QuickBooks Payroll Resource Hub

Learn how to get the most out of QuickBooks Payroll. These resources will provide you with all you need to know from signing up to payroll to setting up and completing your first pay run.

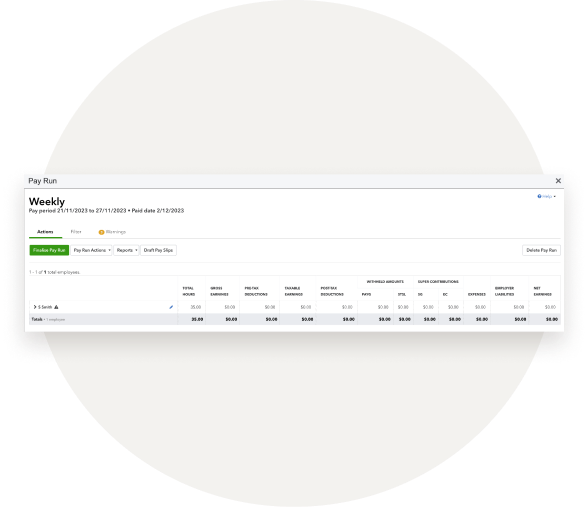

Complete your Pay Run

A pay run involves calculating employee wages, taxes, and deductions, and then issuing payments to employees. By completing a pay run, you can ensure that your employees are compensated fairly for their work and completing your pay run in a timely manner can help you maintain good relationships with your employees.

To complete a pay run in QuickBooks Payroll, follow these steps:

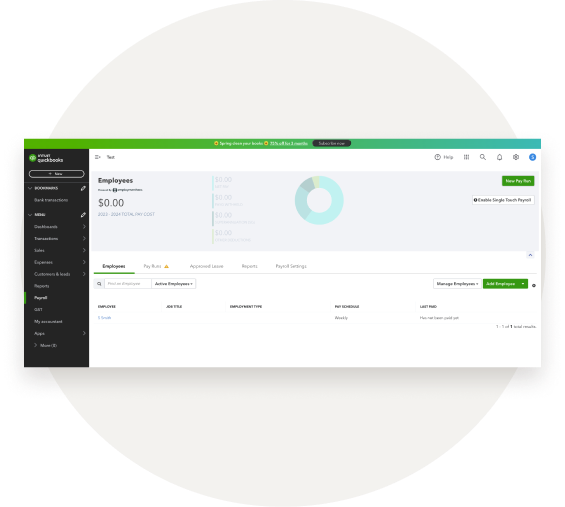

Step 1.

Go to the Payroll tab and select New Pay Run in the top right hand corner of the Payroll dashboard.

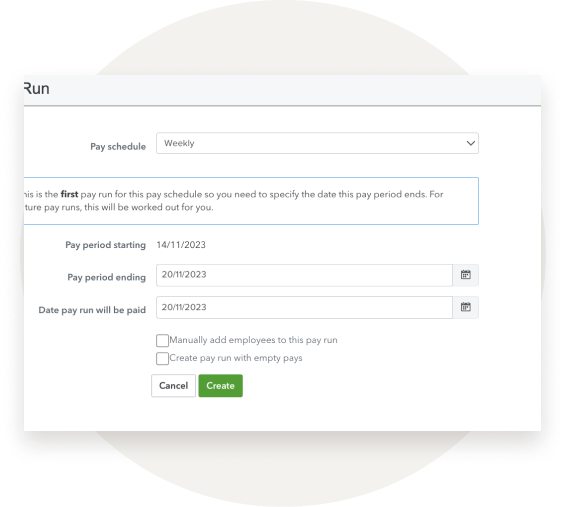

Step 2.

Select the pay schedule you want to use for this pay run. Next input the pay period end date and the date the pay run will be paid. Optional: Select if you want to manually add employees to this pay run and/or create pay run with empty pays.

Step 3.

Review the list of employees and their pay rates. If needed, you can make any necessary changes to employee hours, pay rates, or deductions at this stage, such as overtime pay.

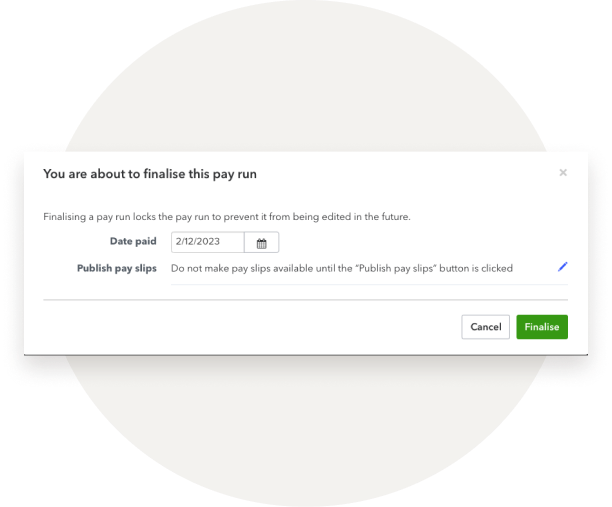

Step 4.

Review the payroll summary to ensure that all information is correct. Click Submit Payroll to process the pay run.

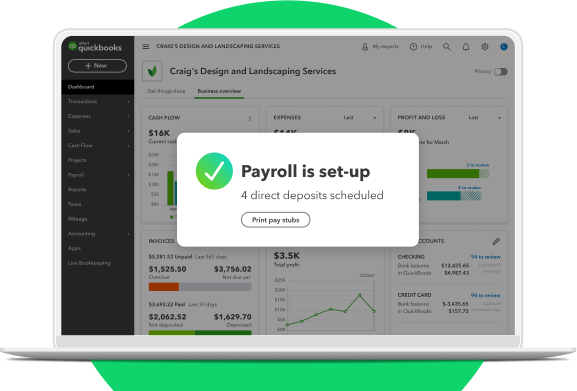

Pay employees: After submitting payroll, you can pay your employees by printing checks or using direct deposit. Under the Employees tab, select Pay Employees and follow the prompts to complete the payment process.

We hope this guide has been helpful in setting up and preparing a pay run in QuickBooks payroll. Remember to review reports regularly to stay on top of your payroll and tax obligations.