QuickBooks Payroll Resource Hub

Learn how to get the most out of QuickBooks Payroll. These resources will provide you with all you need to know from signing up to payroll to setting up and completing your first pay run.

Set up your employees

If you run a business - setting up employees on your payroll system is essential. Once you’ve signed up for QuickBooks Payroll powered by Employment Hero, you’ll need to add your employee’s details to be able to start a pay run. We'll guide you through the steps you need to take to set up your employees, so you can focus on growing your business with peace of mind.

Step 1.

Select the Payroll tab on the left hand navigation and click the Add Employee button on the right hand side of the screen.

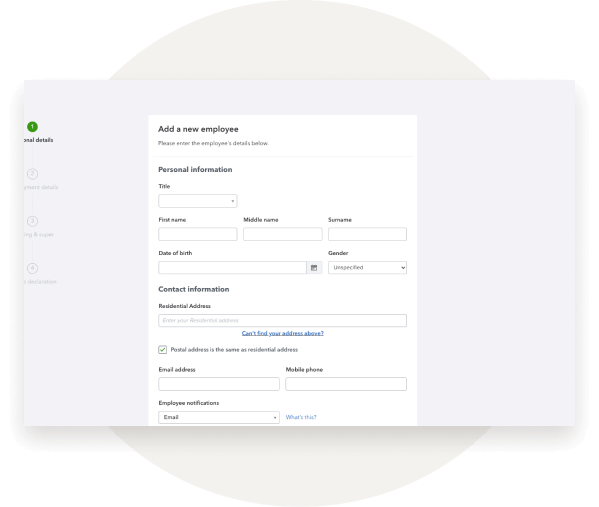

Step 2.

Enter your employee’s name, contact details, their date of birth and address.

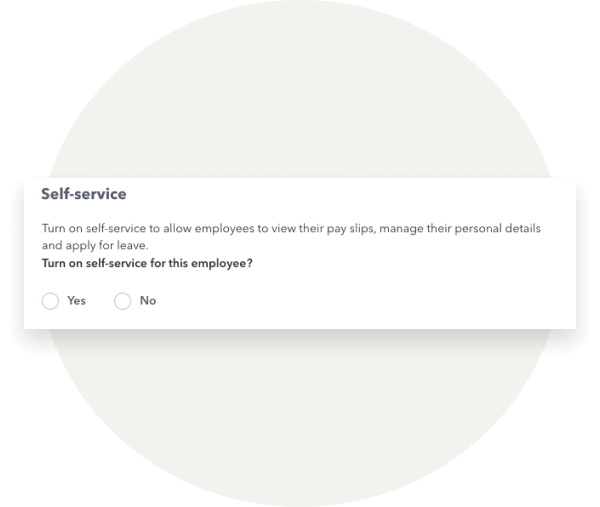

Step 3.

Select if you want this employee to have access to the self-service function under the self service section.

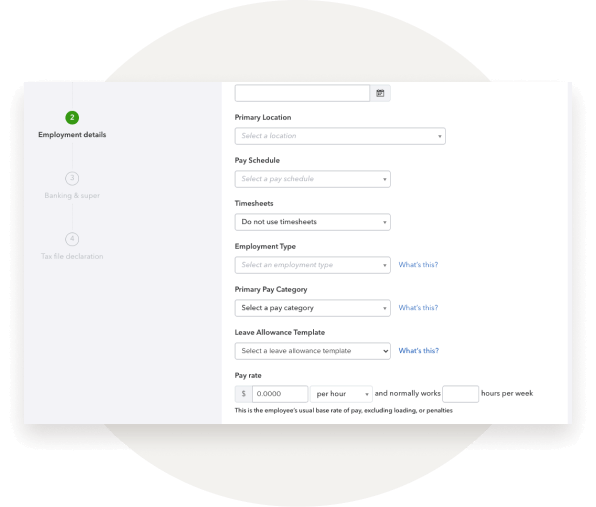

Step 4.

Under Employment Details add their start date, pay information including their employment type, pay schedule, rate and whether you’d like them to submit timesheets.

Step 5.

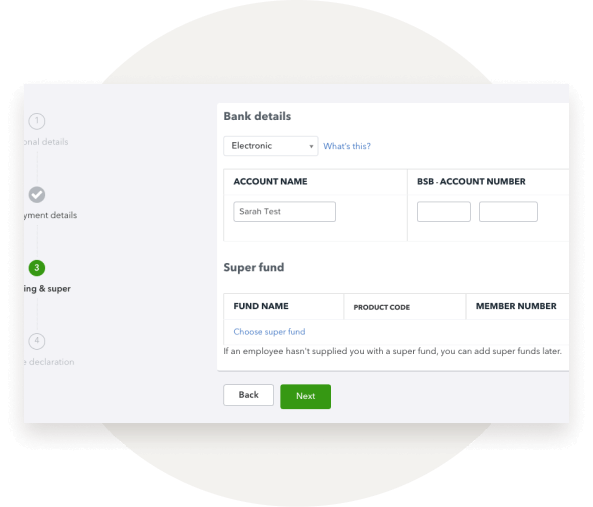

You’ll then be asked for their bank details and information about their Super Fund.

Step 6.

Finally, you’ll need to submit the Tax File declaration for the employee.

QuickBooks Payroll powered by Employment Hero makes it quick and easy to accurately compensate your team on time. We hope that this article has provided you with a guide to setting up your employees on payroll.

Have some topic suggestions to include in the hub? Leave your feedback here.