QuickBooks Payroll Resource Hub

Learn how to get the most out of QuickBooks Payroll. These resources will provide you with all you need to know from signing up to payroll to setting up and completing your first pay run.

Setting up STP manually

In the first STP article, we discussed STP 2 changes as well as the benefits and how to set up STP using the QuickBooks Payroll wizard. In this article, we will provide you with the steps to set up STP manually.

Set up Single Touch Payroll without the STP wizard

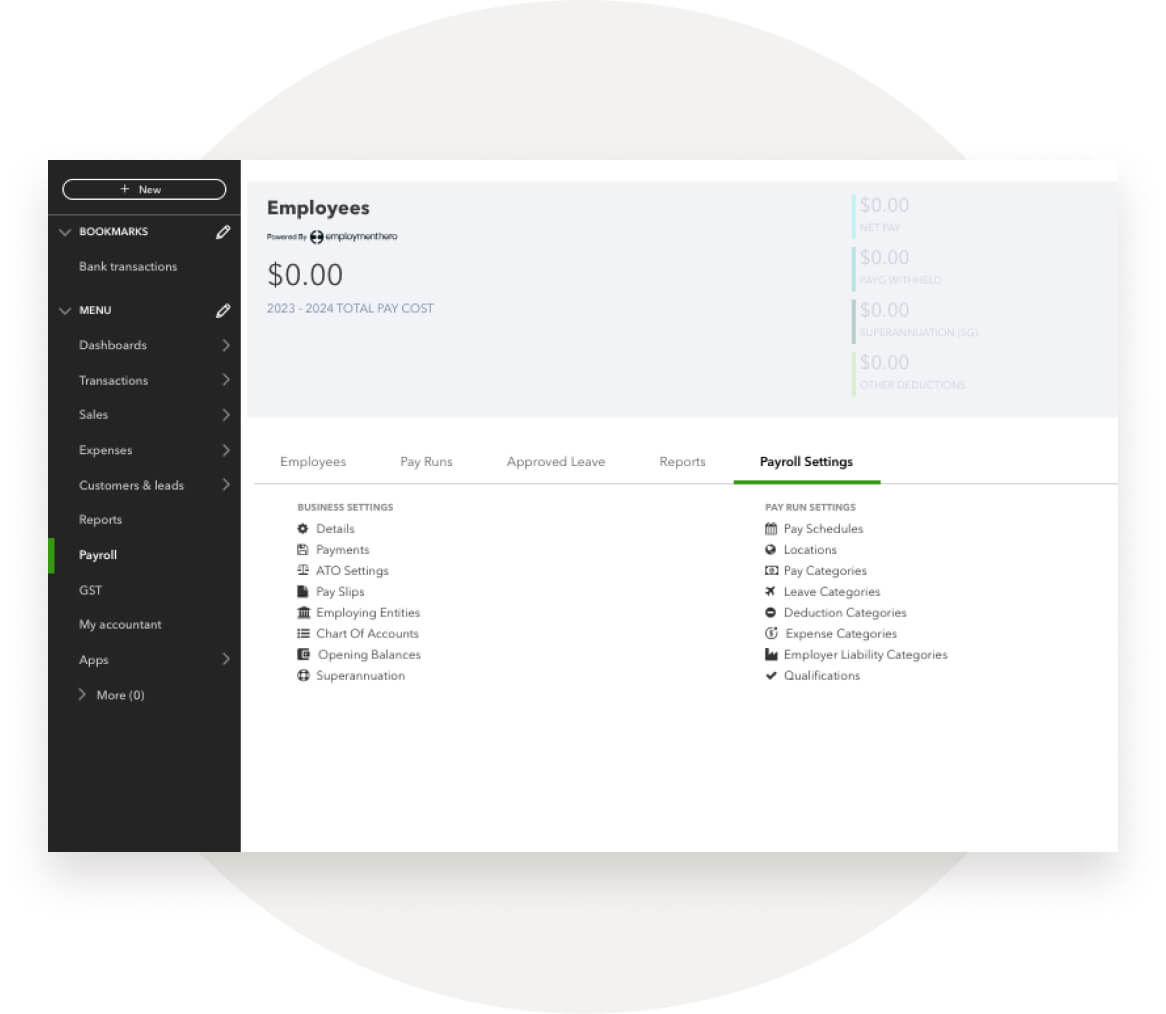

Step 1.

