Good day, belindabot,

I'm glad to show you how to enter those paychecks from Payroll Manager 20.

You'll want to enter those payments as journal entries to track your payroll and account date made outside QuickBooks Online. To do so, let me walk you through manually recording them:

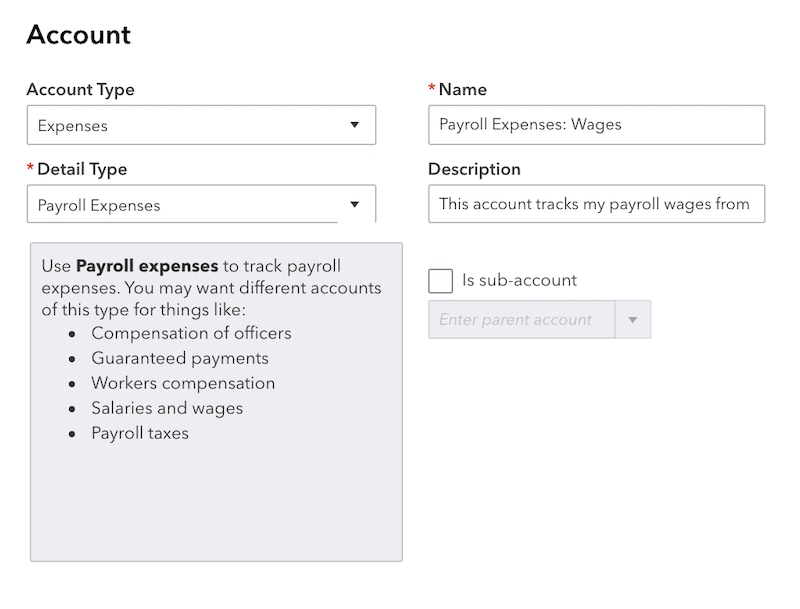

Step 1: Create manual tracking accounts t track your payroll liabilities and expenses.

Create these expense accounts. Select Expense as the account type:

- Payroll Expenses: Wages

- Payroll Expenses: Taxes

Create these liability accounts. Select Liabilities as the account type:

- Payroll Liabilities: Federal Taxes (941/944)

- Payroll Liabilities: Federal Unemployment (940)

- Payroll Liabilities: [State] SUI/ETT

- Payroll Liabilities: [State] PIT/SDI

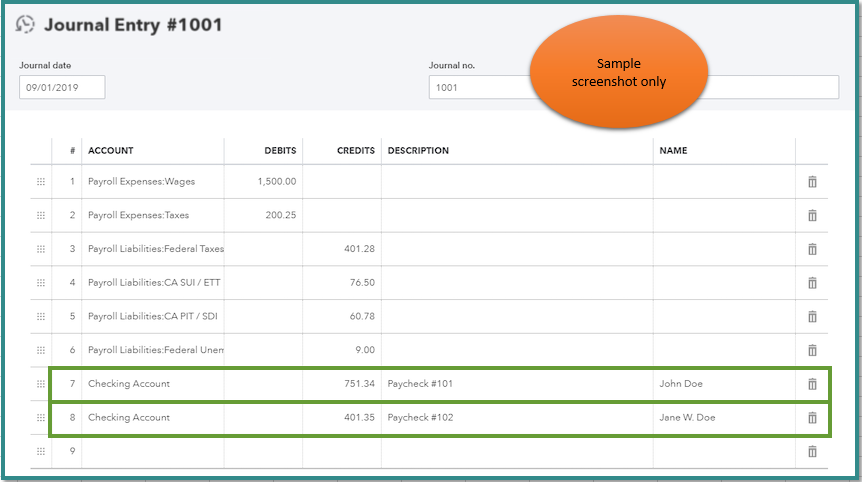

Step 2: Enter the payroll paychecks into QuickBooks Online

- Click + New, then choose Journal Entry.

- Under the Journal date, enter the paycheck date.

- If you want to track the paycheck number, enter it in the Journal no. field.

- When you're done entering the debits and credits, select Save.

I also suggest consulting your accountant to know what accounts to debit or debit on your entries.

I've added a screenshot below for your visual guide on how to enter each paycheck on a separate line.

Keep me posted if there's anything else you need. I'm always right here to help.