Let me ensure you can follow the steps in deducting hours from your employee's monthly pay, Lozza.

Deductions offered in QuickBooks Online (QBO) has two types.

- After tax deductions

These types of deductions must be agreed upon in writing by the employee or be included in the employee's contract.

- Loan repayments

Loans given to employees for expenses such as rail tickets are not taxed.

Here's the steps to follow when you add/edit a deduction:

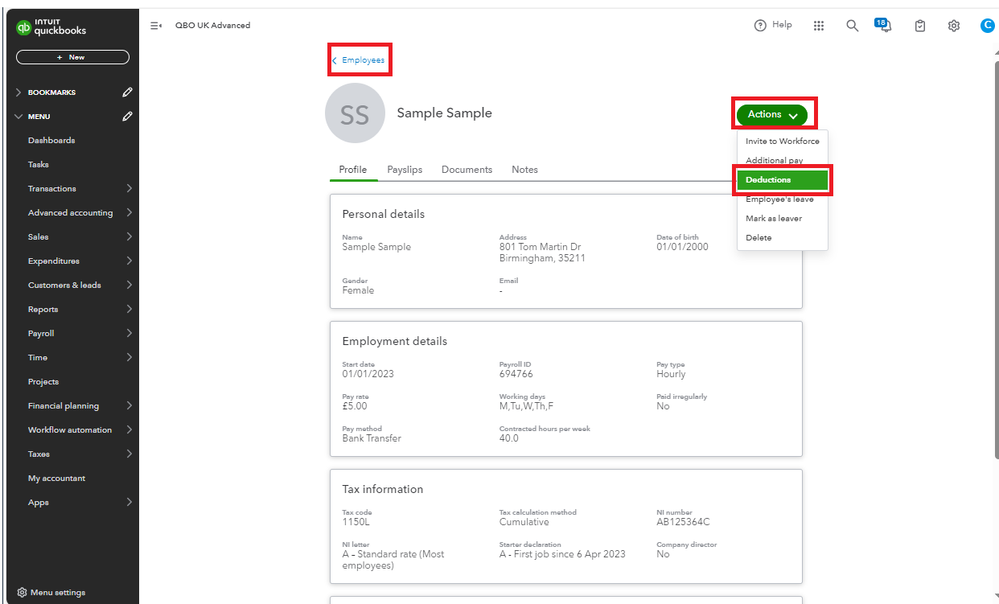

- Go to the Payroll and choose the applicable employee.

- Click Actions at the top right of the page, then Deductions.

- Enter the deduction you want to add from the list. If you can’t find the deduction you’re looking for, you can create a new one.

- Click on the plus icon, then select Add next to the following to add the type of deduction:

- Once done, hit Save.

Additionally, you'll want to refer to this article and learn how a payslip is generated for each employee when you run payroll: Email or download payslips in QuickBooks Online Standard Payroll.

I'll be in the comments if you need additional assistance managing your employees. Have a good one.