From the left hand navigation, select Payroll. Select the Payroll Settings tab and under Business Settings, select ATO Settings.

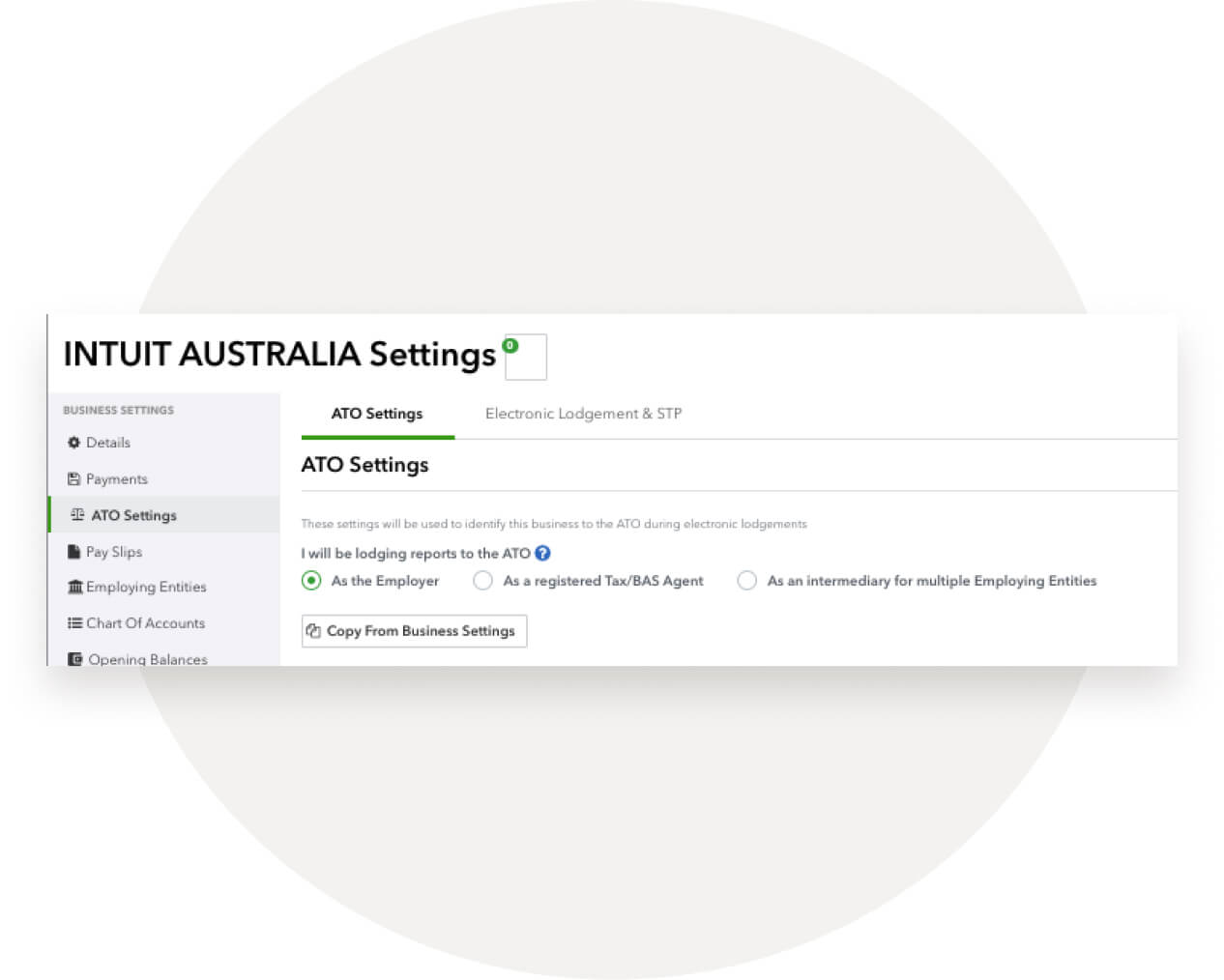

Step 2.

If you have selected As the Employer, you will be required to complete the following information:

- ABN

- Business address

- Business contact details

If you will be lodging reports to the ATO as a registered tax/BAS agent. You will need to provide additional details required including your Tax Agent Number.

