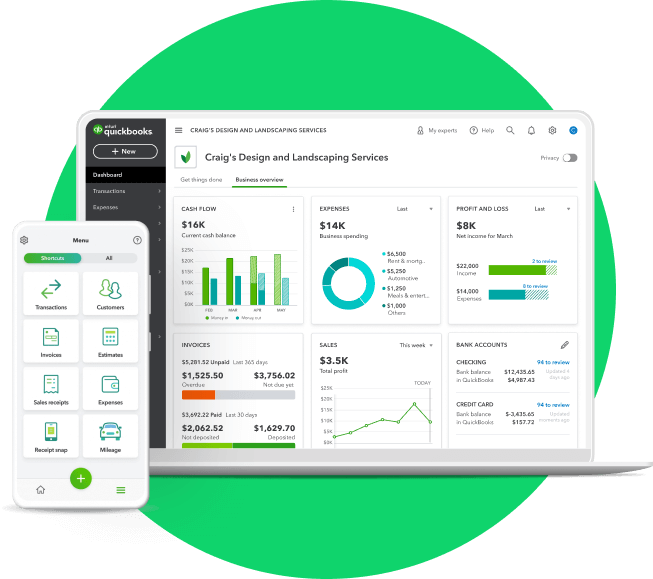

Pack up and move for free

It's never been easier to switch to QuickBooks with our moving partners, Dataswitcher and MMC Convert.

They will take care of your conversion from start to finish, keeping you informed along the way.

"Very efficient accounting process"

"I switched from MYOB to Quickbooks due to the relentless price rises from MYOB with little functional benefit.

The change has been a good one - not only in cost savings but also because my accounting processes are much more efficient and less time consuming than in MYOB."

Edmund B. | Sydney, NSW | ProductReviews | 18 Sept 23

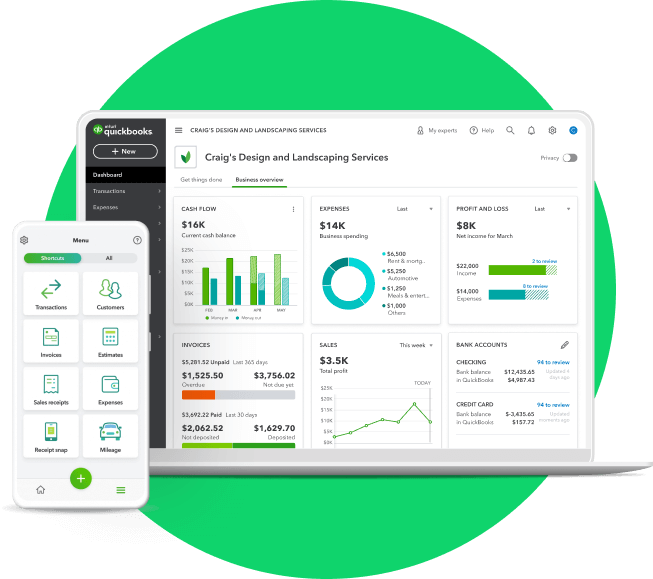

How to move to QuickBooks Online

Before you move your data you’ll need to choose the right QuickBooks plan for your business.

Moving from your old accounting software is free when you sign up on a QuickBooks Essentials or Plus plan.

Before we begin your move with MMC Convert, you’ll need to give your current books a quick tidy.

Take a look at our Moving to QuickBooks checklist to make sure your books are ready to move.

When you’ve completed the preparation checklist and your file is ready to go, upload it to MMC Convert so they can get started.

Remember, while we bring your data over you won’t be able to use your existing software or new QuickBooks Online file.

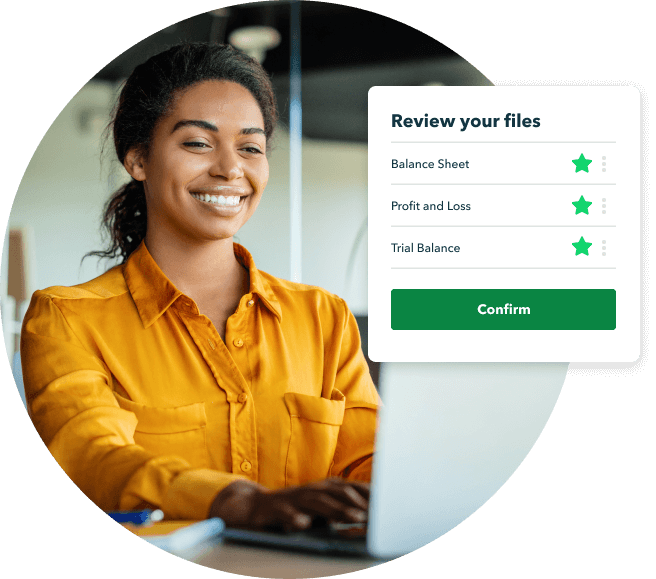

You’ll receive a notification when your move has been completed by MMC Convert. This is the time to review your data.

Feel confident that all the data in your new QuickBooks account is good to go by using our post-move checklist.

After you’ve reviewed the data in your new QuickBooks file you can approve your move.

Then, it’s time to get stuck in and enjoy running your business with QuickBooks. Book a free session with one of our experts to Get Started, or explore our Learn & Support hub.

Here’s what gets moved

Move all the info you need to get up and running with QuickBooks Online.

Basic conversionKeep it simple and only move the basics. Great for businesses who want a fresh start. |

|

Opening balances

|

|

Customers and suppliers

|

|

Chart of Accounts

|

|

Open invoices and credits

|

|

Open payments and credits

|

|

Product/Service info

|

|

| Extras | |

Year-to-date transactions

|

Please contact our team 1800 618 521 |

Frequently asked questions

Before you move your data you’ll need to choose the right QuickBooks plan for your business.

Moving from your old accounting software is free when you sign up on any QuickBooks Simple Start, Essentials, Plus or Advanced plans. Your data can also be moved within your free thirty-day trial so you can get up and running as soon as possible.

Before we begin your move with Dataswitcher, you’ll need to give your current books a quick tidy.

Take a look at our Moving to QuickBooks checklist to make sure your books are ready to move.

When you’ve completed the preparation checklist and your file is ready to go, it’s time to get started with the Dataswitcher wizard.

You'll get a notification from Dataswitcher when your migration is complete.

Now your migration is complete it is time for you to review your data. Follow the steps in our post-move checklist to confirm the data in your new QuickBooks Online file is correct.

We're here to help you get the most out of QuickBooks. Book a complimentary one-on-one session with an expert or explore our online self-paced learning to get started now.

Here’s what gets moved

Here’s an overview of what data can be moved to QuickBooks. See a detailed list here.

Data |

|

| Opening balances | |

| Invoices and credits (AR) | |

| Expenses and credits (AP) | |

| Bank account transactions including incoming and outgoing transactions and transfers | |

| Matched payments (AR and AP) | |

| Chart of Accounts | |

| Customer Lists | |

| Supplier List | |

You can convert up to 2 fiscal years of this data to QuickBooks at no charge.

Enter the email address you use to log into QuickBooks.

Then, you’ll be taken to Dataswitcher to start your move.