- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- Employees and Payroll

- :

- Employer NI expense not being reduced by Employer Allowance in Advanced Payroll from P&L and balance sheet?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Employer NI expense not being reduced by Employer Allowance in Advanced Payroll from P&L and balance sheet?

Hi all,

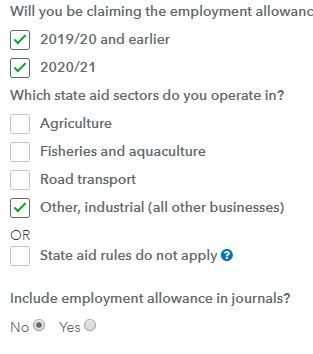

I had a similar issue with the journals. However, there is a tick box under payroll settings HMRC settings that by default says "Include employment allowance in journals = No"

Change that to "Include employment allowance in journals = Yes" and hey presto should be included in your Journals!

Not sure why the Intuit Helpdesk couldn't help?

Rosco

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Employer NI expense not being reduced by Employer Allowance in Advanced Payroll from P&L and balance sheet?

@RoscoPC , brilliant. Intuit have finally fixed the issue by adding the option.

I'm glad I also took a screenshot of the HMRC setting page, because that option never existed when I and others hit our head against it. That is why Intuit Helpdesk did not point it out ![]()

This is obviously why I got a curious notification that they wanted me to add their care team as a user so they could "fix" the issue. Why they could not have just told me they just added the option? My guess its because they want it still to appear as our fault - we did not select the option. How could we if it did not exist until just now!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Employer NI expense not being reduced by Employer Allowance in Advanced Payroll from P&L and balance sheet?

Getting just a bit peeved with Intuit myself. Thanks for this. I have checked and 'yes' the option is now available. Like BIGAL I had Intuit telling me 'this is how it is supposed to work, you have to manually add it'. Got a real problem now with HMRC submissions which I will post elsewhere but basically my RTI liability amount on HMRC website is more than twice my P32 figures for both Month 1 and Month 2. Intuit say 'call HMRC'. Have you checked yours??

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Employer NI expense not being reduced by Employer Allowance in Advanced Payroll from P&L and balance sheet?

@Cidonline I had checked with HMRC, thanks. I also looks at the raw submissions to HMRC by Intuit to confirm their HMRC were correct, and it was "just" that their journal entries were incorrect. Had I paid HMRC the amount reflected as being due in the liability accounts, I would have overpaid.

I had a book-keeper who was fortunately paranoid enough to keep a P32 spreadsheet that tracked EA, because at one stage the desktop version did not reflect EA either (though HMRC knew we were claiming EA through a previous EPS), to make sure we never overpaid again. She left a couple of years ago but fortunately I have continued the practice, so picked up the issue early on and corrected Intuit's journals to take into consideration EA and bring my employers liabilities after HMRC payment back to zero in the books.

Intuit's P32 report in advance payroll fortunately does also take EA into account, although you still need to enter the amounts paid to HMRC.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Employer NI expense not being reduced by Employer Allowance in Advanced Payroll from P&L and balance sheet?

This is embarressing Intuit, once again you have forced us to use a sub standard product to accomplish basic and mandatory tasks. ENOUGH IS ENOUGH! I encourage all users to email the CEO / Chairman's office (google the address) and report this, and if you have an account manager report it to them as well.

I had an employee have their pensions contributions wiped completely from the payroll in month 2 after the upgrade, first month worked fine. We got into all kinds of trouble.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Employer NI expense not being reduced by Employer Allowance in Advanced Payroll from P&L and balance sheet?

As a last gasp, this issue is still not fully resolved.

While the journals now include line items for the EA in the payroll entries, the P32 report currently does not include these figures in the Employers Allowance column.

See this post.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Employer NI expense not being reduced by Employer Allowance in Advanced Payroll from P&L and balance sheet?

I just stumbled upon exactly the same issue. I tried to fix by switching EA off in HMRC Payroll Settings (Small Employers) - are you eligible "NO") "Save" then switching it back on again.

When I then re-ran the P32 the historic EA deductions claimed reappeared reducing the C/F HMRC Balance back which had increased back to 0 , hope that works for you

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Employer NI expense not being reduced by Employer Allowance in Advanced Payroll from P&L and balance sheet?

Hello there, @BigAl42.

Thank you for visiting the Community today. I'm seeing a duplicate post from you about this concern.

I'll direct you to the post where my colleague responded. Please check this link for your reference: https://quickbooks.intuit.com/learn-support/en-uk/employees-and-payroll/employers-allowance-in-advan....

Feel free to visit and let me know if you need further assistance. I’m always here to help.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Employer NI expense not being reduced by Employer Allowance in Advanced Payroll from P&L and balance sheet?

@katherinejoyceO Do you get paid by the response and actually read the content of the messages yopu are responding to or referring to?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Employer NI expense not being reduced by Employer Allowance in Advanced Payroll from P&L and balance sheet?

@benny001 Thanks for the tip - unfortunately this did not work for me. I tried this 2x, the second re-running the report between saves. Absolutely zero difference.

Unfortunately looks like I am going to still have to deal with Intuit support :(

Intuit staff: Please stop with your meaningless responses - they just clog up the list

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Employer NI expense not being reduced by Employer Allowance in Advanced Payroll from P&L and balance sheet?

Please note this issue has been fixed. If you are still experiencing the behaviour, please contact our support team.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Employer NI expense not being reduced by Employer Allowance in Advanced Payroll from P&L and balance sheet?

Thanks for your notes on the Employer allowance in April 2020

i am having a nightmare and do not know how to resolve this.

my Employer Allowance shows on my P32 and deducts from the overal amount to pay hmrc.

what’s happening for me is that although the figures look correct they are not going through to hmrc correctly. It would appear that when I click finalise payroll and it connects with hmrc the employer allowance is not being into account at hmrc end. I am getting numerous letters stating I owe money to hmrc and I don’t. I am totally pulling my hair out and do not know how to rectify the situation without making this worse. Any help would be much appreciate

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Employer NI expense not being reduced by Employer Allowance in Advanced Payroll from P&L and balance sheet?

Hi DP200749 Have you activated the 'Include employment allowance in journals?' option within the settings? Select payroll settings > HMRC settings > select the edit/pencil icon to the right of 2021/22 in the 'Will you be claiming the employment allowance?' section > select yes in the 'include employment allowance in journals?' section > save. To have the employment allowance included in your previous payrun journals you'll have to unlock the payruns and re-finalise, you will also have to re-submit the FPS's as corrections to earlier submissions. Also have you submitted an EPS to HMRC?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Employer NI expense not being reduced by Employer Allowance in Advanced Payroll from P&L and balance sheet?

Have you registered with HMRC to receive the Employment Allowance in the current tax year? They no longer roll this forward each year. You also need to select the relevant tax year within payroll settings in QBO. You also need to submit an FPS for HMRC to then adjust the tax account.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Employer NI expense not being reduced by Employer Allowance in Advanced Payroll from P&L and balance sheet?

The Radio Button, Include Employment allowance in journals, should be set to YES!

0 Cheers

- « Previous

-

- 1

- 2

- Next »

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...