Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi

I am working on submitting my VAT return. On my VAT return, the "tax point" for all my sales and purchases is the date of the invoice, not the date on which I pay the invoice or receive payment. I am on the most basic quickbooks online and it seems I can only record expenses that have been paid. How do I get MTD VAT on quickbooks to recognise the invoice date of expenses rather than the payment date so that the expenses full within the correct VAT return period?

Thanks

Solved! Go to Solution.

Hi ronc,

Thanks for getting back to us here.

Just to correct my original post, you would need the VAT settings (Taxes > Edit VAT > Edit settings) to be set to Standard to account for the VAT on the transaction date, not the payment date.

As there is no option to enter a payment date on an expense, you would need to raise the bill first, and then match this to your transactions in the bank.

If you created all of the expenses by adding from the bank feed, you can undo these and then raise the bill, and then match.

If you have multiple similar bills, you can use the copy function (More > Copy on the toolbar in the transaction) to create a copy of this, then edit any details needed.

Thank you

Hi ronc,

Thanks for joining us on the Community.

As the expense can only have one date assigned and needs to reflect the date this was actually paid from your bank account, you would have to upgrade to Essentials to enter bills where you can enter a bill date and payment date, and ensure you are using the setting for cash VAT. This way the transactions will post to your VAT return when you mark them as paid/payment received.

Please get back to us below if you have any queries!

Thanks for your response.

I have upgraded to Essentials now - is there a way to transfer transactions on my bank account to bills? I know I can transfer transactions on my bank account to expenses, but can't seem to make bills out of the same information from a bank transaction. I am just trying to find a quick way to create a bill for every expense paid - I understand this is what I need to do now if I want to ensure that it is the invoice date that is captured for an expense for VAT purposes.

Thanks

I appreciate you for upgrading your QuickBooks Online (QBO) account, @ronc.

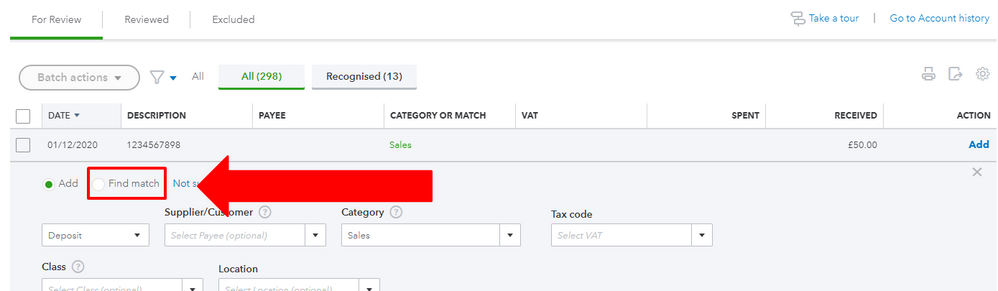

You'll just have to match the invoices recorded in your QBO to your bank transactions to ensure the invoice date is captured for your expense. Let me guide you how.

In your QBO account:

Here's an article you can read for more details in matching your bank transactions: Add and match downloaded bank transactions [Video].

Let me know if there's anything I can help you with. I'm more than happy to help and get you back in working order. Have a beautiful day and always stay healthy.

Hi Jason

Thanks for coming back to me.

But this means I still needed to have manually inputted the bill in the first place first? This is the step that I am trying to avoid having to do because I get a lot of bills coming through, and it will be much easier if I could just go through my banking transactions and somehow create a bill+expense for each banking transaction. Does this make sense?

Thanks

Hi ronc,

Thanks for getting back to us here.

Just to correct my original post, you would need the VAT settings (Taxes > Edit VAT > Edit settings) to be set to Standard to account for the VAT on the transaction date, not the payment date.

As there is no option to enter a payment date on an expense, you would need to raise the bill first, and then match this to your transactions in the bank.

If you created all of the expenses by adding from the bank feed, you can undo these and then raise the bill, and then match.

If you have multiple similar bills, you can use the copy function (More > Copy on the toolbar in the transaction) to create a copy of this, then edit any details needed.

Thank you

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.