As an accountant, you likely recognize the importance of communicating with your clients in order to fulfill your duties. However, effectively communicating with each person can be tricky when juggling multiple clients at once. Developing a robust client communication strategy will help to ensure your accounting firm satisfies all clients.

In this article, you will learn:

- Why is Client Relationship Management Essential?

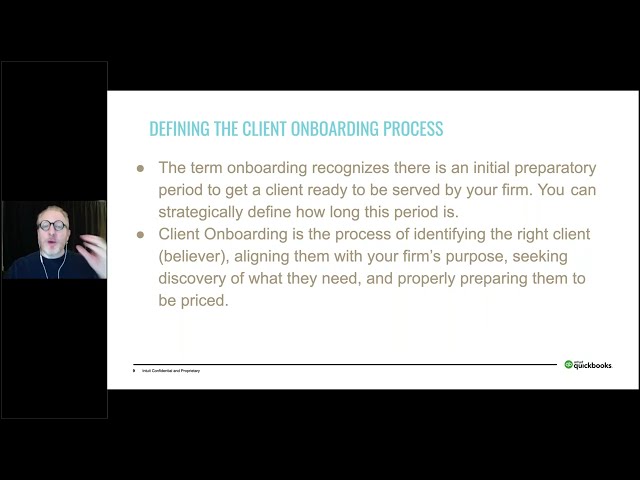

- What is a Client Communication Strategy?

- How to Communicate with Clients: A Step-by-Step Guide for Accountants

- 1. Understand Your Client's Needs and Goals

- 2. Establish Clear Communication Channels

- 3. Develop a Communication Schedule

- 4. Personalize Your Communication

- 5. Use Clear Language and Be Transparent

- 6. Provide Regular Updates

- 7. Adopt Powerful Technology

- 8. Encourage Questions and Feedback

- 9. Offer Education and Resources

- 10. Keep Track of Conversations

- 11. Address Concerns Promptly

- 12. Maintain Professionalism and Ethics

- Practice Effective Client Communication with QuickBooks Online Accountant