Greetings, @minlee2001.

Welcome to the Community. I’m here to help create a transaction and apply it against the customer’s credit note in QuickBooks Online.

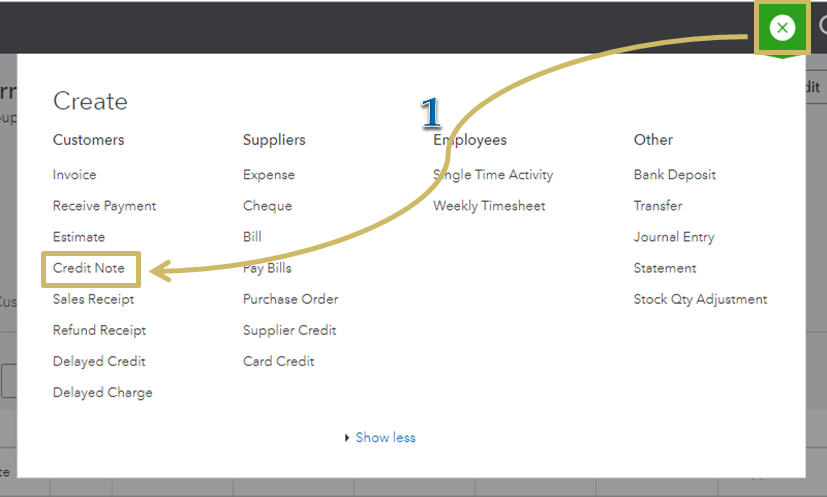

If you haven’t entered a credit note yet, follow the steps below:

- Go to the Plus icon and select Credit Note.

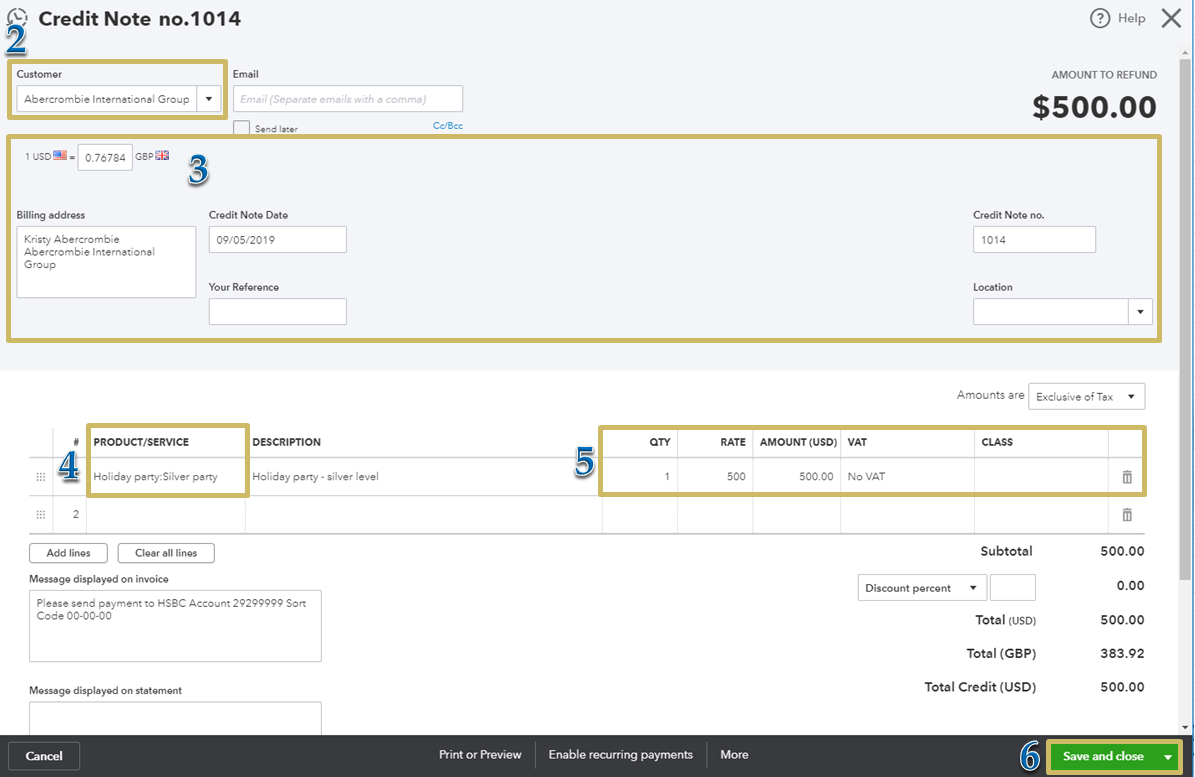

- Choose customer from the drop-down.

- Fill out other necessary fields.

- Select the item under the Product/Service column.

- Enter Qty, Rate, Amount and VAT.

- Hit Save and close.

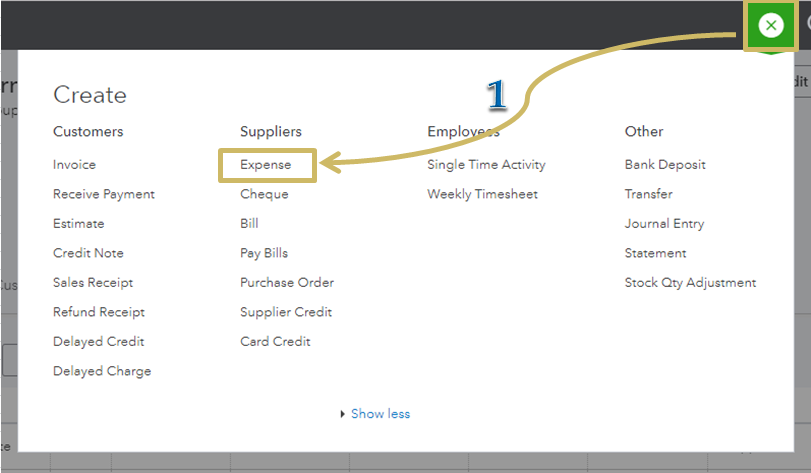

Right after, create an expense transaction. Here’s how:

- Go to the Plus icon and select Expense.

