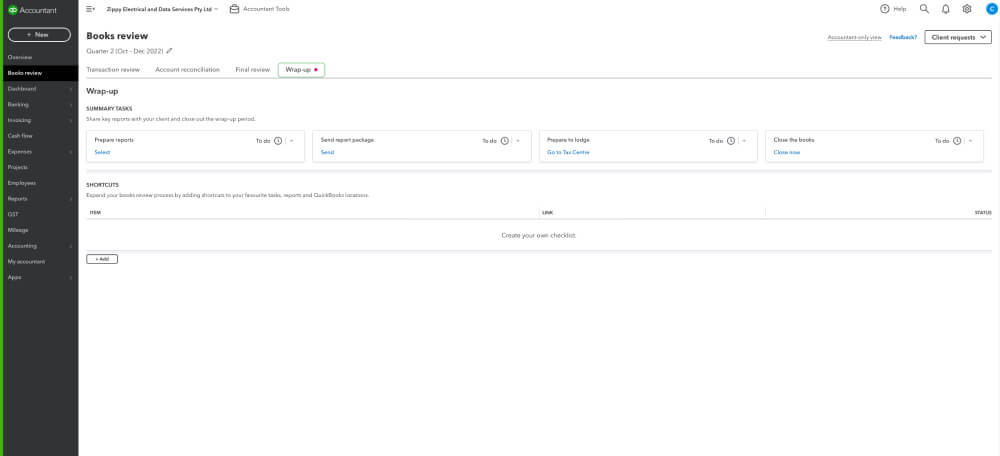

Step 1

- Open a client's QuickBooks Online subscription.

- Select Books Review from the navigation menu or select Accountant Tools and then Books Review.

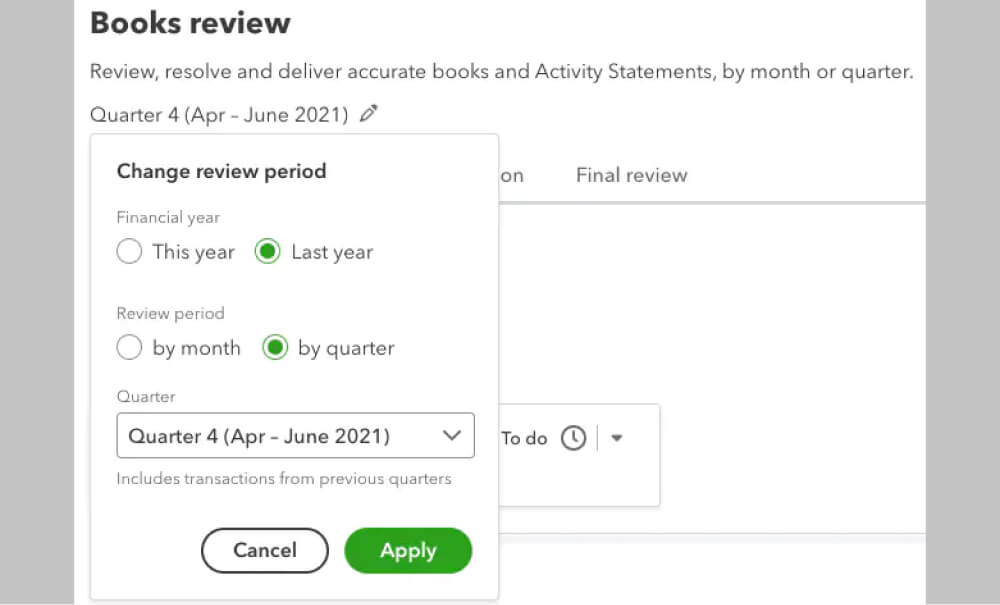

- Select Edit next to the date to choose the review period you’re after. You can choose by month or by quarter.

