QuickBooks Payroll Resource Hub

Learn how to get the most out of QuickBooks Payroll. These resources will provide you with all you need to know from signing up to payroll to setting up and completing your first pay run.

Setting up payroll

As a small business owner, paying your employees correctly is one of your most important responsibilities. To do this correctly and legally, you need payroll software. Although you can handle basic payroll manually, a payroll software such as QuickBooks Payroll powered by Employment Hero will allow you to handle things easily in-house.

Once you’ve signed up for QuickBooks, it’s time to get connected to QuickBooks Payroll. Below you will find a few easy steps to setting up your payroll, but first, it’s important to get a few details together. Make sure you have your:

- Company information (including ABN).

- Employee information (including TFN, superannuation and bank details).

- Pay history (if you have paid anyone in the current year).

- Bank Details (for setting up ABA files and superannuation payments).

Once you have this, the below steps will help you complete everything you need to get closer to finalising your first pay run.

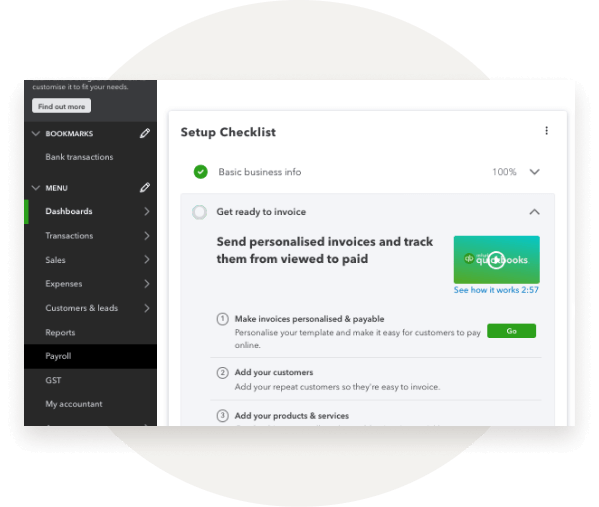

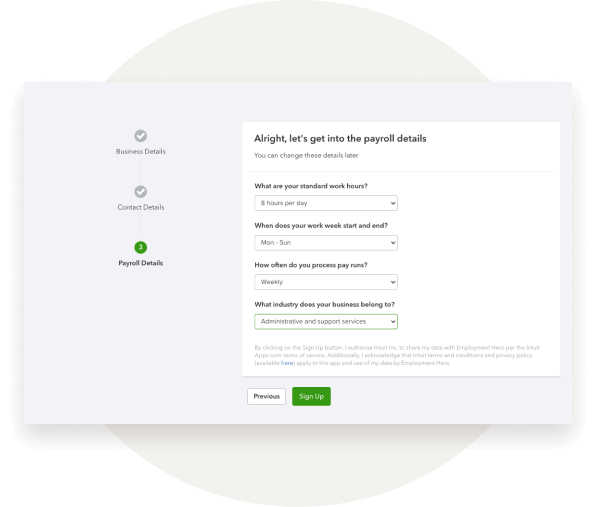

Step 1.

Select the Payroll tab on the left hand navigation bar.

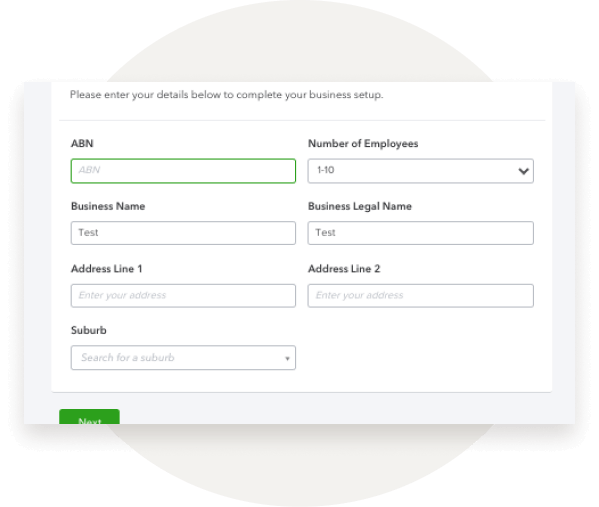

Step 2.

Enter your Australian Business Number (ABN), business name and address.

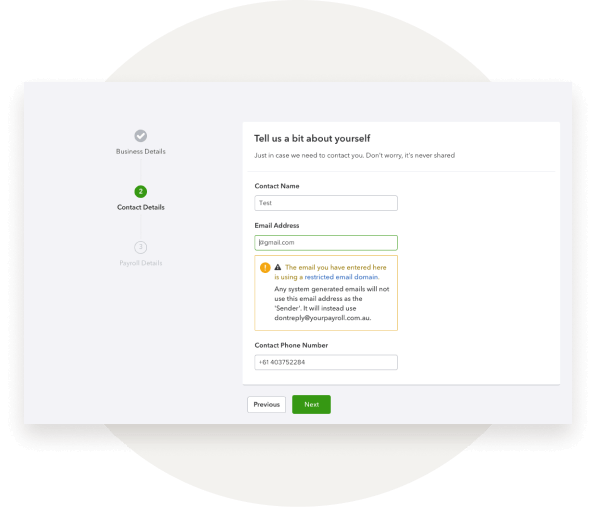

Step 3.

Enter your contact name, email address and phone number.

Step 4.

Under Payroll Details select your standard work hours, the days of your ordinary working week, how often you process a pay run and the industry you’re in.

Step 5.

Select Sign Up to complete the first step to setting up payroll.

We also have a full PDF guide on getting started with QuickBooks Online Payroll.

Have some topic suggestions to include in the hub? Leave your feedback here.