Hello, @userlh_gardenservice.

I'd like to provide you with some helpful tips for managing owner's withdrawals in QuickBooks Self-Employed.

Consider using the owner's withdrawal category when moving money from the company's assets to pay yourself. All the funds that came from self-employed work are categorized as Business. On the other hand, self-employment income deposited to your personal accounts to pay yourself should be categorised as Transfers.

Only categorise income unrelated to your self-employment as Personal. This includes earnings from individuals who share your bank accounts, personal transactions, and deposits, such as regular paychecks from an employer.

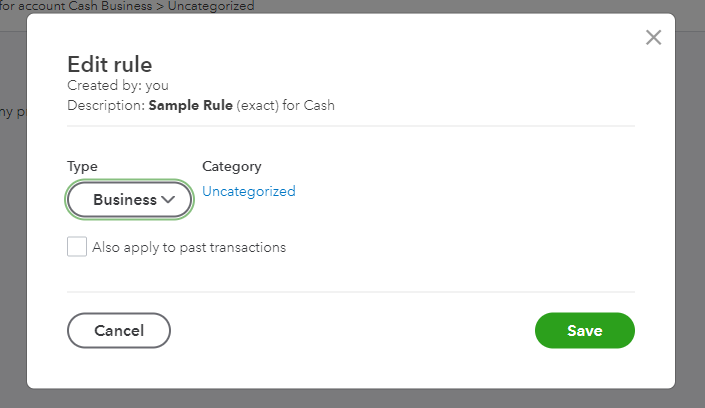

Since you've set a bank rule, you'll want to review the conditions you've set such as the type and category. If you still have questions about the categorization, I recommend consulting your accountant.

To make the review and categorization of your transactions smoother, I recommend reading these articles:

Feel free to reach out to us if you need further assistance managing your transactions. I’m here to help!