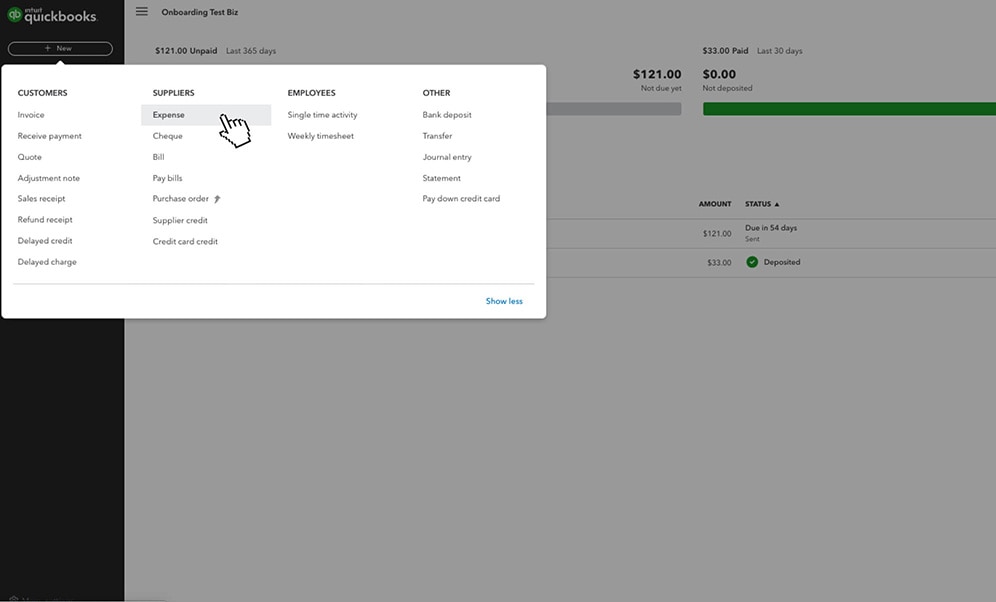

Step 1

- Select + New then select Expense.

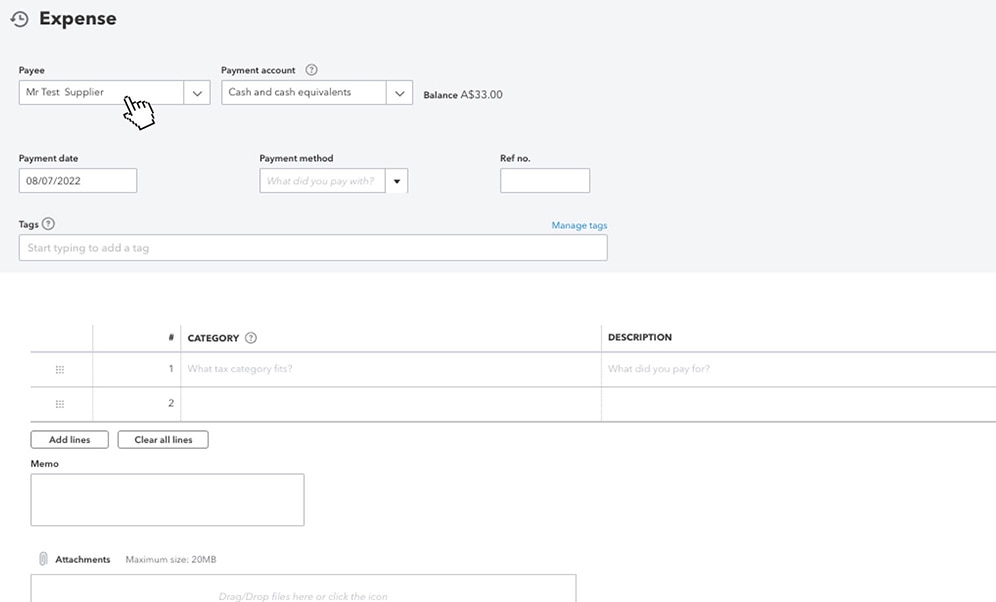

Step 2

- In the Payee field, select the supplier.

- Tip: If the transaction covers multiple petty cash expenses, leave this field empty.

- In the Payment account field, select the account you used to pay for the expense.

