7. How to submit e-invoices via MyInvois portal

Let’s see now how to submit e-invoices on the MyInvois Portal, covering both single submissions and batch submissions.

Step 1: Access the MyInvois portal

1. Go to the MyInvois Portal:

2. Log in using your credentials (Trade Register Number and password).

3. Navigate to the e-Invoice Submission section.

Step 2a: Single submission.

For businesses submitting individual invoices, follow these steps:

1. Click on "Single Submission".

2. Fill in the following details:

Supplier Information (Name, TIN, Address)

Buyer Information (Name, TIN, Address)

Invoice Details (Invoice Number, Date, Total Amount)

Tax Details (GST/SST, if applicable)

3. Attach any supporting documents (if required).

4. Submit the e-invoice for validation by the IRBM system.

5. Once validated, download the Document Identification Number (DIN) and send a copy to the buyer.

Step 2b: Batch Submission (bulk upload).

For businesses submitting multiple invoices at once, use the batch upload feature:

1. Click on "Batch Submission".

2. Download the template provided on the portal. The template includes fields for supplier, buyer, invoice details, and tax information.

3. Fill in the template with the required data for each invoice.

4. Upload the completed template back to the portal.

5. The system will automatically validate each invoice.

6. After validation, download the DINs for each invoice and share them with the respective buyers.

Step 3: Correcting errors.

If any errors occur during validation:

1. The system will highlight the errors.

2. Correct the errors and resubmit the invoice(s).

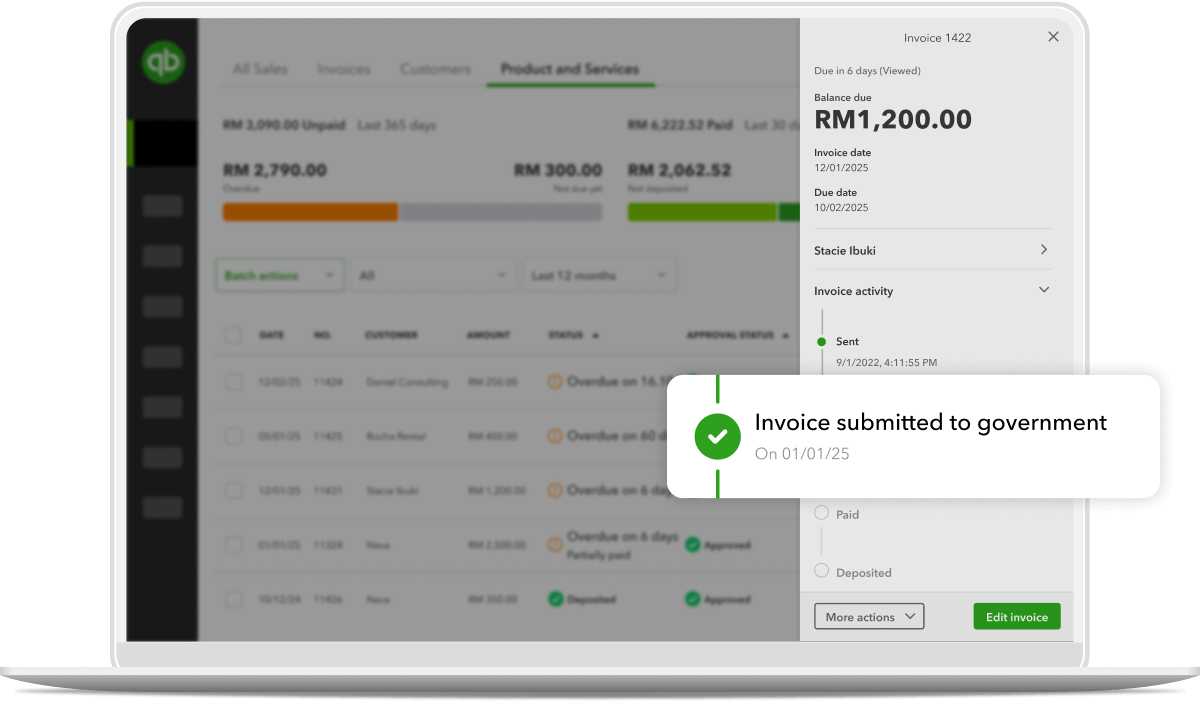

Step 4: Tracking submission status.

To track the status of submitted invoices:

1. Go to "Invoice History" on the portal.

2. Check for statuses such as Pending, Validated, Rejected, or Cancelled.

Best practices for batch submission

- Ensure that the data in the template matches the format requirements.

- Double-check buyer and supplier TIN numbers to avoid validation errors.

- Keep a record of all DINs for future reference.