If you will be lodging reports to the ATO as an intermediary for multiple employing entities, you can choose one of the employing entities to act as the Intermediary or another entity of the business. All the Intermediary fields are compulsory. You will not be able to save the ATO Supplier Settings without completing these details.

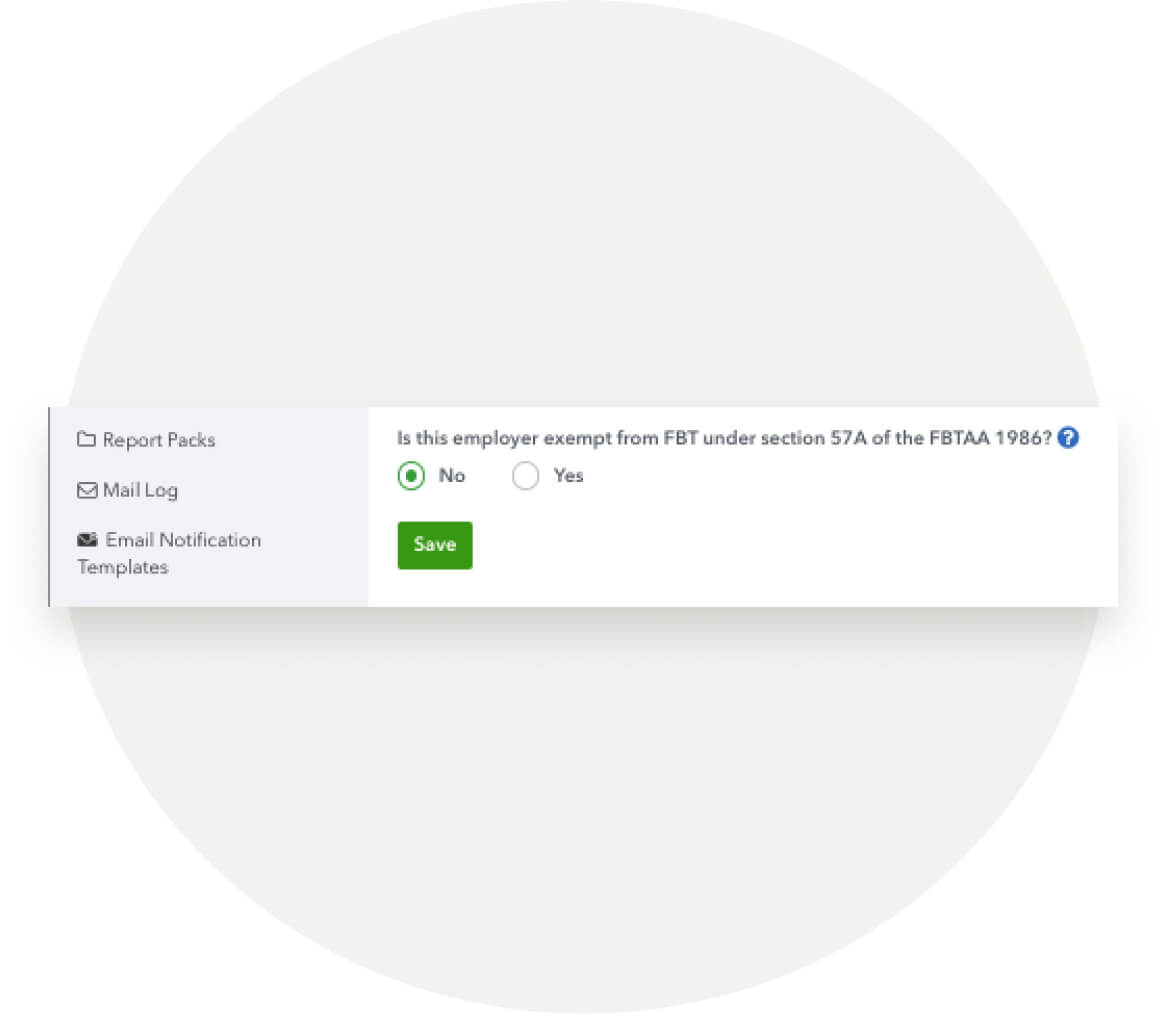

Step 3.

