Greetings, @gyalus.

I'm here to share how QuickBooks Self-Employed handles your self-assessment.

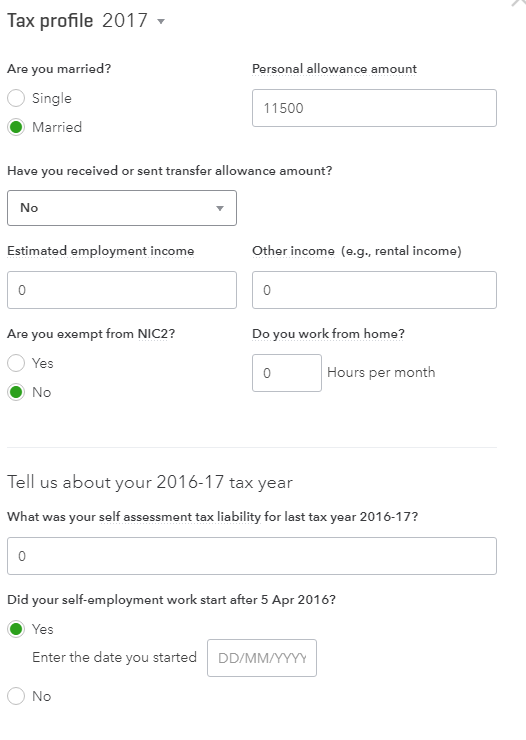

Just to clarify, what specific personalisation are you referring to? If you're referring to changing the SAF103 categories of your transactions, you can easily do so by locating the transaction and clicking on its assigned categories. Also, the ability to create custom categories are currently not available. Lastly, should you want to make changes on your Tax Profile, here's how:

- Go to the Gear.

- Select the Tax Profile.

- Toggle the Tax Year.

- Make the necessary updates.

On the other hand, you'd just want to make sure that all of your self-employed related income and expense transactions are recorded in QuickBooks. This way, the system will automatically calculate and generate your Self-Assessment summary. You have 3 ways to do so:

Once your transactions for 2019 and 2020 are recorded, make sure to assign each transaction to the correct SA103F categories. Here's how to view your Self-Assessment summary:

- Go to the Taxes menu.

- Make sure to toggle the Tax Year 2019 - 2020.

Visit us here again if you have other questions using QuickBooks to manage your self-employed taxes. I'm always here to help.