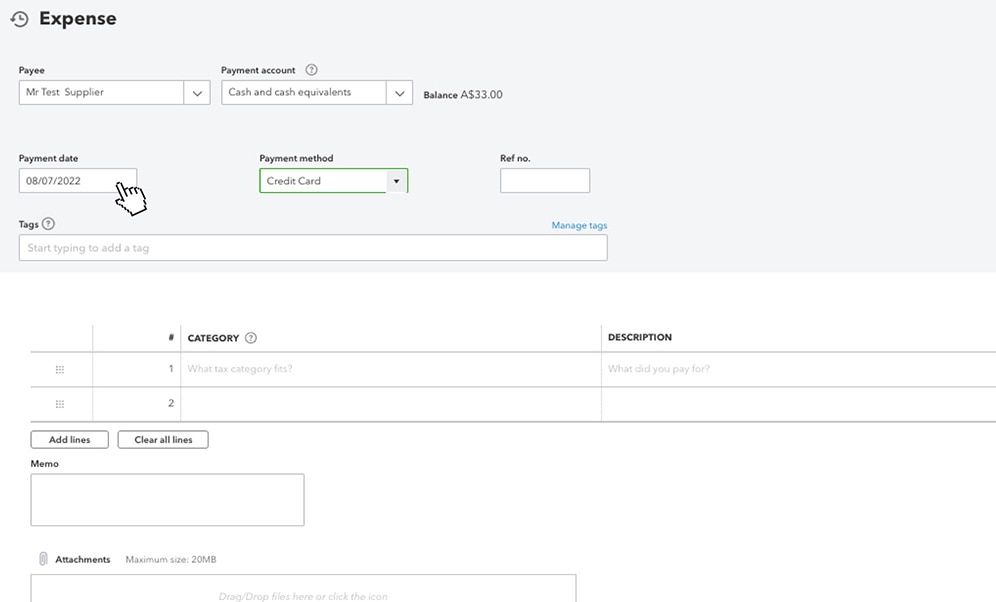

Step 3

- In the Payment date field, enter the date for the expense.

- In the Payment method field, select how you paid for the expense.

- If you want detailed tracking, enter a Reference no (this is optional).

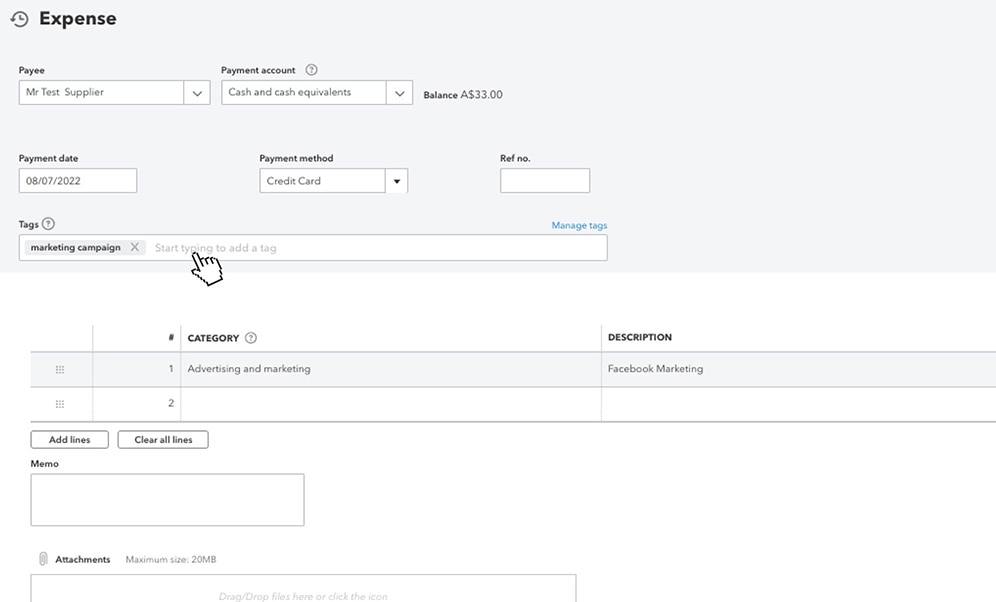

Step 4

- In the Tags field, enter the preferred label to categorise your money. Tags are customisable labels that let you track your money however you want, learn more here.

- In the Category dropdown, select the expense account you use to track expense transactions and enter a description.

- Enter the Amount and GST.

- When you're done, select Save and close.