- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- 3rd Party Apps

- :

- Etsy Payments Transactions

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Etsy Payments Transactions

Hi,

im new to QB / self employed and business in general.

I have linked my Etsy acc, transactions have transferred over fine, however, I have seen that any monthly payments Etsy makes to me (sales minus fees) are listed in my transactions as minus who make it look like losses/sales.

should these entries be removed to reflect the true figures. I’m not seeing why payments made to my bank need to be reported as minus’.

im keeping things as simple since this is a new business. Sales/purchases/fee’s so this is why I had spotted the issue.

I’m worried that when it comes to doing my self assessment, I report the wrong figures.

sorry if it’s a silly question. Thanks

Solved! Go to Solution.

Labels:

0 Cheers

Best answer April 13, 2021

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Etsy Payments Transactions

Thanks for using QuickBooks Self-Employed (QBSE), Bela.

I also appreciate you for sharing a screenshot with us. To help you get those payments sorted out in your bank, I’d recommend working with your accountant for guidance. They can give you their expert advice on whether you should remove those payments and how to categorise them.

If you’re not affiliated with one, you can visit our ProAdvisor page and look for one from there.

Once everything is settled, you can utilize this link for the detailed steps in categorising your transactions.

Let me know in your reply if you need further assistance managing your transactions or with your account. I’m always around ready to help you. Stay safe!

0 Cheers

5 REPLIES 5

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Etsy Payments Transactions

Hi Bela2 Are you able to edit these transactions and categorise them as income and enter the figure as a positive?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Etsy Payments Transactions

Hi John,

from what I can see, I can.

I’m unsure of these are just superfluous entries as the transactions of sales, fees and purchases are listed and unsure if I need to have these

entries of “withdrawls” on my transactions - ie Etsy sending me the remaining funds every month once they take their fees.

I would have thought the only information I need to keep was sales I make, fees I pay and Purchase of stock. I’m feeling that Etsy paying funds into my bank account is a useless transaction entry as it has no effect on my profit and loss and makes it look like an additional loss which it isnt.

not sure if any other Etsy sellers have seen this or altered their entries.

(hopefully I’m explaining this correctly) :grinning_face_with_sweat:

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Etsy Payments Transactions

Thanks for getting back to us Bela2, is each sale already showing cateogrised as Business Income, separate from the withdrawal entry?

Is the withdrawal entry representing a transfer of funds from Etsy to your main bank account?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Etsy Payments Transactions

Hi there,

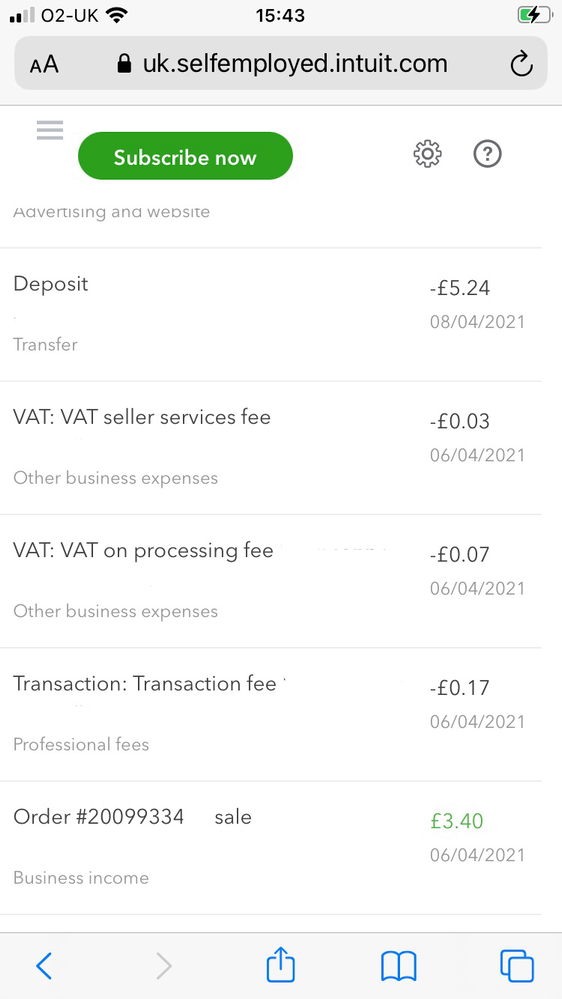

yes everything had its own transaction

1 for the sale of the product (ie +£10)

1 for the Etsy fees (ie -70p)

and then 1 for the payment made to my bank account t (ie -£9.30)

im just wondering if I should be removing the payments to bank account as it seems to have increased my expenses transactions. I’m not sure if this is just a superfluous entry that isnt needed

ive attached a screenshot of one of the recent transactions - bottom is the sale, middle is the fee’s and top is a deposit/payment made to my bank acc

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Etsy Payments Transactions

Thanks for using QuickBooks Self-Employed (QBSE), Bela.

I also appreciate you for sharing a screenshot with us. To help you get those payments sorted out in your bank, I’d recommend working with your accountant for guidance. They can give you their expert advice on whether you should remove those payments and how to categorise them.

If you’re not affiliated with one, you can visit our ProAdvisor page and look for one from there.

Once everything is settled, you can utilize this link for the detailed steps in categorising your transactions.

Let me know in your reply if you need further assistance managing your transactions or with your account. I’m always around ready to help you. Stay safe!

0 Cheers

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...