Welcome to the Community, @SteveYPF. I'm here to ensure you're able to record the net wages and pension payments in QuickBooks Online Advanced Payroll (QBOAP). Also, I'll share the details about automating the pay runs and pension reporting through the program.

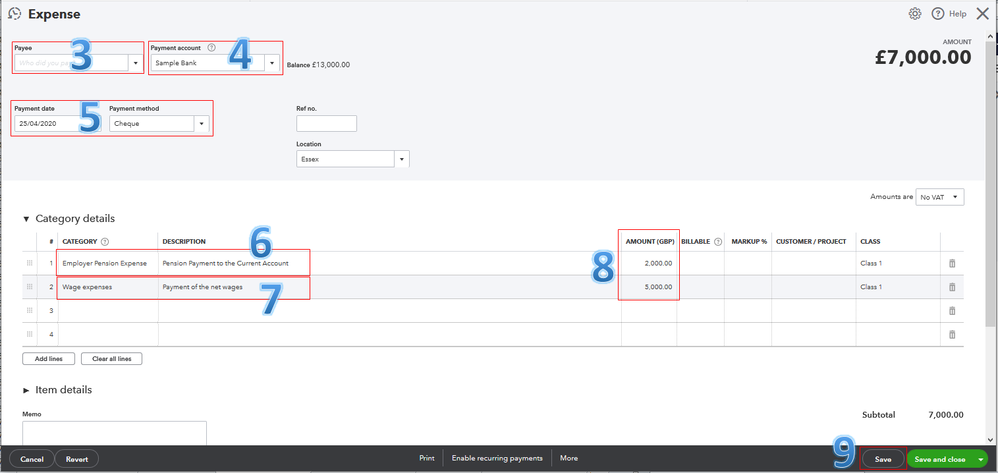

First, let's create an expense to record the payment of the net wages and the pension contribution to the current account. Please take note of the appropriate accounts to use before performing the steps below.

- Go to the + New button from the left menu.

- Select Expense.

- You can leave the Payee field blank since this transaction covers multiple petty cash expenses.

- Choose the Payment account.

- Enter the Payment date and select the Payment method.

- In the first line of Category details section, select the current account for pension payment.

- Choose the appropriate account for the payment of the net wages.

- Enter their amounts.

- Click Save.

The sample screenshot below shows you the last seven steps.

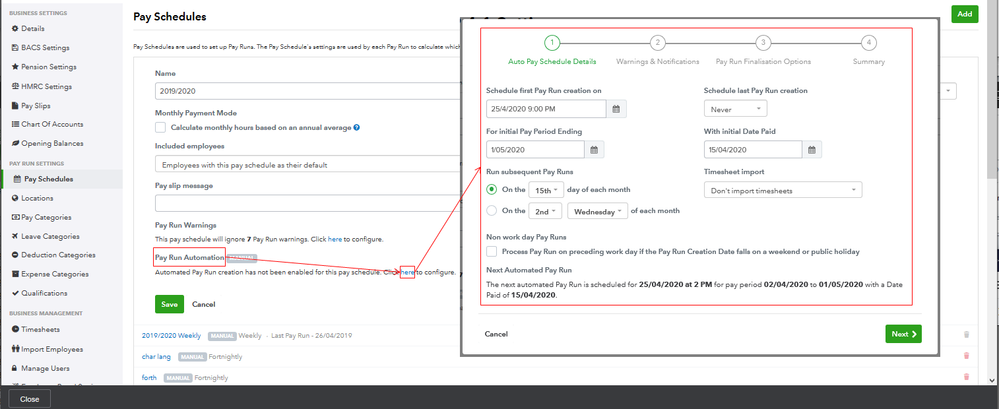

Second, the automation of pay runs and pension reporting is possible in QBOAP. Let's go to Payroll Settings from the Employees menu to configure automated pay runs.

Then, select the applicable pay schedule to view its settings. From there, click here in the Pay Run Automation section. Note that there may be a time delay as to when the pay run is finalised due to its volume and size. Repeat the process for your other pay schedules.

I've attached a screenshot below on how the setup wizard looks like. For more details, check out this article: Configuring Automated Pay Runs.

For the pension reporting, you can use the inbuilt PensionSync integration. This way, the pension contribution amounts will automatically be sent to your provider. To learn more about this process, visit this article: Pension Scheme Setup.

As always, I recommend visiting this resource hub: QBOAP. It contains helpful links about managing your payroll settings, employees, processing pay runs, viewing payslips, and submitting reports.

I'm here anytime you have other concerns. Wishing you and your business continued success while using QuickBooks, @SteveYPF.