Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Can anyone please help me with information on how to enter Etsy fees on QB? The fees have already been taken from my Etsy payouts.

Hope you can help. Thank you.Chris

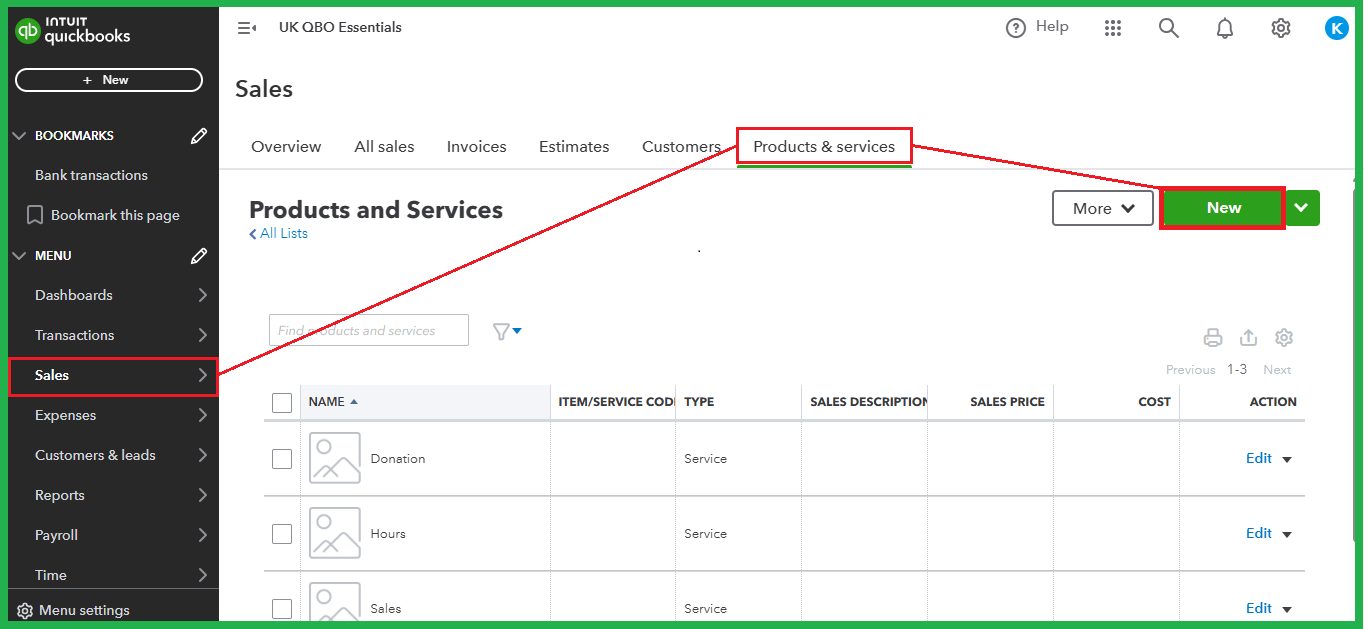

You can create a service item to record Etsy fees, Harty. Let me guide you through the process.

Follow the steps below to register the processing charges from Etsy:

Additionally, I recommend consulting with your accountant about the expense account to use. This way, we maintain accurate bookkeeping.

Moreover, if you generated an invoice without fees, edit it to apply charges. I'll show you how.

Once done, refer to this article if you need to match sales transactions with fees to bank feeds: Manually add service fees to invoices in QuickBooks Online.

Furthermore, you can run a report to monitor sales. To tailor it to your needs, check out this guide: Customise reports in QuickBooks Online.

After documenting the items and charges on invoices, do you require a hand in personalizing sales reports? Please know that you're always welcome to add the details to your reply. We'll be here to assist you.

Firstly, a big thank you for your help. Just to clarify, I receive a payment from Etsy every Monday that shows up in my QB, but Etsy has already taken the Fee, so that doesn't show up in my QB. Can I just go to the + icon and enter an expense?

Thank you Chris

Yes, you can definitely do that if you want to record the fee as a separate entry, Harty. However, I recommend adding it to the bank deposit so it matches the amount of the downloaded transaction from Etsy. Let's work together to log the Etsy fees on QuickBooks.

If you haven't done this yet, record the payment that you've received from Etsy into the Undeposited Funds account. I'll show you how:

After that, deposit the payment to the appropriate account and include the fee as a second line item by following these steps:

Lastly, match this deposit to the downloaded Etsy payment.

Finally, reconcile your accounts by comparing the transactions from your bank statements to ensure accurate financial records.

Please notify us if you need further assistance managing your Etsy transactions by providing the details below. I'm always here to help in any way I can.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.