Thanks for contacting us, paulwoodruff.

I'm here to help you with recording the payment you made to your subcontractor.

You need to create a bill or expense to record subcontractors payments.

Contractors are responsible for calculating and deducting the payments due to HMRC on behalf of a subcontractor. Thus, QuickBooks lets you use the Construction Industry Scheme (CIS) to help you pay subcontractors.

If you've already setup CIS in your account, you should be able to create a subcontractor. Thus, there isn't a need to upgrade your subscription.

Otherwise, you need to turn on this feature. By doing so, QuickBooks will calculate your CIS deduction, track withholdings, and create reports for HMRC.

Just a heads up, you can't turn off the CIS. No worries. You can stop using it anytime. We keep your accounts and reports for your records.

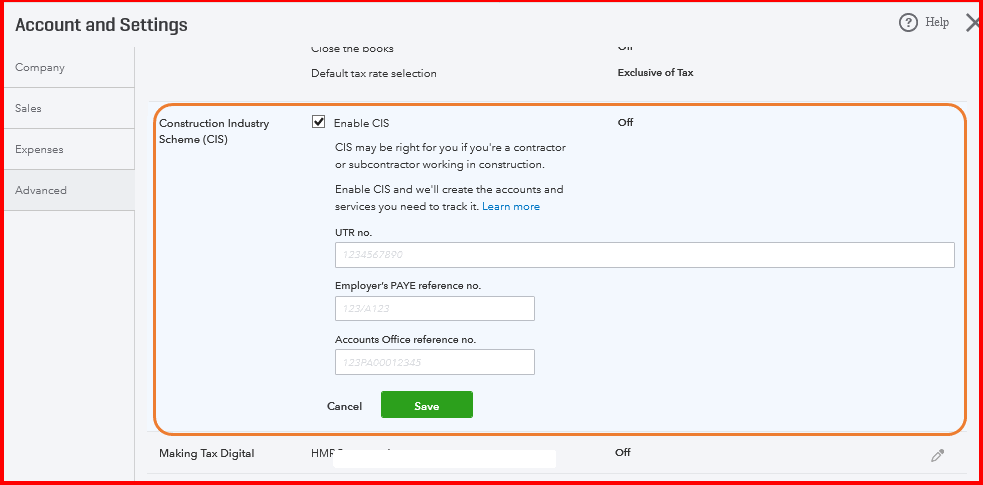

To turn on the feature:

- Click the Gear icon at the right top.

- Under your Your Company, select Account and Settings.

- Click Advanced.

- Select Construction Industry Scheme (CIS).

- Mark the Enable CIS box, then enter your information.

- Click Save, then Done.

Once done, enter the subcontractor. Here's how:

- Go to Expenses from the left navigation bar.

- Select Suppliers, then New supplier.

- Fill in all fields in the Supplier information window.

- Select is CIS subcontractor.

- Enter info in the CIS Information tab.

- Click Save. The subcontractor will appear in the supplier list.

For more details about the feature, check this out: CIS in QuickBooks.

Should you need anything else, please let me know. I'm always around to help you out.