QuickBooks Payroll Resource Hub

Learn how to get the most out of QuickBooks Payroll. These resources will provide you with all you need to know from signing up to payroll to setting up and completing your first pay run.

Setting up STP

STP is the method used to report your payroll information (wages, tax withheld and superannuation) to the ATO each time you pay your employees. Instead of waiting until the end of the financial year, payroll information is reported every time staff get paid.

In 2022, the Australian Tax Office (ATO) rolled out Phase 2 of Single Touch Payroll (STP2) to include new reporting requirements designed to reduce the reporting burden of employers who have to report to multiple government agencies. These include further details about gross income, employment and taxation conditions, visibility on income types, country codes, child support garnishees and deductions. While STP Phase 1 aimed to standardise reporting and helped to streamline payroll reporting for employers in Australia, STP2 aims to expand on the granularity of reporting requirements and provide more visibility around payroll.

Benefits of STP 2

Payroll information that employers submit to the ATO is shared in real-time to streamline Services Australia request.

The ATO has removed Lump Sum E payment letters and forwarded Tax File Number (TFN) declarations.

Some reporting requirements are now consolidated to improve income visibility.

Set up Single Touch Payroll with the STP wizard.

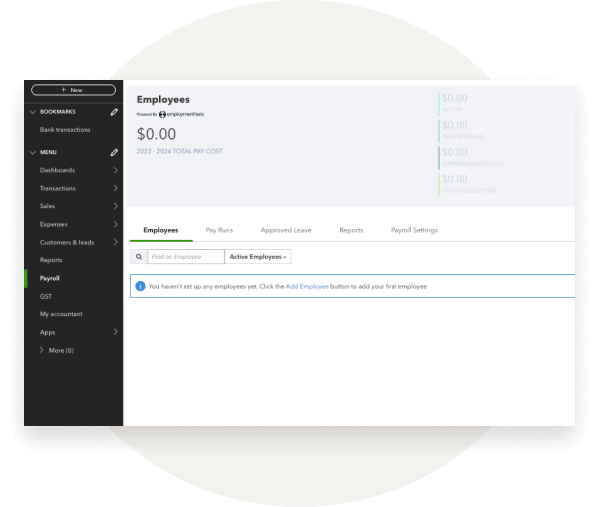

Step 1.

Select Payroll from the right hand menu.

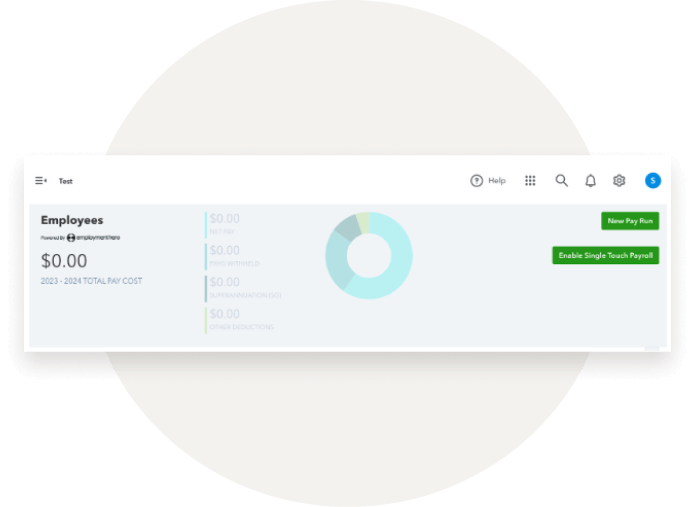

Step 2.

Select the ‘Enable Single Touch Payroll’ button in the top right corner of the payroll page.

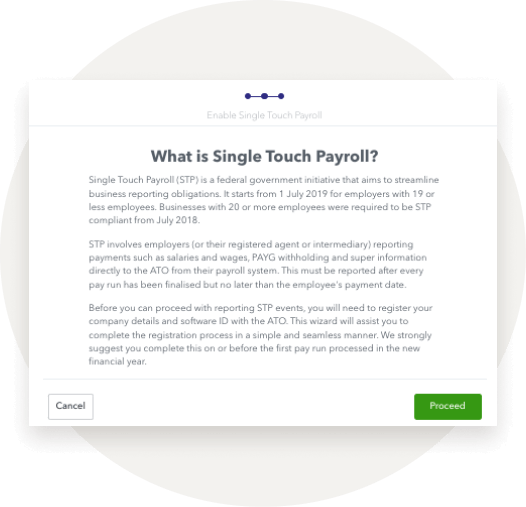

Step 3.

After reading the brief summary of Single Touch Payroll, and clicking proceed, confirm your business details and select Next.

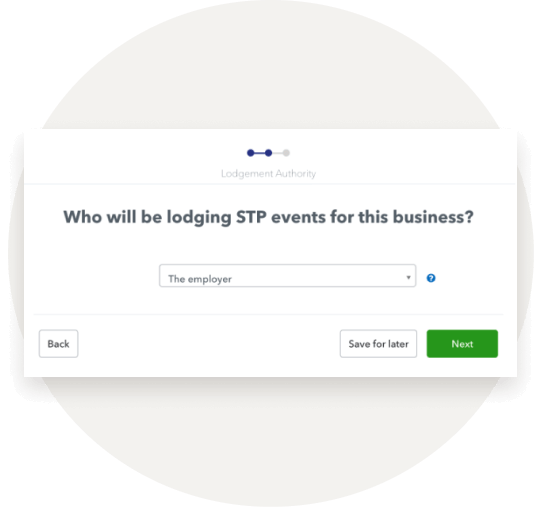

Step 4.

Select from the drop down menu who will be lodging STP events for the business and click Next.

Step 5.

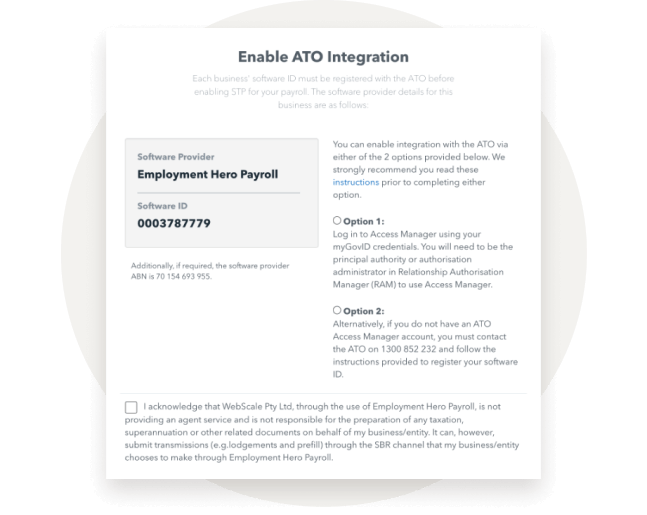

You will be given information about the software provider and how to enable ATO integration. You can enable integration with the ATO via either of the 2 options provided below. We strongly recommend you read these instructions prior to completing either option. Once you have selected an option and acknowledged the terms and conditions you can select Complete.

Step 6.

Call the ATO on 1300 852 232 and provide them with your Software Provider and ID. Or update your details through the Access Manager.