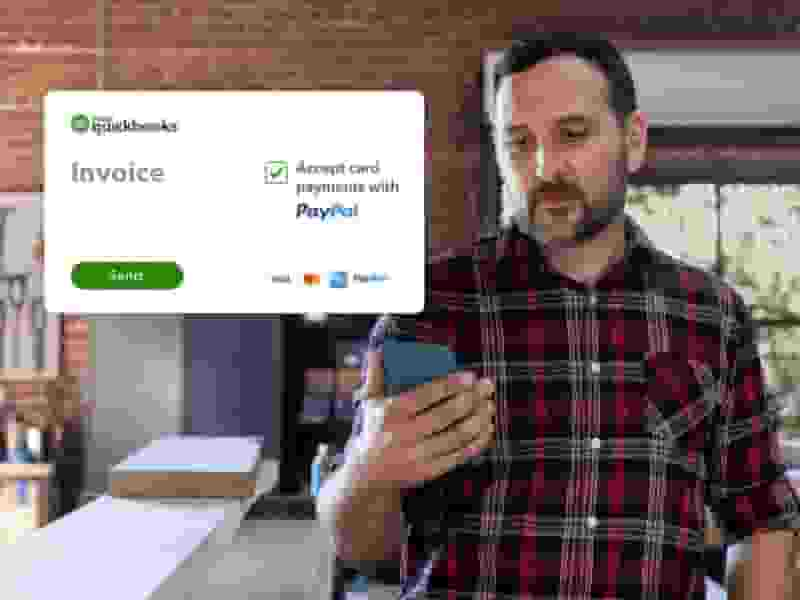

More ways to get paid

Send invoices that customers can pay anywhere, anytime, on any device.

Accept online payments via PayPal, credit or debit card and make getting paid fast.

Benefits of PayPal integration in QuickBooks

Boost your cashflow

Customers can pay online with PayPal, credit or debit card, cutting time from invoice to payment.

Secure and protected

PayPal monitors transactions in real time to prevent fraud and help keep transactions safe.

Get set up in minutes

All it takes is a few simple steps. Go to your QuickBooks and add your payment method.

Say yes to credit card payment*

Increase your payment options. Adding PayPal to your invoices makes it easy for your customers to pay.

Save on accounting time

All PayPal payments and fees are automatically recorded in QuickBooks, which means no manual data entry.

No hidden fees

Set up within QuickBooks is free - you’ll only be required to pay the applicable PayPal transaction fees.

Save with low card fees

Start accepting PayPal, credit or debit card payments today with no upfront costs, or subscription fees.

You can also benefit from PayPal fees that start as low as 1.7% + $0.20 per transaction.

Find a plan that’s right for you

Free unlimited support

No contract, cancel anytime