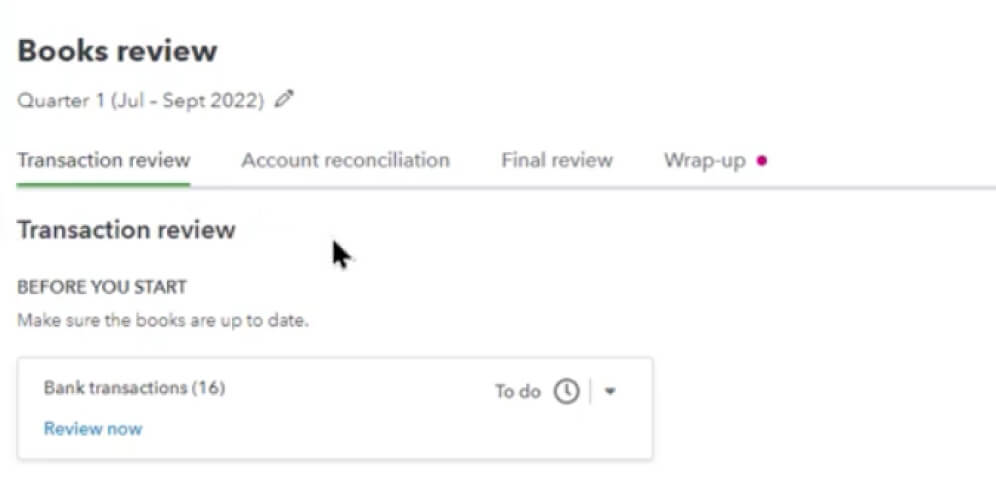

Step 2: Review Transactions

- The Transaction review tab shows transactions with missing or incorrect information. QuickBooks flags uncategorised transactions, transactions without payees, and unapplied payments.

- If data is missing, you'll see a blank line in the column. Select a transaction to open it and make corrections.

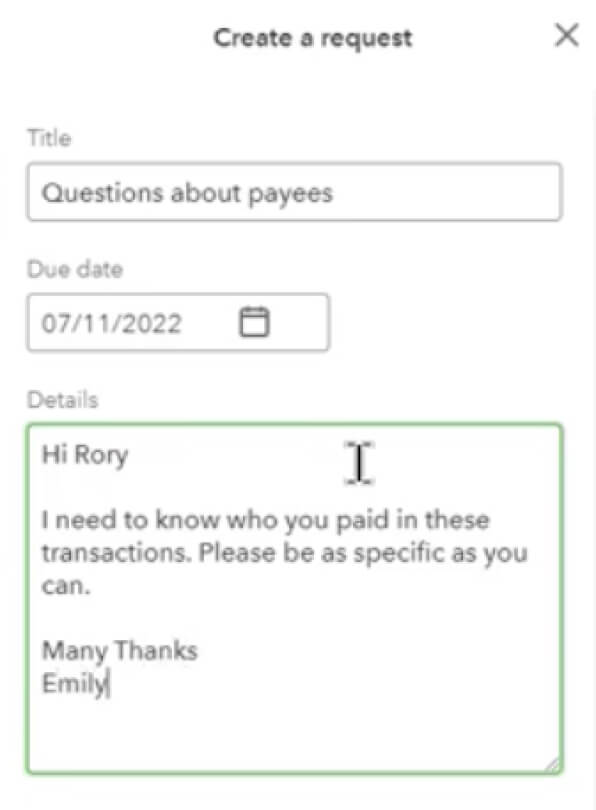

Step 3: Client Requests

- A unique feature in Books Review is that you can ask clients directly for missing information. Select one or more transactions. In the Actions pop-up, select Ask client.

- The Create a request form automatically fills out a name and description along with the request for missing details. You can edit these fields, such as the due date when you’d like a client response, or add related documents.

- Your client will receive an email asking them to log into the My Accountant function in QuickBooks to respond to your queries.

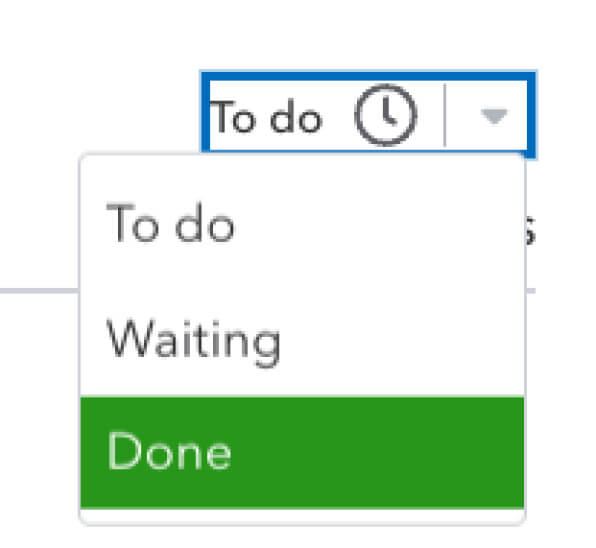

Step 4: View the status of every job

- Update the status of every job - when you click on the timer icon you can easily change the status to Done.

