Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

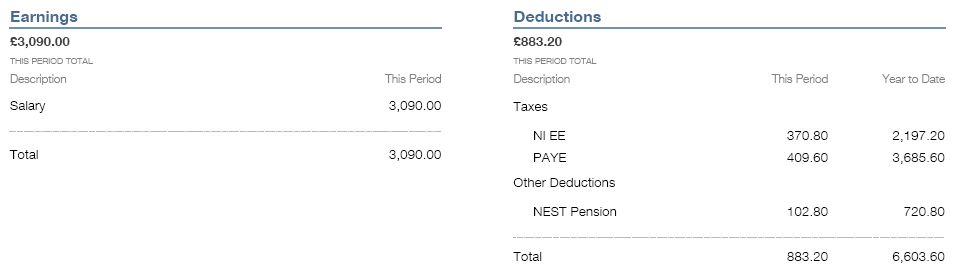

Ran the payroll for December on 16 December, only just noticed an error. Two employees, one of the two payslips is absolutely fine. The other: gross pay £3,090 (same as previous month) but pension contributions show as £102.80 & £77.10 rather than the correct figures of £123.60 & £92.70. The 5% and 3% figures are correctly in the set up, nothing has changed from November when QB calculated the correct amounts. Have just tried running January's payroll and that is generating the incorrect amounts also. Any suggestions as to what's gone wrong? Only just noticed it when checking the NEST contributions were correct. Help appreciated.

Solved! Go to Solution.

By playing around I've found the problem and publishing it in the hope it helps someone else encountering this.

In settings there is a tick box for Use Earnings Thresholds. It says "Earnings threshold - Use the latest defined earnings thresholds to work out when employees are auto enrolled in the pension."

There is no earnings thresholds that affect the % of contributions until earnings hit £50k but having this ticked means that QB appears to have changed the % in the ninth month of earnings at £3,090, with this box ticked. Having unticked this the figures are now correct. Have deleted and rerun December's payroll.

This makes no sense but perhaps needs looking at by QB.

Hello AlisonH1, Are all the pensionable items ticked?

Hi Emma, nothing has been changed in the setup from the previous month - which had the correct figures calculated. Not sure where items are ticked though as pensionable though - there is only one item, gross pay, no additions or deductions.

Thanks for keeping us updated, AlisonH1.

I'm here to help ensure that your pension contributions are accurate.

To isolate the issue, you can check the pensionable items from the Account and Settings. It could be that some pension pay types were not included in the calculation that's why the contributions are incorrect. When you're ready, here's how to do it:

Additionally, here's an article that you can read to help automate the pension reporting in QuickBooks Online: Pension Scheme Setup.

I'm just a few clicks away if you have any other concerns or questions. Have a great rest of the day.

Nope, I have only basic "salary", no additional types of pay. No settings have been changed between November's calculations, which were correct, and December's which are incorrect for one of the two employees. That is what makes no sense.

November:

I cannot see any reason why this would have changed - and previewing January's that is also wrong.

Thank you for sharing the screenshots, @AlisonH1.

Since the pension is still incorrect even after that no changes have been made with the setup, I'd recommend contacting our Payroll Care Team. With their tools, one of our specialists can further look into what is the cause of the incorrect calculation of your pension.

To contact our dedicated support:

Additionally, I've also included this reference for a compilation of articles you can use while working with us: Help Articles for QuickBooks Online Payroll.

If there's anything else that I can help you with, please let me know by leaving any comments below. I'll be here to lend a hand.

Thanks, but that just launches a popup window to start chat but doesn't actually do anything more once you submit it, I've even tried in two different browsers in case it's me! Really need this to be resolved.

By playing around I've found the problem and publishing it in the hope it helps someone else encountering this.

In settings there is a tick box for Use Earnings Thresholds. It says "Earnings threshold - Use the latest defined earnings thresholds to work out when employees are auto enrolled in the pension."

There is no earnings thresholds that affect the % of contributions until earnings hit £50k but having this ticked means that QB appears to have changed the % in the ninth month of earnings at £3,090, with this box ticked. Having unticked this the figures are now correct. Have deleted and rerun December's payroll.

This makes no sense but perhaps needs looking at by QB.

OMG thank you SO much Alison, this problem has been doing my nut in for ages. Once I found your thread, it's finally all sorted (can't say the same for my sanity!)

Good day, @Jay Cee.

I'm glad that QuickBooks Community was able to help you with the error.

You can always share your concern in this public forum. My QuickBooks Team and other users in the Community are always here to help. Have a good one.

Seconding the huge THANK YOU to AlisonH1 for finding and sharing this fix!

We've just done our first payrun and thought it went OK on Friday, only to realise today that the pension contributions were all off. A bit of digging turned up this query & solution, we checked it against our system, tested it - and yes, this is the exact same issue.

Fixed now, and hopefully it won't turn itself on again (80-something records was more than enough to have to correct one at a time!).

Thank you Alison, you've saved us!

Hi there, Su WM.

I'm very glad that the information was able to help you. The Community will always be around to lend you a hand any time you need guidance. If you have any other questions or concerns, don't hesitate to ask.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.