Hello there, stonefieldproper.

Selecting the correct liability and bank account you use on paying your corp tax is important when manually recording it in QuickBooks. This way, you'll be able to reduce the amount in your bank and current liabilities on your balance sheet as well as making sure your books are accurate. Let me guide you how.

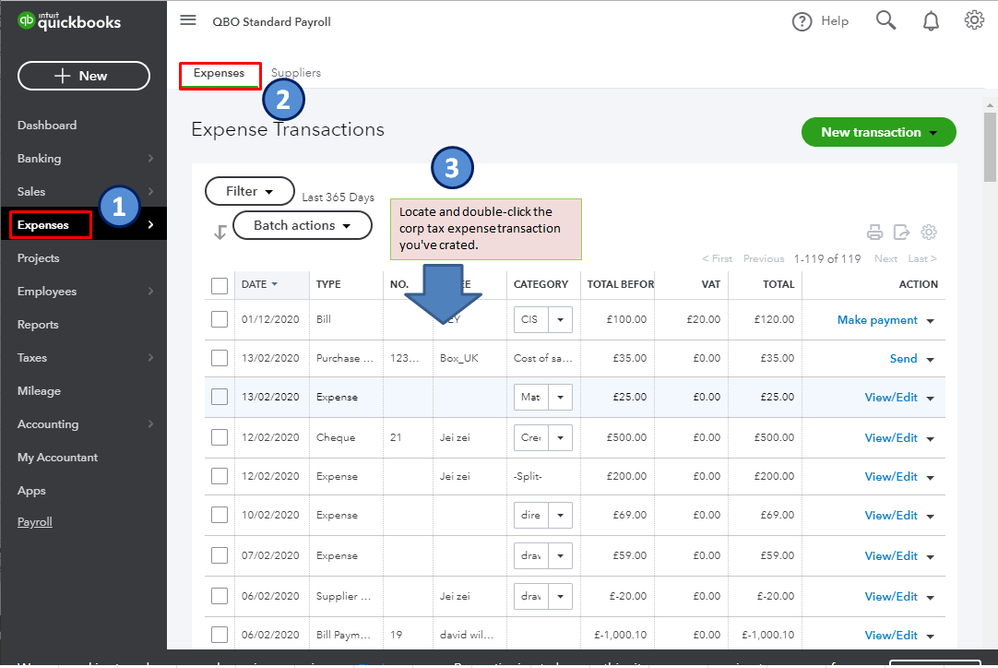

- Go to the Expenses menu.

- Select Expenses.

- Locate and double-click the corp tax expense transaction you've created.

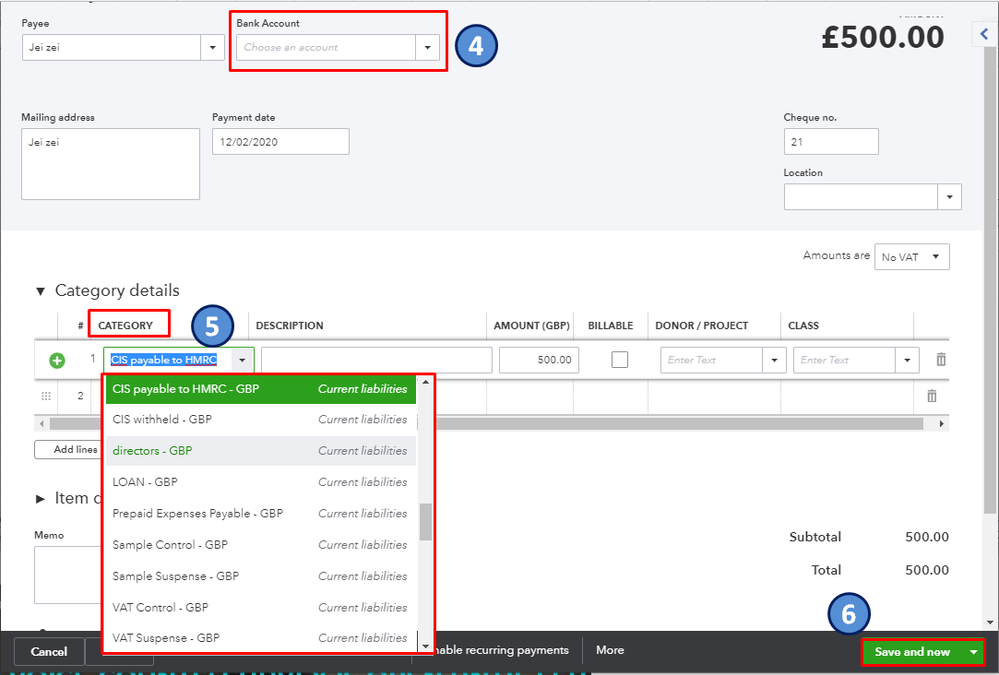

- Choose the right Bank Account.

- Select the correct liability account under the Category column.

- Click Save and new or Save and close.

Once done, pull up the Balance Sheet report to verify the update. I've attached screenshots below for your reference.

Please let me know if you have other concerns. I'm just around to help.