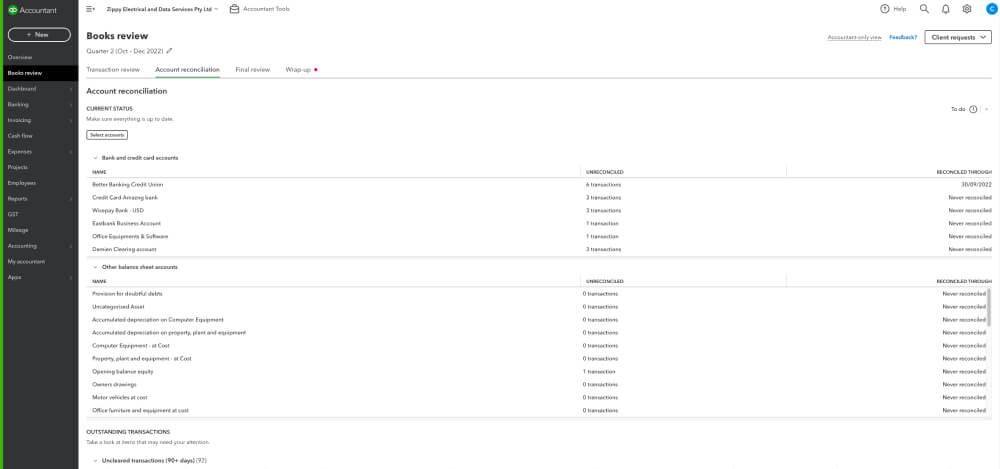

Step 5: Account Reconciliation

- The Account reconciliation tab lists accounts you need to reconcile.

- Select an account to start reconciling it.

- Outstanding transactions appear in the Unreconciled column.

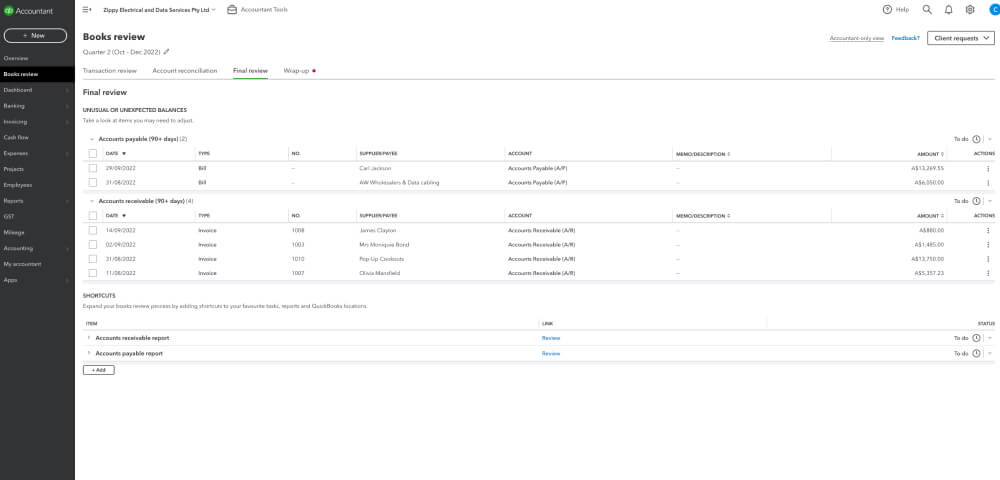

Step 6: Final Review

- The Final review tab lists key financial reports to help you check account balance issues.

- Select Review to open a report.

- QuickBooks automatically filters reports for the month you select.

Step 7: Wrap up your clients' book review

- Prepare and send a report package to your client and close their books.

- Proceed to the GST Centre by selecting GST from the navigation menu for one final review prior to lodging your BAS.