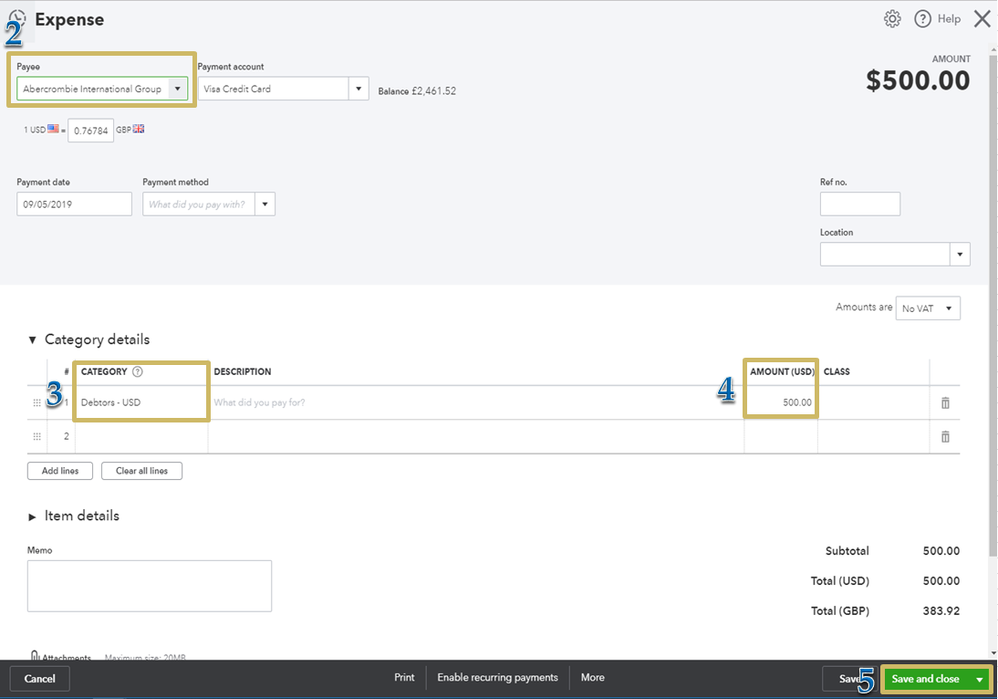

- Choose customer from the Payee drop-down.

- Under Category column, select Debtors.

- Enter amount.

- Hit Save and close.

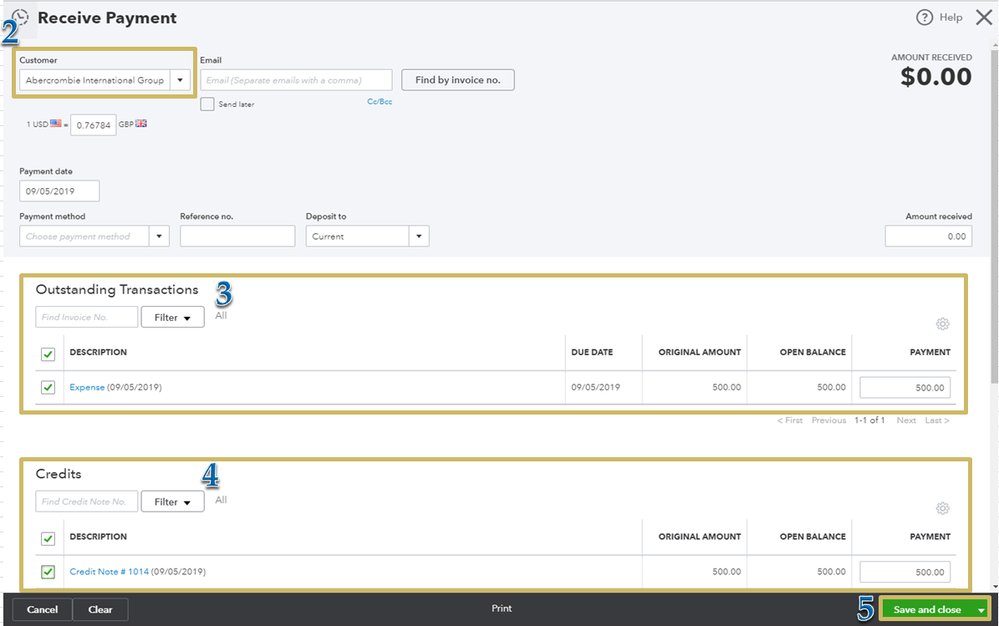

Once done, use the Receive Payment option to link the two transactions. Let me show you how:

- Click the Plus icon and select Receive Payment.

- Select customer from the drop-down.

- On the Outstanding Transactions section, select the Expense transaction.

- Place a check mark next to the Credit Note under the Credits section.

- Hit Save and close.

Check out the following articles for reference:

That should answer your concern for today.

Let me know if you have any issues after following those steps. I’m always here to help you out. Have a good one!