QuickBooks Payroll Resource Hub

Learn how to get the most out of QuickBooks Payroll. These resources will provide you with all you need to know from signing up to payroll to setting up and completing your first pay run.

Pay conditions

Pay conditions are an essential aspect of employment in Australia. They are designed to ensure that employees receive fair and reasonable pay for the work they perform. These conditions can include the employee's hourly rate, overtime pay, penalty rates, allowances, and superannuation contributions and are usually set out in an employment contract or agreement between the employer and employee.

Follow the steps below to set up pay conditions in QuickBooks Payroll:

Step 1.

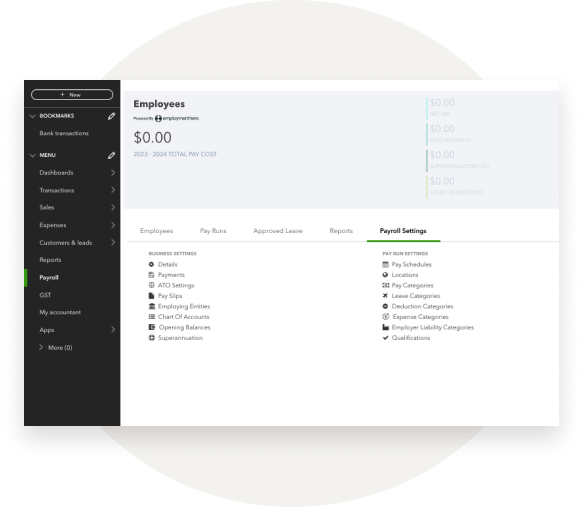

Log in to your QuickBooks account and navigate to Payroll within the left hand navigation bar. Click on the Payroll Settings tab.

Step 2.

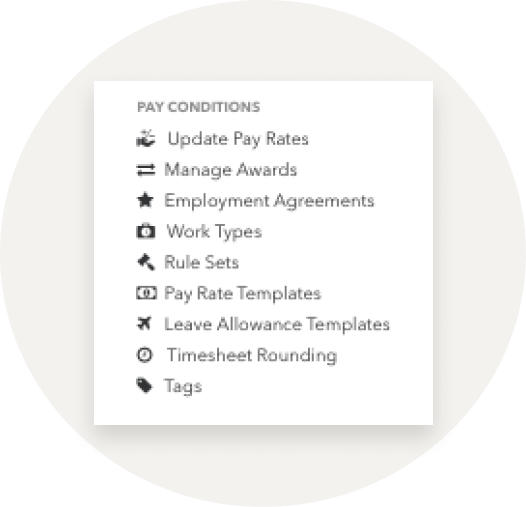

Under the "Pay Conditions" category, select Rule Sets. Select Add.

Step 3.

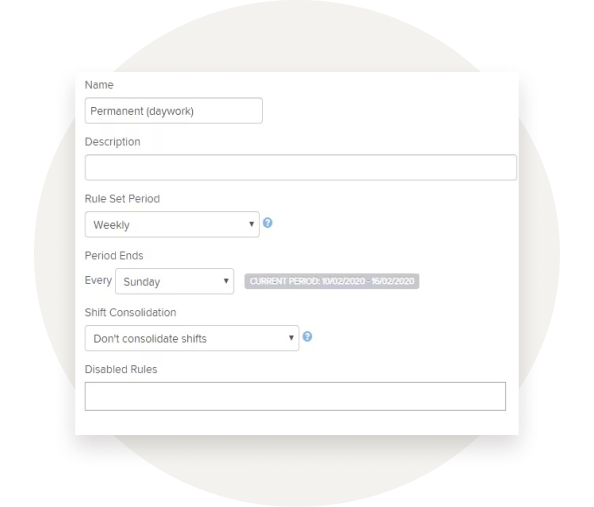

Name the rule set, and define the period for the rule set. Save and repeat the process for any additional pay policies you need to create.

Once you have set up your pay conditions, you can use them to calculate payroll for your employees. It is important to ensure that your pay policies comply with any relevant awards or regulations that apply to your industry. You should also review your pay policies regularly to ensure that they remain up-to-date and reflect any changes in your business or industry.

QuickBooks Payroll will automatically apply the appropriate pay rates and conditions based on the policies you have set up. For more infortmation on setting up pay conditions, visit this page.

Have some topic suggestions to include in the hub? Leave your feedback here.