Before clicking Save, check the box to indicate whether you are eligible for FBT under section 57A of the FBTAA 1986. If you’re unsure about either of these, check with ATO.

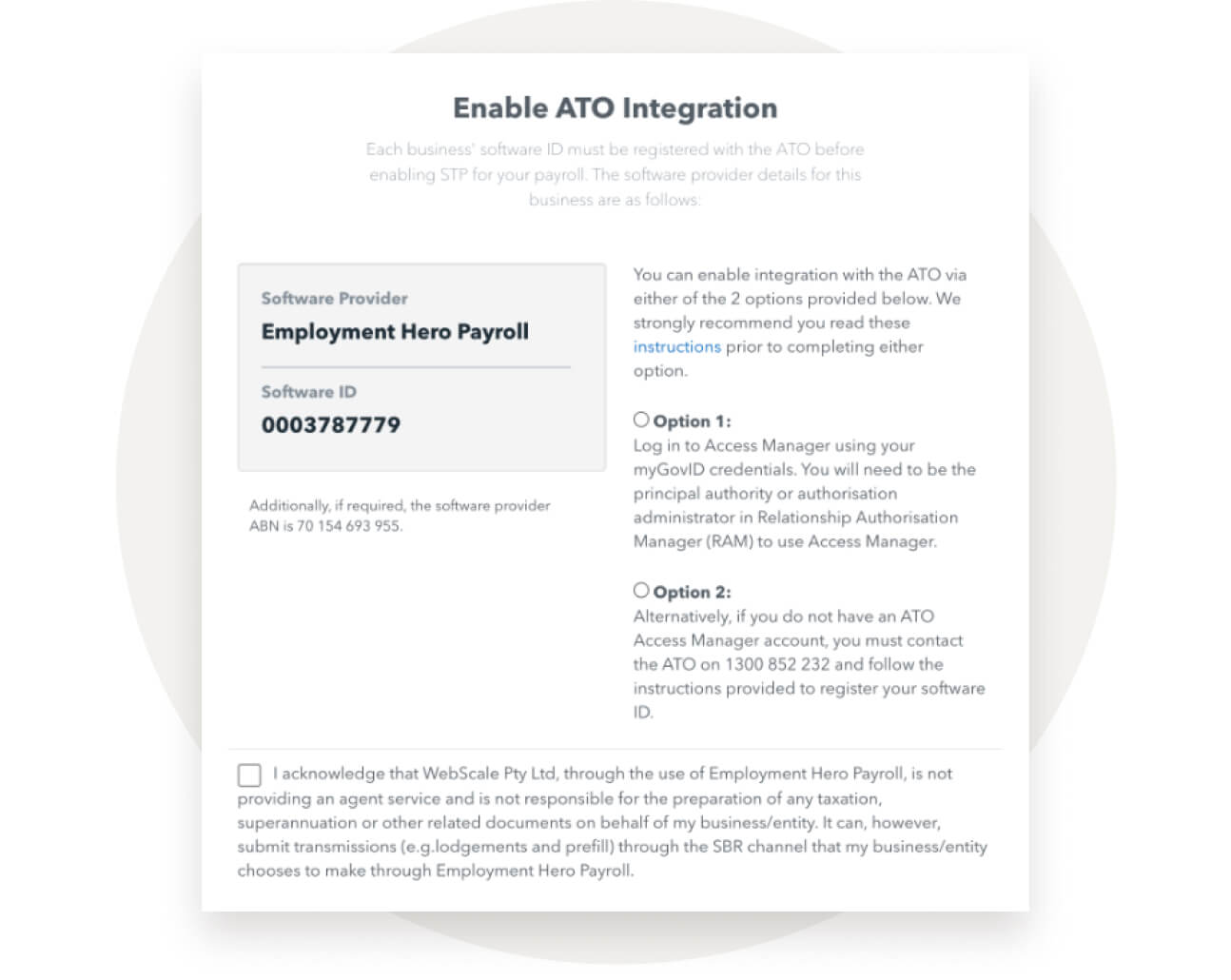

Step 4.

Call the ATO on 1300 852 232 and provide them with your Software Provider and ID. Or update your details through the Access Manager.

To find out more about STP2, visit the QuickBooks Payroll blog. Additionally, information on STP can be found on the ATO's website.