Before a business can claim their employment allowance, it’s essential to verify their eligibility. @CaptainEon, I’d be happy to provide you with more details about this.

This allowance helps specific businesses reduce their annual Employer Class 1 National Insurance by £5,000 per tax year. To claim this, visit the HMRC website to check your eligibility. If you qualify, you'll have to inform HMRC accordingly.

Moreover, please ensure to set up your payroll before we proceed with configuring your employment allowance in your QuickBooks Online account. Once completed, you can proceed with the following steps:

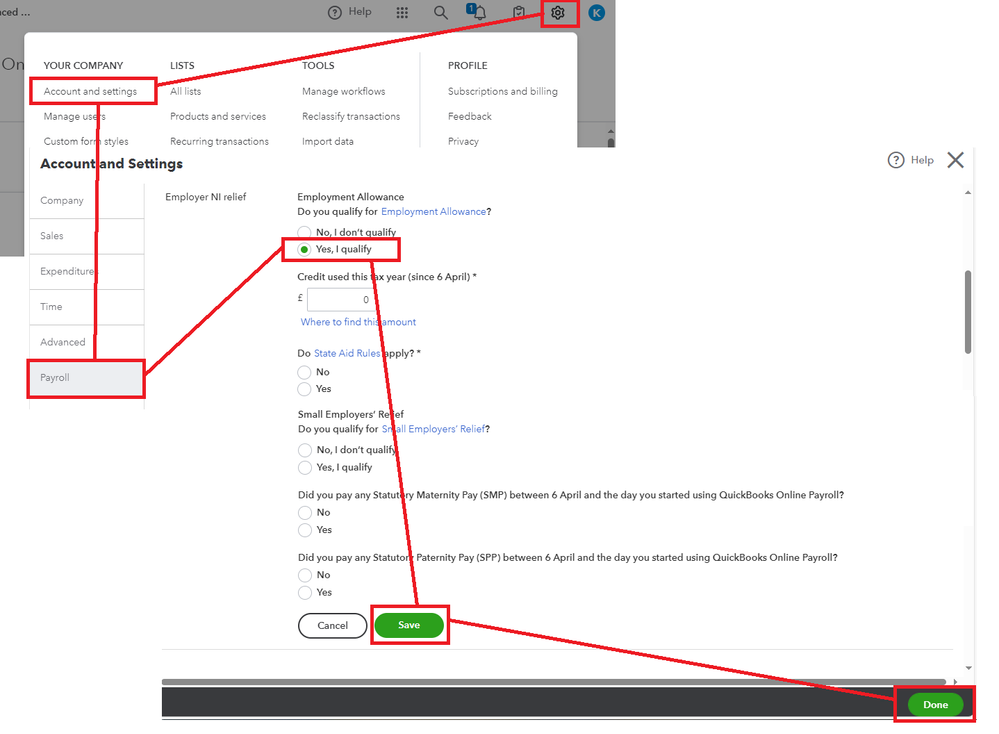

- Open your QuickBooks account.

- Head to the Gear icon, then Accounts and Settings.

- Go to the Payroll tab.

- Once there, find the Employer NI relief and click the pencil icon to edit.

- From the Employment Allowance section, tick the radio button beside the Yes, I qualify. Please know that we will create an EPS filling to confirm your eligibility and walk you through the steps for submitting it to the HRMC.

- Provide the amount of Employment Allowance used this tax year. If you're not sure about the amount, you can check it by logging into your HMRC account (PAYE for Employers).

- Click Save, then Done.

For reference, please see this article: Set up Employment Allowance in QuickBooks Online Standard Payroll.

For effective management of payroll and scheduling in QuickBooks, I recommend exploring these helpful articles:

If you have any other concerns about your employment allowance, please don't hesitate to reach out in this forum. I'm here to assist you whenever you need help.