Hello MHElm,

I'm here to assist you with the outstanding old invoices in QuickBooks Online.

When invoices are non-collectible, the usual process is to write off the balance and declare it as bad debt. By doing so, it'll clear out the invoice from the A/R account and will reduce net profit.

For your question about credit, yes, it's part of the process to create a credit note to write off the bad debt. However, you need to create the account first through Chart of Accounts.

Here's how:

- Click the Gear icon.

- Click Chart of Accounts.

- Click New.

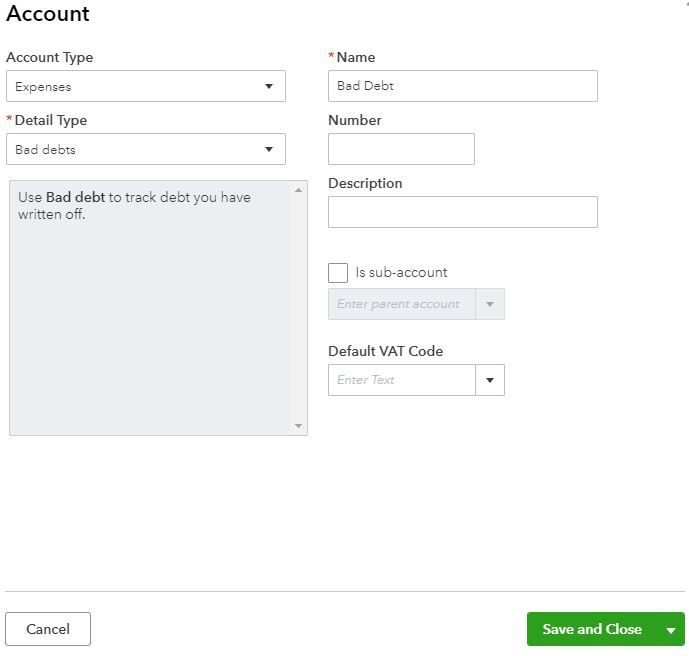

- Below Account Type, click the drop-down arrow and select Expenses.

- Below Detail Type, click the drop-down arrow and select Bad debts.

- Enter a name.

- Click Save and Close.

Here's a sample screenshot:

Once it's set up, I recommend following the detailed steps in the article I recommend on this (scroll-down to Step 3:(

How to write off bad debt.

Leaving the invoices unpaid or deleting them will affect your balances from the prior year. It would be best seeking expert advice from an accountant to ensure your books will be accurate.

Reach out to me anytime you have further questions with the outstanding invoices. The Community will keep an eye on your response.