QuickBooks Payroll Resource Hub

Learn how to get the most out of QuickBooks Payroll. These resources will provide you with all you need to know from signing up to payroll to setting up and completing your first pay run.

Set up automated super payments

Superannuation is a mandatory contribution that employers in Australia are required to make on behalf of their employees. With the integration of Beam and QuickBooks Online, this process can be streamlined and simplified. In this article, we will provide you with a step-by-step guide on how to set up Super Payments with Beam in QuickBooks Online, allowing you to easily manage your super contributions and payments directly from your QuickBooks account.

Note: Check that your business details are correct before you register, as the system will pre-fill these details in Beam. To register your business for automated super payments, follow the below steps:

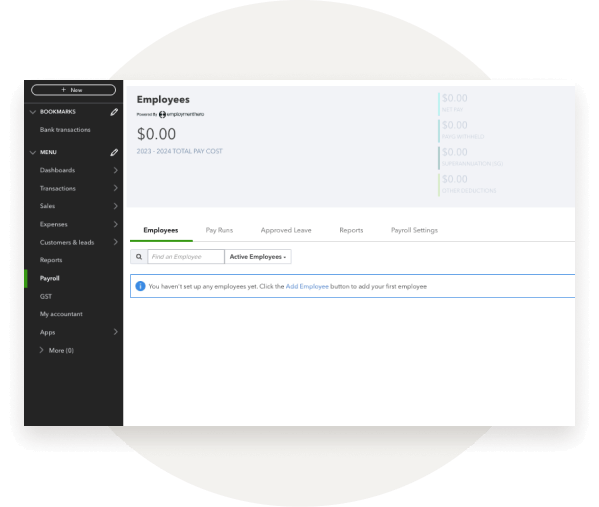

Step 1.

Select Payroll from the left navigation then click payroll settings. Next select Superannuation (located under Business Settings).

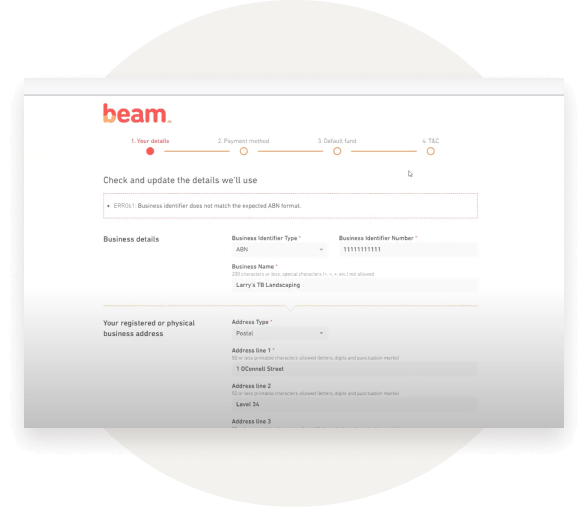

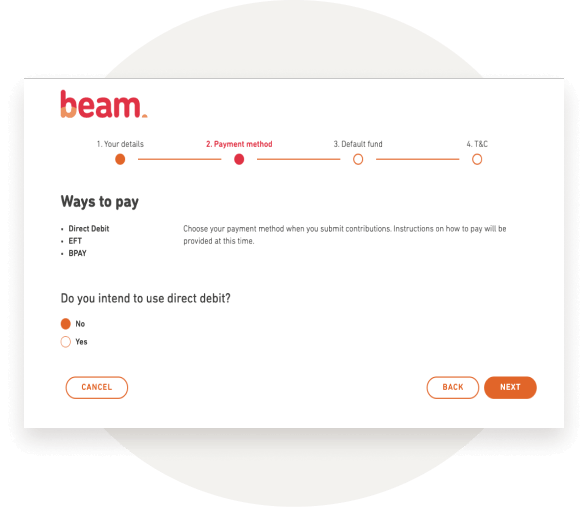

Step 2.

Select Register with Beam and enter in your Business details, Business address and Contact details, then select Next.

Step 3.

Enter Payment method and details, then select Next.

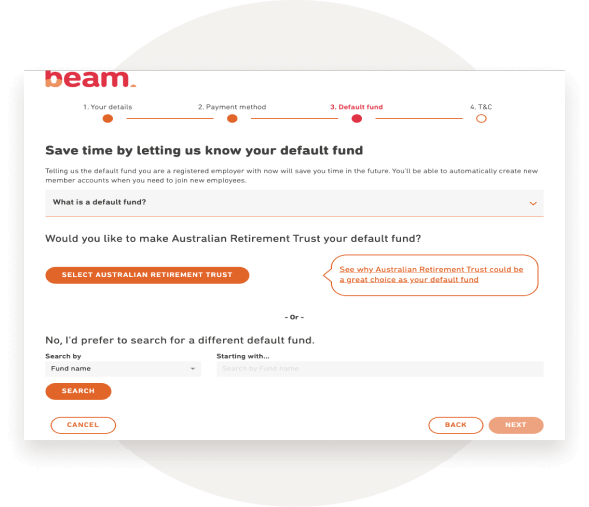

Step 4.

Nominate your Default super fund then read and confirm the Terms and Conditions. The Default fund you selected in Beam will now be displayed on the Superannuation Settings screen.

Have some topic suggestions to include in the hub? Leave your feedback here.